The S&P 500 has experienced a broad rally over the last three months, but not every sector has participated in the uptrend. In fact, some sectors have been struggling in the face of stiff headwinds from regulators and macroenvironmental factors.

Homebuilders have yet to join the market rally because the housing market remains stifled by high mortgage rates, rising construction costs, and a price growth contagion emanating out of previously hot markets.

Today, we’ll examine the myriad factors putting pressure on housing stocks and three companies investors might want to avoid while their margins are being threatened.

Multiple Factors Putting Pressure on Homebuilder Margins

- Tariffs on Construction Materials: Steel, copper, and lumber tariffs continue to weigh heavily on homebuilders, and President Trump’s latest tariff on copper hasn’t even gone into effect yet (although that didn’t stop copper prices from jumping 2.5% on the announcement). Rising input costs exacerbate the affordability crisis, keeping prospective homebuyers in their rentals for longer as prices continue to increase. Some notable year-over-year (YOY) cost increases include fabricated steel plates (13.6%), metal molding and trim (15.1%), softwood lumber (18.9%), and machinery equipment and parts (24.2%). With home prices already near all-time highs and mortgage rates showing no signs of abating, homebuilders must either pass on these expenses and risk fueling even higher prices or absorb them and face margin reductions. Neither option is currently desirable for this sector.

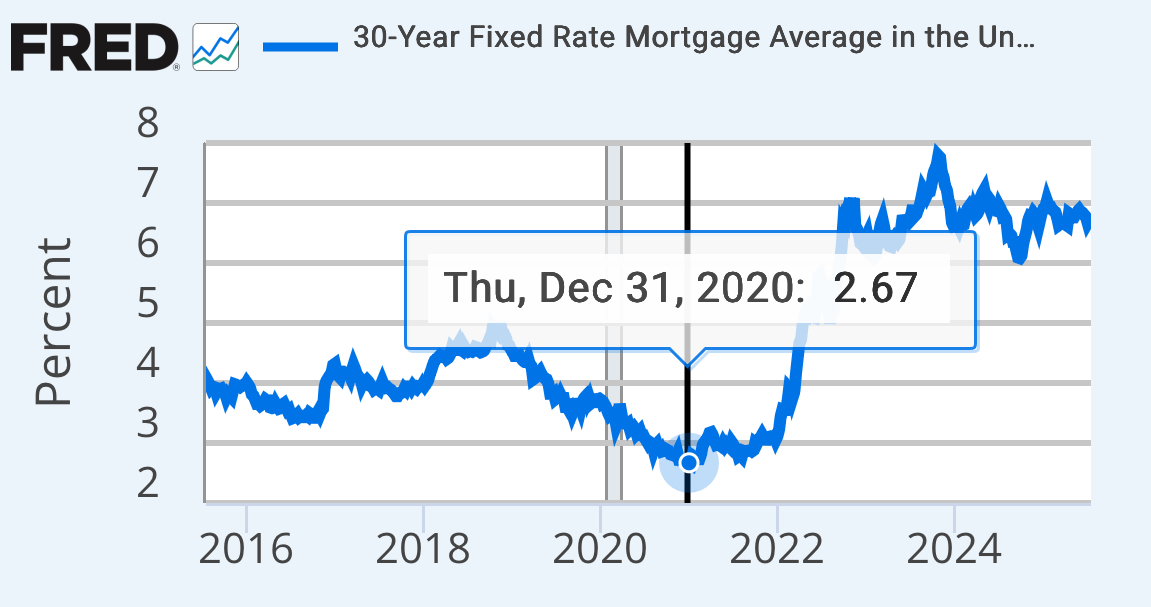

- Persistently High Mortgage Rates: The 30-year fixed-rate mortgage has remained stubbornly elevated, fluctuating between 6.5% and 7% for the better part of two years. This number is a far cry from the 2.67% rate homebuyers saw in December 2020, when the COVID-19 pandemic was at its peak and the Fed had dropped rates to near zero to protect the economy. The Federal Reserve’s Housing Affordability Index (HAI) sits at 97.5, meaning that median household income is below the threshold required to afford a median-sized home with a 20% down payment. Don’t count on the Fed coming to the rescue here either; mortgage rates are higher today than when the cutting cycle began.

