Social media

Social media 3D gaming platform provider

Roblox NYSE: RBLX stock has been a rollercoaster in 2021 climbing from a low of $60.50 in March to reaching highs of $103.87 in June 2021. Shares of the leading

mobile gaming publisher in the U.S. are attempting a recovery off $78.56 recent lows. The Company is creating a metaverse comprised of user-generated content (UGC) development to attract major advertising fees. The Company has grown a community of diehard developers and

gamers. At the core, Roblox is an online platform enabling users to create a character (avatar) to participate in different games, worlds, and experiences. Within these ecosystems,

players can enhance their experience with in-game purchases of items and enhancements with Robux currency. The currency is currently US $0.0035 for each $1 of Robux. The Company primarily benefits from the purchase of Roblox currency in addition to advertising and in-game purchases. As players get deeper into the world, activity is measured by daily active users (DAUs), Hours Engaged, and Average Bookings per DAU. While they are the top mobile publisher in the U.S., the runway for international growth is long and plentiful. One controversial factor is the average player is

13 or younger, which can be a benefit for stickiness and liability in relation to content and Child Protection policies especially in terms of content and payments. The Company is seeking to expand its engagement demographic to above 13 while keeping its core audience. The post-

pandemic return to normal reopening trend naturally means growth metrics are expected to fall due to the return to school of these kids. The Company is a

pandemic winner, but will it continue to be one during the return to normal period is yet to be seen? The Company plans to roll out the platform on popular next-gen consoles from

Sony PlayStation 5 NYSE: SNE and/or

Microsoft Xbox (NASDAQ: MSFT), but those are in short supply now. Prudent investors seeking a piece of the Metaverse can watch for opportunistic pullbacks in Roblox shares.

Q1 FY 2021 Earnings Release

On May 10, 2021, Roblox released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.46) missing analyst estimates for (-$0.13), by (-$0.33). Revenues rose 139.5% year-over-year (YoY) to $387 million falling short of the $490.90 million consensus analyst estimates. April metrics saw DAUs up 37% YoY to 43.3 million. Hours engaged rose 18% YoY to 3.2 billion. Bookings were between $242 million to $245 million, up 59 to 61% YoY. Average bookings per DAU was between $5.59 to $5.66, up 16% to 17% YoY.

May Metrics Update

On June 15, 2021, Roblox released its May monthly metrics (to the disappointment of the markets). DAU were up 28% YoY to 43 million, but down (-1%) sequentially from 43.3 million in prior month April 2021. Hours engaged were up 9% YoY to 3.2 billion. Bookings were estimated to come in between $216 and $219 million, up 24% to 26% YoY. Average bookings per DAU is estimated between $5.02 and $5.09, down (-2% to -3%) YoY. Revenues are expected between $149 million to $151 million, up 123% to 126% YoY. Fear of a slowdown caused shares to fall (-6%) on the release.

Litigation Update

On June 10, 2021, Roblox disclosed a number of lawsuits filed against the Company. Most of the lawsuits are among music publishers represented by the National Music Publishers’ Association (NMPA) for a minimum of $200 million in damages stemming from illegal use of music on its platform. NMPA CEO David Israelite stated, “Roblox has earned hundreds of million of dollars by requiring users to pay every time they upload music onto the platform… taking advantage of young people’s lack of understanding about copyright… and then they take virtually no action to prevent repeat infringement or alert users to the risks they are taking.” This sounds like Napster all over again. On June 18, 2021, Roblox inked a deal with music giant BMG to bring new talent to the Roblox metaverse of kids.

