Digital advertising technology (AdTech) platform

Pubmatic NASDAQ: PUBM stock has fallen below its

pandemic lows accelerated by the macro

market sell-off. The digital advertising supply chain platform-as-a-service (PaaS) provider has doubled its sales in the past two year to turn profitable and expects 35% adjusted EBITDA margins for fiscal 2022. The tailwinds continue to accelerate for Pubmatic as the digital advertising market grew nearly double pre-pandemic levels and 31% in 2021. This growth is expected to be permanent, not transitory.

E-commerce is expected to grow 17% annually for the next four years driven by

online grocery shopping adoption by consumers. The addressable market for advertising continues to expand as its closed television (CTV) business has grown 6X processing 90 trillion impressions for full-year 2021. However, the Company lowered it fiscal 2022 revenue guidance reflecting 25% growth causing shares to

collapse. Prudent investors seeking adtech exposure can watch for opportunistic pullbacks in shares of Pubmatic.

Q4 Fiscal Year 2021 Earnings Release

On Feb. 28, 2022, Pubmatic released its fiscal fourth-quarter 2021 results for the quarter ending December 2021. The Company reported an earnings-per-share (EPS) profits of $0.50 beating analyst estimates of $0.27 by $0.23. Revenues rose 34.5% year-over-year (YoY) to $75.6 million, beating analyst estimates for $75.47 million. Pubmatic Co-founder and CEO Rajeev Goel commented, “For the second consecutive year, we delivered an incredible combination of revenue growth and profitability. Organic revenue growth in 2021 was 53% over last year, reflecting significant market share gains in a large and rapidly growing market,” said Rajeev Goel, co-founder and CEO at PubMatic. “PubMatic delivers the digital advertising supply chain of the future where both publishers and buyers can maximize value. Our infrastructure-driven approach, combined with our usage-based software model, strengthens our competitive advantages and funds continuous innovation and investment in future growth. This flywheel underpins our strong position in the market, and I couldn’t be more excited about the number and magnitude of growth opportunities in front of us.”

Mixed Guidance Estimates

Pubmatic lowered revenue guidance to come in between $53 million to $55 million versus $56.66 million consensus analyst estimates for fiscal Q1 2022. The Company provided in-line guidance for fiscal full-year 2022 revenues to come in between $282 million to $286 million versus $283.48 million consensus analyst estimates.

Conference Call Takeaways

CEO Goel detailed its record Q4 results highlighting the strong 51% adjusted EBITDA margin and 34% organic revenue growth. He commented, “PubMatic is committed to delivering the digital advertising supply chain of the future where both publishers and buyers can maximize value. As an independent technology company focused on the best interests of the publishers, we provide a platform that connects disparate parts to the ecosystem with robust audience addressability solutions, and cross-screen targeting that power the open Internet. And our infrastructure-driven approach is delivering superior outcomes and cost efficiencies that both our customers and we benefit from.” The Company had an estimate 2% to 3% market share of the digital advertising market upon its IPO in December 2020. In a single year, it has grown its estimated market share to 3% to 4%. A 1% shift in a year’s time is significant as the addressable market continues to grow. Ultimately, CEO Goel wants to achieve 20% market share or more. This will be driven by Supply Path Optimization (SPO) with omnichannel formats and customers, audience addressability, and global expansion. The Company grew its SPO partners by 44% in 2021.

