Retail department store chain

Macy’s NYSE: M stock has been weathering the bear market in retail stocks after posting

stellar fiscal Q1 2022 earnings and raising guidance. The

department store giant’s Polaris strategy has been successful as Macy’s saw 88% of its omnichannel markets saw growth in the quarter with nearly 44.4 million active Macy’s shoppers. Consumer

shopping trends shifted away from the pandemic

active/casual and more towards

occasion-based apparel due to the reopening trends and COVID vaccinations leading to more in-person engagements. This resulted in strong sales in women’s dresses, accessories, and shoes along with strong men’s tailored apparel for the

retailer.

E-commerce sales rose 2% for the quarter but rose 35% compared to Q1 2019. Inventory turnover rose 17% in Q1 2022. The Company has been able to navigate the

supply chain and implement pricing science to bolster both top and bottom line growth in an inflationary environment.

Q1 Fiscal 2022 Earnings Release

On May 26, 2021, Macy’s released its fourth-quarter fiscal 2021 results for the quarter ending April 2022. The Company reported earnings-per-share (EPS) of $1.08 excluding non-recurring items versus consensus analyst estimates for a profit of $0.83, a $0.25 per share beat. Revenues rose 13.6% year-over-year (YoY) to $5.35 billion, beating consensus analyst estimates for $5.33 billion. Comparable same-store-sales (SSS) rose 12.8% YoY. Digital sales rose 2% YoY and up 34% compared to 2019. The Company bought back $600 million in stock under its $2 billion buyback program. Macy’s comparable sales rose 10.7% with nearly 44.4 million active customers, up 14% YoY.

CEO Comments

Macy’s CEO Jeff Genette commented, “Our company delivered solid results in the first quarter despite a challenging operating environment. We delivered strong earnings, beating our estimates, and sales that were in line with our expectations. While macroeconomic pressures on consumer spending increased during the quarter, our customers continued to shop. We saw a notable shift back to occasion-based apparel and in-store shopping, as well as continued strength in sales of luxury goods. Our omnichannel ecosystem, which spans the value spectrum, has supported our ability to flex our wide assortment of categories, products, and brands to capture consumer demand despite the volatile environment. As we look ahead to the rest of 2022, we remain focused on our customers and the successful execution of our Polaris long-term growth strategy. We believe that the efficiencies we built into our business enable us to navigate through the current uncertain macro environment.”

Raised Fiscal Full-Year 2023 Guidance

The Company raised fiscal full-year 2022 EPS in the range of $4.53 to $4.95 versus $4.34 consensus analyst estimates. Macy’s raised its fiscal full-year 2022 revenues to come in between $24.46 billion to $24.70 billion versus $24.52 billion consensus analyst estimates.

Conference Call Takeaways

CEO Jeff Genette credited the strong performance to the Polaris strategy which continues to bolster efficiencies. They leveraged transformation muscle and quickly pivoted to accommodate the shifting consumer trends, notably the acceleration of occasion-based apparel and away from casual apparel which was strong during the COVID lockdowns. As workers return to the office and in-person social settings, its logical that consumers are putting away their sweats and putting on more business and socially suitable attire. The Company generated $211 in adjusted EBITDA in the quarter. It’s Bloomingdale’s brand performed exceptionally strong as luxury consumer spend remained robust as evidenced by comparable sales on an own plus licensed basis rising 26.9%. Nearly four million active customers shopped the Bloomingdale’s brand, up 21% YoY. CEO Genette summed up the consumer shifts, “Across our nameplates, it's clear that our customers were changing how they shop during the quarter, and we were ready. As COVID-19 restrictions loosened in the US, people grew more comfortable returning to normal activities. They went back to the office at least a few days a week. They attended group events and celebrations and resumed in-store shopping.”

