Global media entertainment giant

Paramount Global NASDAQ: PARA has undergone an image makeover and rebranding after its stock collapsed as ViacomCBS. Hoping to shed its controversial past with the Redstone family drama and the Archegos Capital Management $20 billion blowup, the company has emerged as a still profitable

sum-of-all parts media empire which may be vastly overlooked by the market.

Its shares trade at less than a fifth of its value just over a year ago. Paramount Global is an

entertainment powerhouse with brands that include Paramount, Pluto, Showtime, CBS, CBS Sports, Nickelodeon, MTV, Comedy Central, BET and the Smithsonian Channel.

CBS is the No. 1 broadcast

network in the country and it grew its market share by 20% from last year. Warren Buffett increased his shares from 68.95 million to 78.42 million through the

Berkshire Hathaway Inc. NYSE: BRK.A 13F filing for Q2 2022 on August 15. Shares have since fallen as they now sell for 8x forward earnings with a 5.15% annual dividend yield.

Top Gun 2 Kills It

Paramount Studios released five No. 1 box office films in a row. It had the strongest movie of the year, "Top Gun 2," which raked in $1.45 billion worldwide on a $170 million budget. The movie has surpassed the $714 million box office mark in the U.S., making it the 22nd largest grossing movie of all time in unadjusted global earnings. Management showed impeccable timing for the release of the surprise blockbuster.

Streaming Empire

Its streaming empire faces fierce competition from rivals, including Netflix NASDAQ: NFLX, The Walt Disney Company NYSE: DIS, Amazon.com Inc. Prime Video NADSAQ: AMZN and Warner Brothers Discovery Inc. NYSE: WBD. Its streaming assets include the Paramount+ streaming service, which has grown to over 43 million paid subscribers. Pluto has had over 70 million monthly active users (MAUs) on its ad-supported streaming network and its legacy platform, Showtime OTT, still brings in subscription fees from cable TV as well as its streaming platform.

Here’s What the Charts Say

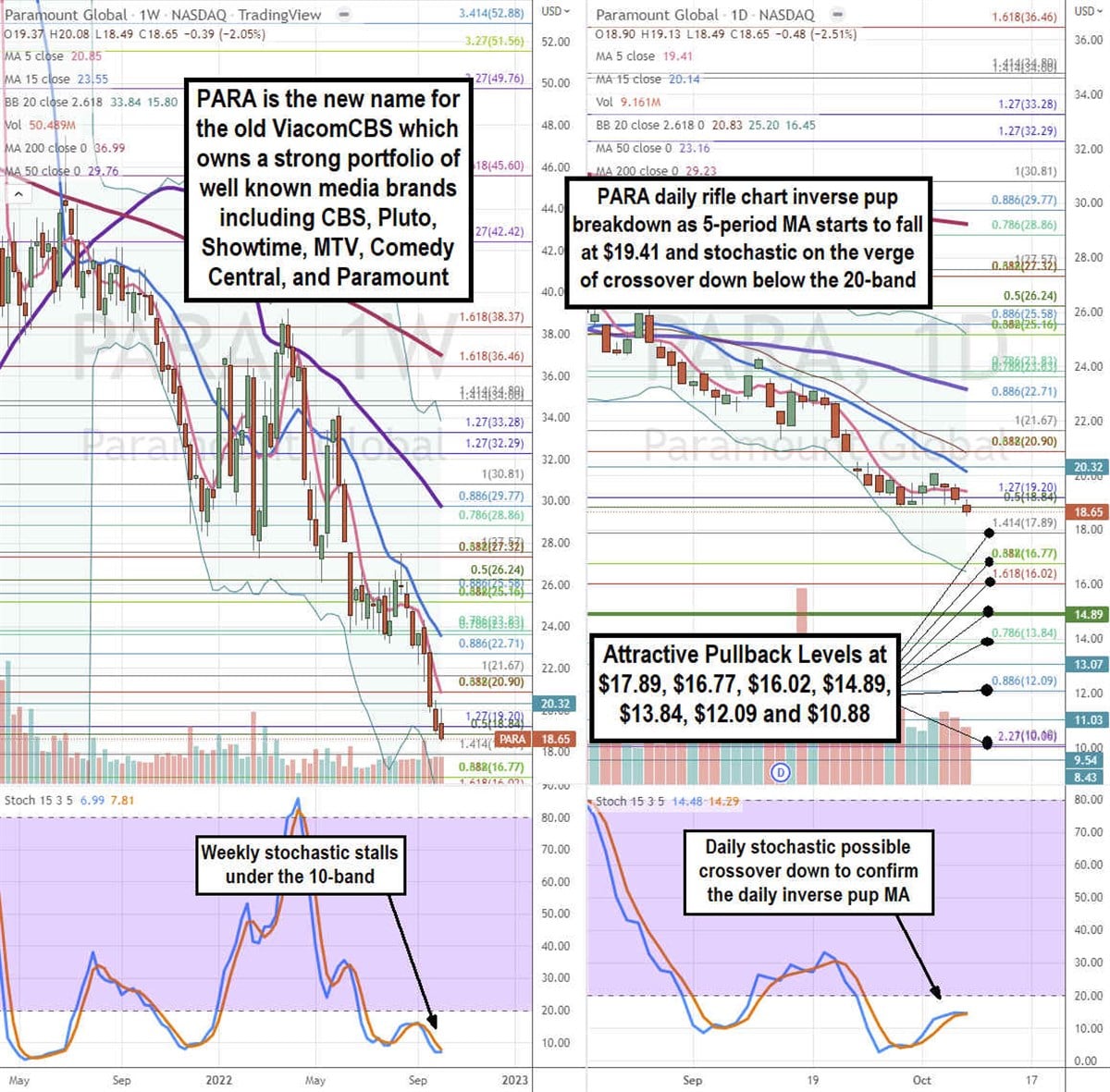

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for PARA stock. The weekly rifle chart has been collapsing on the inverse pup breakdown through the $23.83 Fibonacci (fib) level. The weekly 5-period moving average (MA) resistance continues to fall at $20.85 followed by the weekly 15-period MA resistance at $23.55. The weekly lower Bollinger Bands (BBs) sit at $15.80 still above its weekly market structure low (MSL) buy trigger at $14.89.

The weekly stochastic rejected the 20-band bounce attempt and crossed back down through the 10-band to stall again for a possible bounce or mini inverse pup. The daily rifle chart is forming an inverse pup breakdown as shares fall under the daily five-period MA at $19.41, followed by a falling daily 15-period MA at $20.14. The daily lower BBs sit at $16.45 as the stochastic stalls below the 20-band for a possible crossover back down to confirm the daily MA inverse pup breakdown. Attractive pullback levels sit at the $17.89 fib, $16.77 fib, $16.02 fib, $14.89 weekly MSL trigger, $13.84 fib, $12.09 fib and the $10.88 fib level.

Digital Driving Growth

On August 4, Paramount released its fiscal Q2 results for the quarter ending June 2022. The company reported earnings per share (EPS) of $0.64, beating $0.62 consensus analyst estimates by $0.02. Revenues climbed 18% year-over-year (YoY) to $7.78 billion, beating consensus analyst estimates for $7.55 billion. Paramount+ added 4.9 million new subscribers and removed 1.2 million Russia subscribers to grow to over 43 million subscribers. Advertising revenues rose 25% in the DTC segment, driven by increases impressions on both Paramount+ and Pluto TV. Advertising revenues fell (-6%) to $2.17 billion due to lower linear impressions and FX.

Before you consider Paramount Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paramount Global wasn't on the list.

While Paramount Global currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.