PUBM Opportunistic Pullback Levels

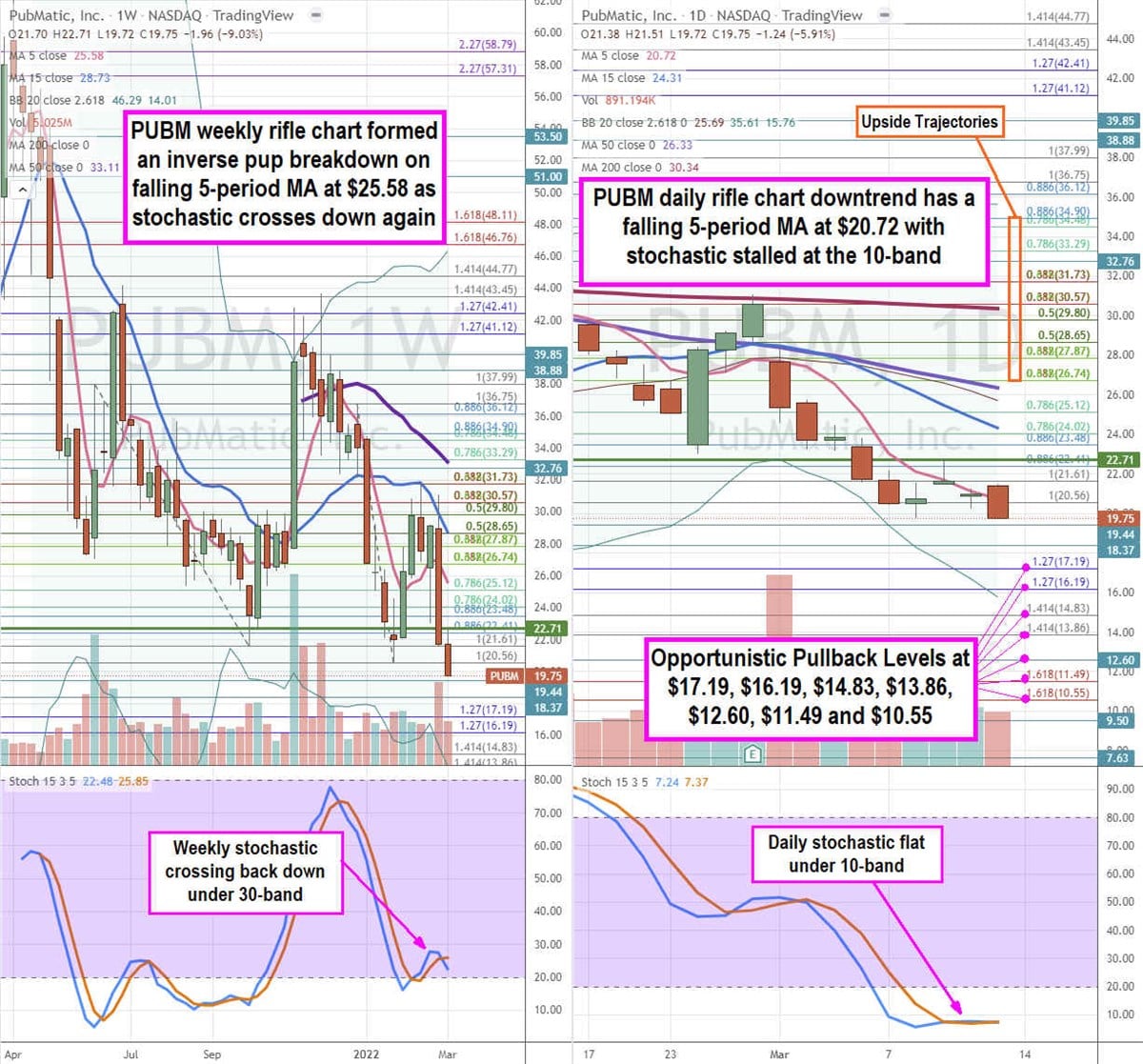

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the playing field for PUBM shares. The weekly rifle chart indicates a bearish inverse pup breakdown after peaking near the $31.73 Fibonacci (fib) level. The weekly 5-period moving average (MA) is falling at $25.58 followed by the 15-period MA at $28.73 with 50-period MA falling at $33.11. The weekly lower Bollinger Bands (BBs) are at $14.01 as the stochastic crossed down on a rejection of the 30-band. The daily rifle chart downtrend has a falling 5-period MA at $20.72 with falling 15-period MA at $24.31 and daily lower BBs at $15.76. The daily market structure low (MSL) buy triggers on a breakout through $22.71. Prudent investors can watch for opportunistic pullback levels at the $17.19 fib, $16.19 fib, $14.83 fib, $13.86 fib, $12.60, $11.49 fib, and the $10.55 fib level. Upside trajectories range from the $26.74 fib level up towards the $34.90 fib level.

Before you consider PubMatic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PubMatic wasn't on the list.

While PubMatic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.