Luxury consignment resale platform The RealReal Inc. NASDAQ: REAL shares have been sinking from $30.22 in February 2021 to a low of $1.00 in March 2023. However, an unlikely buyer has been accumulating shares in the troubled retailer. On March 31, 2023, Scion Asset Management disclosed a new position of 684,000 shares. Scion is led by celebrity portfolio manager Mike Burry, famous for predicting the real estate bubble in 2007 in The Big Short.

RealReal was one of 21 stocks held by the firm. The news sent shares higher by 20% as they attempted to stage a rally. Investors wonder what compelled Burry to take a stake in the fallen e-commerce platform. Is there a turnaround in the cards? RealReal has been underperforming other digital marketplaces like eBay Inc. NASDAQ: EBAY, Etsy Inc. NASDAQ: ETSY and Shopify Inc. NASDAQ: SHOP.

The New CEO

The RealReal hired a new CEO starting in January 2023. John Koryl comes from Canadian Tire Corporation. He was a board member of the Guitar Center and formerly president of Neiman Marcus Stocks and Online. Before that, he served as SVP of eCommerce and Marketing & Analytics at Williams-Sonoma NYSE: WSM. He was a senior director of marketing solutions at eBay. Koryl specializes in e-commerce and digital marketing with experience in digital marketplaces and luxury retail.

Improving Margins on Falling Revenues

On May 9, 2023, The RealReal released its fiscal first-quarter 2023 results for the quarter ending March 31, 2023. The Company reported a GAAP earnings-per-share (EPS) loss of ($0.83) versus ($0.61) in the year-ago period. Net loss was $82.5 million) or 58.1% of total revenue, including a $36.4 million restructuring charge. Adjusted EBITDA was ($27.3 million) and (19.2%) of revenues compared to ($35.3 million) and (24.1%) of revenues in the year-ago period.

Surpassing One Million Active Buyers

Active buyers rose 22% YoY to 1,014,000. Orders fell (1%) YoY. Average order value (AOV) grew 2% to $499 driven by an increase in average selling prices partially offset by decreased units per transaction.

Forward Guidance

The RealReal provided Q2 2023 and full-year 2023 guidance. It expects general merchandise volume (GMV) between $400 million to $430 million for Q2 and $1.7 billion to $1.8 billion for full-year 2023. It expects total revenues for Q2 to come between $125 million to $135 million and $535 million to $565 million for the full year. Adjusted EBITDA is expected between ($29 million) to $($25 million) for Q2 2023 and ($75 million) to ($65 million) for full-year 2023.

CEO Insights

The RealReal CEO John Koryl touched on many points during the conference call. He stated that the company increased its take range while reducing inventory and narrowing its losses. The company focused on growing its higher-margin consignment business. Consignment revenues grew 22% in the quarter, while direct revenues fell (49%), resulting in a gross margin improvement of 980 bps. The RealReal surpassed 1 million active buyers for the first time while improving its customer satisfaction.

Turnaround?

The company optimized its commission structure to improve its take rate. It limited consignment on lower-value items and increased consignment on higher-value items. This resulted in a 170 bps improvement in its take rate in Q1 2023. He concluded, “Overall, the business is headed in a positive direction. We're growing our consignment revenue. We're expanding both our gross margin and gross profit dollars, and we're recruiting our customer satisfaction and the consignor experience. We are also managing costs as we drive toward profitability.” He expects The RealReal will retain adjusted EBITDA profitability in full-year 2024.

The RealReal analyst ratings and price targets can be found on MarketBeat.

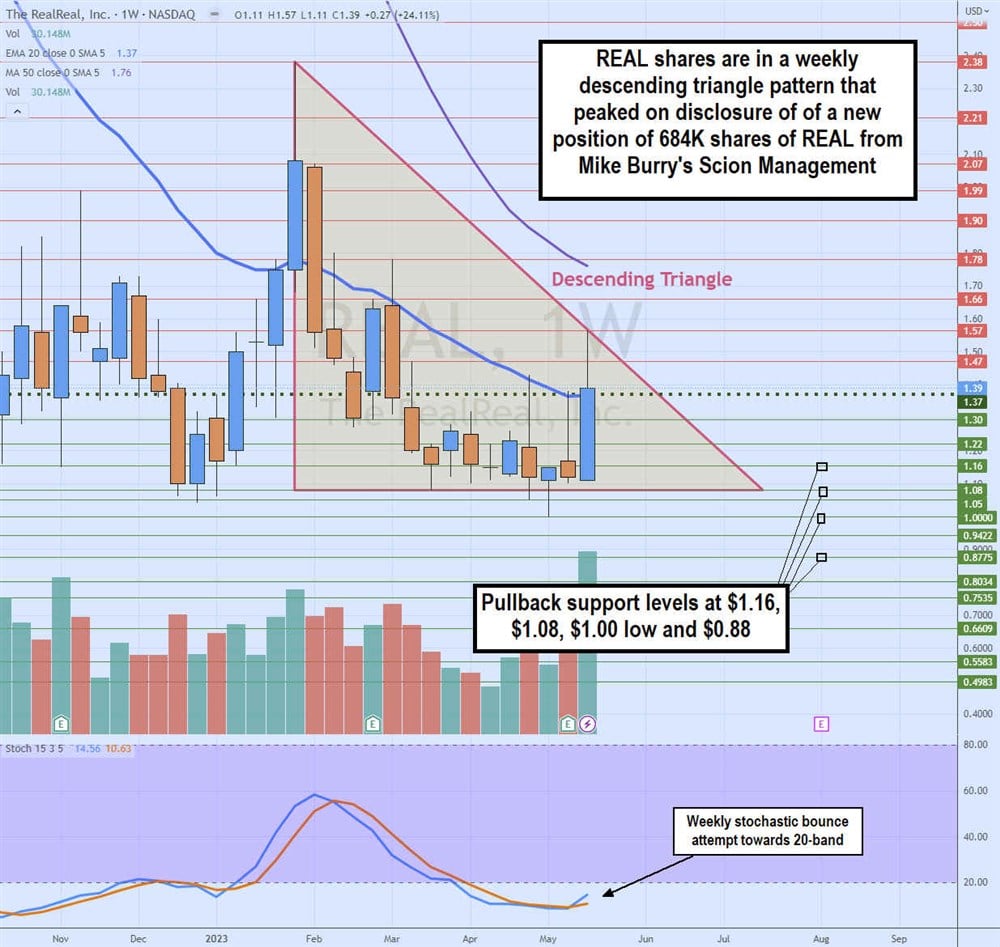

Weekly Descending Triangle

The weekly candlestick chart on REAL illustrates a weekly descending triangle comprised of lower-higher bounces with a flat bottom at $1.08.

The triangle commenced after peaking at $2.38 in January 2023 as shares fell to a low of $1.00 on May 1, 2023. REAL bounced through the weekly market structure low (MSL) trigger at $1.37 to peak at $1.57, forming the descending triangle falling trendline. The weekly 20-period exponential moving average (EMA) overlaps the weekly MSL trigger at $1.37. The weekly stochastic is trying to bounce for a 20-band break.

Pullback support levels are at $1.16, $1.08, $1.00 swing low and $0.88.

Before you consider RealReal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RealReal wasn't on the list.

While RealReal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.