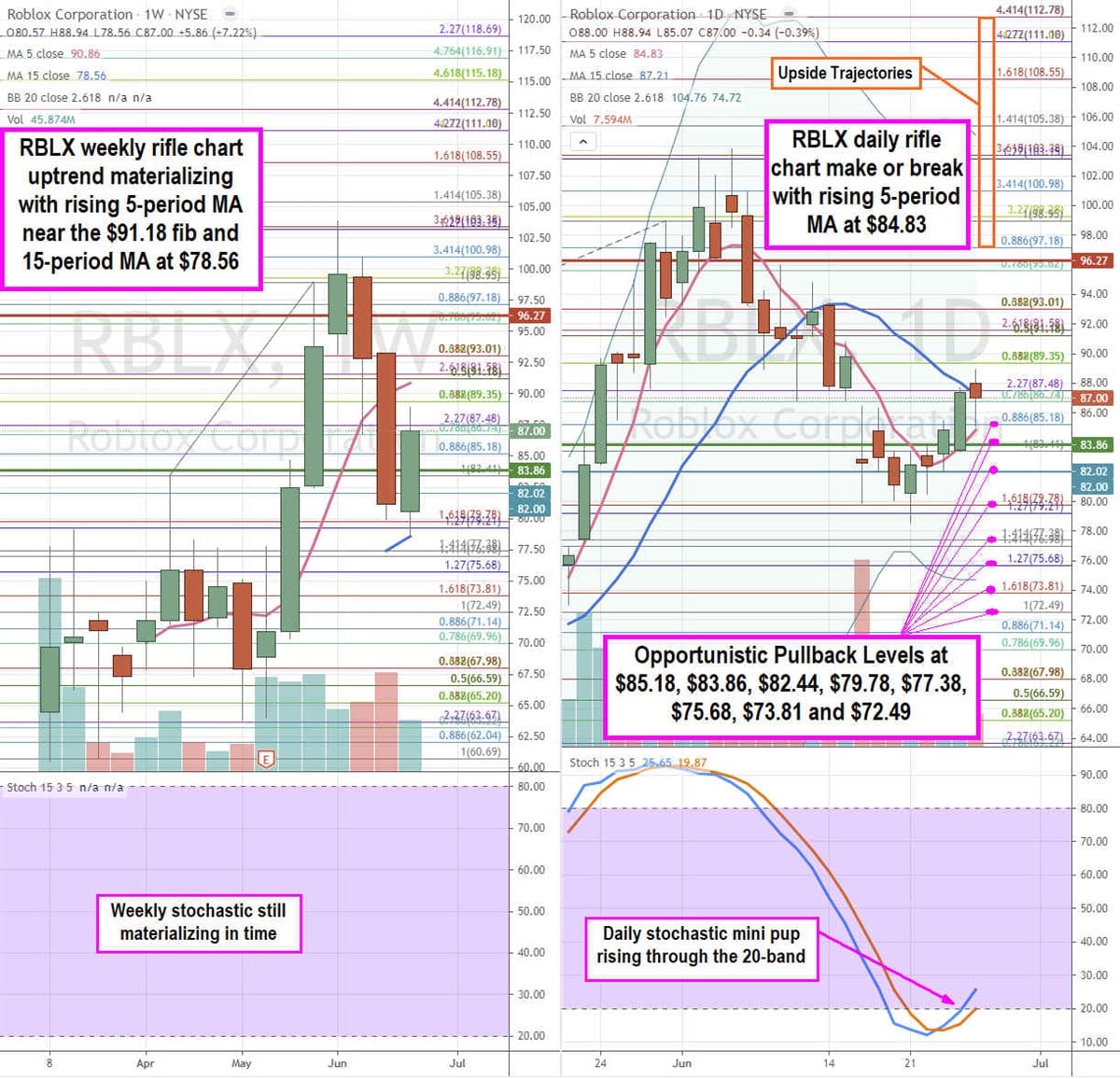

RBLX Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for RBLX shares. The materializing weekly rifle chart shows a uptrend with rising 5-period moving average (MA) support near the $91.18 Fibonacci (fib) level. The weekly 15-period MA is also rising at $78.56, where it deflected selling pressure. The weekly stochastic is still materializing on this recent IPO. The daily rifle chart has been a rollercoaster as stochastic made a full oscillation down from the $103.38 fib under the $79.21 fib before triggering a daily market structure low (MSL) buy on the breakout through $83.86. The daily formed a channel tightening as shares overshot the daily 15-period MA at $87.21 as the daily 5-period MA is grinding up at $84.83. The daily stochastic coiled up through the 20-band to form a mini pup. This make or break set-up will result in either a bullish or bearish outcome. The bullish outcome would be the continued uptrend as the daily 5-period MA crosses up through the 15-period MA on a full stochastic oscillation up through the 20-band towards the upper daily Bollinger Bands (BBs) at $104.76. The bearish outcome would be a failure on the daily stochastic to maintain the oscillation up forming a cross down as shares fall back under the daily 5-period MA towards the daily lower BBs near $74.72. Prudent investors can monitor for opportunistic pullback levels at the $85.18 fib, $83.86 daily MSL trigger, $82.44 fib, $79.78 fib, $77.38 fib, $75.68 fib, $73.81 fib, and the $72.49 fib. The upside trajectories range from the $97.18 fib up towards the $112.78 fib level.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.