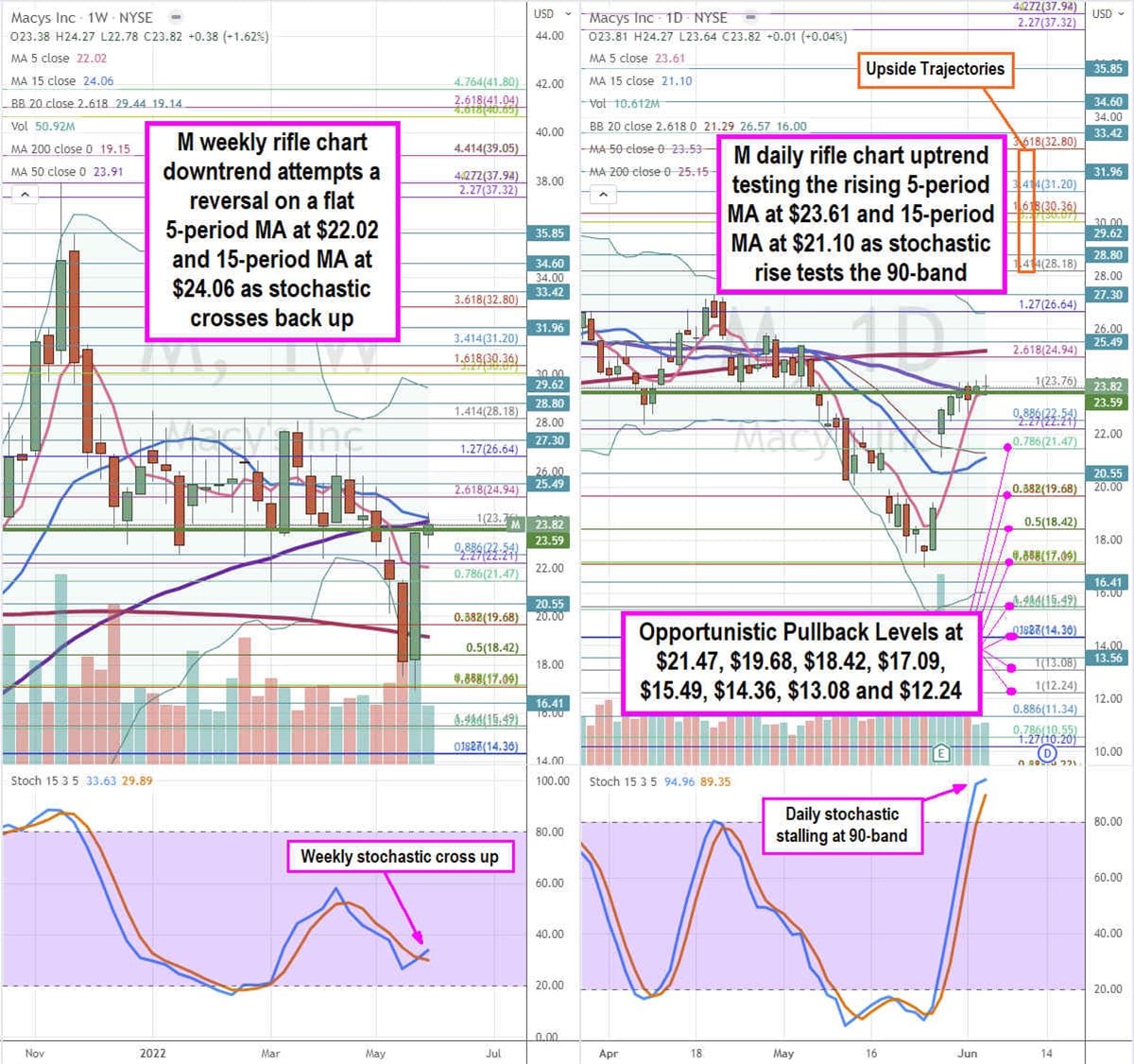

M Opportunistic Pullback Price Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for M stock. The weekly rifle chart breakdown put in a bottom near the $17.09 Fibonacci (fib) level. Shares staged a rally as the weekly stochastic crossed back up . The weekly rifle chart downtrend is stalling and attempting to reverse as the weekly 5-period moving average (MA) stalls at $22.02 and 50-period MA overlaps at $23.53 with the weekly 15-period MA at $23.61. The weekly market structure low (MSL) buy triggers on a breakout above $23.82. The daily 200-period MA is rising at $25.15 with daily upper Bollinger Bands (BBs) at $26.57. The daily stochastic is attempting to form a mini pup through the 90-band. The daily lower BBs sit at $16.00. Opportunistic pullback levels sit at the $21.47 fib, $19.68 fib, $18.42 fib, $17.09 fib, 15.49 fib, $14.36 fib, $13.08 fib, and the $12.24 fib level. Upside trajectories range from the $28.18 fib up towards the $32.80 fib level.

Before you consider Macy's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Macy's wasn't on the list.

While Macy's currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.