Since the onset of the pandemic:

All resulting in… Fewer cups of coffee being purchased.

That Starbucks NASDAQ: SBUX struggled mightily in fiscal Q3 (which ended June 28) wasn’t much of a surprise: Revenue dipped 38% yoy for the quarter and US comps were down 65% yoy at their low point.

What is surprising, however, is how quickly Starbucks started turning it around: In Starbucks’ fiscal fourth quarter (which ended September 27) US comps were down just 9% yoy, and fell just 4% yoy in September.

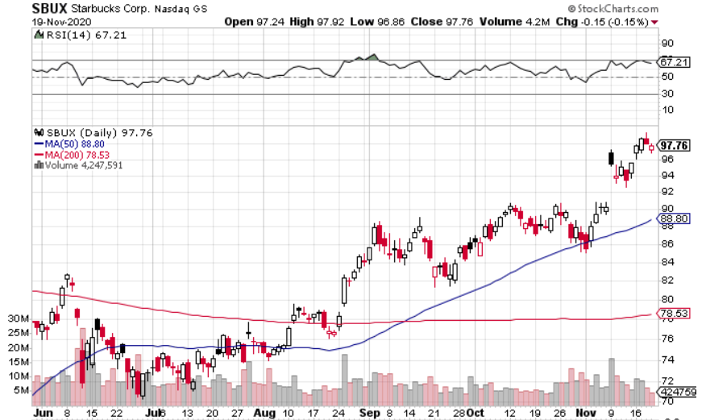

With a vaccine on the way, Starbucks shares are pushing all-time highs because investors realize that if Starbucks can hold up in 2020, it can thrive in a post-pandemic world.

The optimism is certainly well-founded. In fact, I don’t think the market is optimistic enough about Starbucks’ prospects.

Starbucks is a Digital Leader

The success – at least relatively speaking – of eating and drinking places in 2020 has hinged on their digital presence. Starbucks belongs in the successful category, by any measure. The Starbucks Rewards loyalty program now has more than 19 million members, up 10% yoy.

The true test is: How much has Starbucks been able to leverage its membership?

Well, the coffeehouse chain has passed that test. “In Q4, Starbucks Rewards drove 47% of US company-operated tender for a second consecutive quarter.”

The Company Showed Resilience in 2020

Five or ten years from now, we will probably (hopefully) look back at 2020 as a one-off. But even if companies never face similar challenges in the future, you still want to look around…

Did this company roll over in the face of adversity? Did that company do whatever it took to overcome a tough operating environment?

Starbucks did whatever it took by:

- Opening new drive-thrus and launching curb-side pickup.

- Turning to its ready to drink coffee products – up 15% domestically in Q4.

- “Closing lower-performing stores while continuing to capture that traffic where customers need us to be.”

Starbucks isn’t a COVID-proof or recession-proof business. But it’s comforting to know that in a tough economy, Starbucks is likely going to outperform its peers.

2021 is Shaping up Nicely

On the Q4 earnings call, Starbucks said it expects “global comparable store sales growth of 18% to 23% in fiscal 2021.”

At the time, those numbers looked a little conservative as Starbucks is going to face easy comps in 2021. But the call took place before the vaccine news came out, so now it’s quite possible that Starbucks will blow those early estimates away.

In fiscal 2021, the company expects to add 1,100 net new Starbucks stores globally after adding 1,400 in fiscal 2020. With more than 30,000 stores worldwide, there is still room for more profitable Starbucks locations.

Particularly in China.

China Can Drive Company-Wide Growth for Years to Come

On the Q4 call, Starbucks said it’s expecting China’s comps to grow 27-32% in fiscal 2021.

And it’s not only comps that are improving in China. Starbucks is rapidly opening new stores over there. In Q4, the company opened almost 260 stores in China, taking it to 4,700+ stores in the country. Over the past 12 months, Starbucks has increased its China footprint by 561 stores or 14%.

There may seemingly be a Starbucks on every corner in the US, but that’s not even close to being the case in China. Starbucks’ growth story – with the help of the Chinese market – can continue for years to come.

What About Work-At-Home?

Work-at-home. The elephant in the room.

A lot of people will return to the office post-pandemic… But some will stay fully remote. Others will do a hybrid arrangement. Where does that leave Starbucks?

Starbucks will lose some business, but I’m not too concerned. Comps were, after all, not down that much in the US in Q4. And business is going to get a lot better from here.

If we were talking about a fly-by-night coffeehouse, I’d be more concerned. But we’re talking about Starbucks…

The Final Word

Starbucks is trading at 34.8x forward earnings, so there is a decent amount of growth priced in. But considering China, digital, and the company’s overall operational chops, I think that Starbucks will make its current valuation look downright cheap in a few years. I’d look to get in sooner rather than later.

Before you consider Starbucks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Starbucks wasn't on the list.

While Starbucks currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report