- Immigration Crackdown: The Trump administration’s aggressive immigration crackdown could have a chilling effect on the construction labor market, especially in the South and Midwest, where undocumented immigrants make up a large portion of the workforce. In states close to the border like California and Texas, immigrant employees often comprise more than 40% of the workforce. A labor shortage can hinder homebuilders by delaying projects and increasing costs, as employers are compelled to pay higher wages to attract workers.

- Declining Home Prices in Several Major Markets: Home prices grew by 2.7% in April, marking the slowest month for housing price growth since the summer of 2023. In June, home prices retracted 0.1% month-over-month, with several formerly booming markets like Austin, Dallas, Tampa, Orlando, Phoenix, and San Diego. The Northeast isn’t immune, as Washington, D.C., saw declining home prices in June.

3 Stocks That Could Suffer in These Market Conditions

You might have read that last section and thought, “Well, other than that, Mrs. Lincoln, how was the play?” However, homebuilder headwinds continue to intensify as consumers expect high prices and elevated mortgage rates to persist longer than initially anticipated.

D.R. Horton Inc. NYSE: DHI boosted the sector this week by beating top and bottom line earnings expectations, but the numbers still shrank year over year, and this brief bump could be a good exit point for the following three companies.

NVR: Apprehension Ahead of Earnings

NVR Today

$8,070.94 +37.12 (+0.46%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $6,562.85

▼

$9,964.77 - P/E Ratio

- 17.03

- Price Target

- $8,783.33

NVR Inc. NYSE: NVR comprises three brands: Ryan Homes, NVHomes, and Heartland Homes, which focus on detached homes, condominiums, and townhouses. It operates in 18 states, including the Midwest and Southeast, where prices have recently shown weakness. It also has a significant presence in D.C., which experienced a slowdown in June.

NVR runs an asset-light business model by outsourcing land development, but it also remains at the mercy of developers passing on tariffs. New immigration restrictions will also affect NVR’s subcontractors, and the company will likely need to increase wages to compensate.

NVR posted a significant EPS miss in its Q1 2025 earnings report, and analysts are expecting more YOY declines in this week’s Q2 report.

Lennar: High-Volume Strategy Under the Microscope

Lennar Today

$133.04 -0.29 (-0.22%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $98.42

▼

$193.80 - Dividend Yield

- 1.50%

- P/E Ratio

- 11.00

- Price Target

- $128.85

Lennar Corp. NYSE: LEN focuses on a high-volume operation, which leaves it vulnerable to macro and regulatory pressures. Since Lennar’s strategy requires a high number of homes to be built and sold each year, any type of disruption can severely hurt margins and cause a cascade of delays.

Tariffs can be especially damaging to high-volume sellers like Lennar, as the company‘s ability to fully pass these costs onto buyers is limited by splintered demand.

LEN shares soared 8% following the DHI earnings release, but this sympathy rally could be short-lived as Lennar’s Q2 earnings report showed a 4.4% drop in YOY revenue, and the stock is still down nearly 13% in 2025.

KB Homes: Clientele Most Vulnerable to Price Pressure

KB Home Today

$63.46 +0.14 (+0.22%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $48.90

▼

$89.70 - Dividend Yield

- 1.58%

- P/E Ratio

- 8.41

- Price Target

- $66.14

KB Home Inc. NYSE: KBH specializes in land development and housing for first-time buyers or first-time move-up buyers, which is, unfortunately, the customer base most likely to feel the sting from high prices and mortgage rates.

The company’s Built To Order strategy offers unique customization and a personalized experience; however, this model may struggle with the HAI under 100, as customization matters less to buyers than affordability.

KBH has also already reported Q2 earnings, and saw revenue drop an eye-popping 10.5% YOY. Several analysts dropped their price targets following the June release, including Wells Fargo and Barclays, which cut their price estimates below the current market price.

Before you consider Lennar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennar wasn't on the list.

While Lennar currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.