Last week, when technology stock Unity Software NYSE: U reported earnings, shares fell as much as 15% in the after-hours session. The sharp decline came as the company missed on revenue and did not provide guidance.

Unity is currently undergoing internal changes, so management was reluctant to provide guidance because they were not positive about the timing of the improvements and changes.

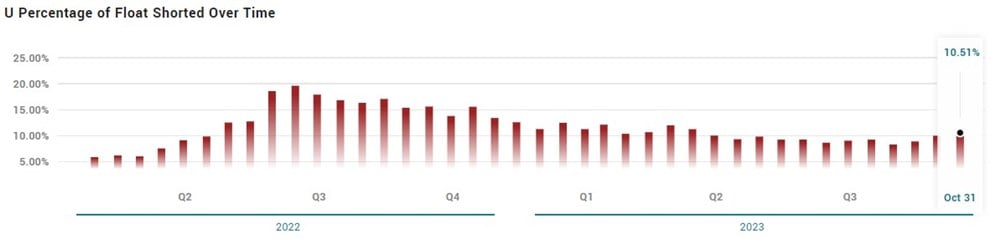

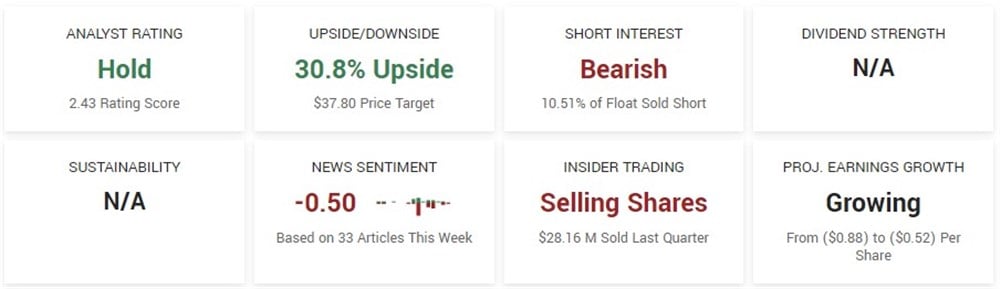

The uncertainty surrounding the company and said changes, combined with weaker-than-expected earnings, has raised some question marks. That’s reflected in the stock's short interest, which has steadily climbed in recent months and perhaps amplified by steady insider selling in recent quarters.

So, given recent price action and company developments, let's take a closer look to understand in greater detail what's going on with Unity Software.

What is Unity Software?

Unity is a game development platform that allows users to create and build interactive 2-D and 3-D environments for gaming and other applications. Unity was one of the first developers to fully support the iPhone operating system, making it a go-to choice for game developers. Over the years, Unity has expanded its offerings to include desktop, mobile, tablets, consoles, 3-D, web-based, and virtual reality platforms.

Year-to-date (YTD) shares of Unity are close to flat, up just 1.12%, and considerably underperforming the overall market and its sector. The stock has a market capitalization of just under $11 billion and is trading near the low end of its 52-week range at $29 per share.

Short interest has risen in recent months

Something important to note is the short interest in U is currently 10.51% or 24.5 million shares sold short. That is a significant number that makes the short interest in U stand out as well above average. Since mid-September, that figure has risen from 8.25% of the float sold short to 10.51% of the float sold short as of October 31. It’s important for anyone trading or investing in the stock to note the short interest, especially when it’s above average, as it could impact the supply and demand of shares and, therefore, greatly influence the volatility of the stock.

Unity posts weaker-than-expected revenue and lacks guidance

Shares of Unity faced a sharp decline in the extended hours after posting a third-quarter revenue miss and a lack of future guidance. The company reported a loss of 32 cents per share with revenue at $544.2 million, falling short of analysts' expected $553.7 million.

In the Create Solutions segment (game-development tools), revenue hit $189 million, slightly below analyst consensus, affected by reduced income from China due to gaming limitations.

The company encountered backlash in September over new fees tied to game installations through its editor software. CEO John Riccitiello's sudden retirement in October saw Jim Whitehurst taking over as interim chief, acknowledging challenges and planning to reassess fee structures. It is yet to be confirmed whether he will remain a permanent CEO.

The Grow Solutions segment recorded revenue growth to $355.3 million but felt pressure from the new fees. Management aims to revamp pricing strategies, potentially leading to discontinuations, layoffs, and office space reductions. The company plans these changes by the first quarter of 2024.

Recent price action indicates a prevailing sense of optimism

Despite recent uncertainties and underwhelming results, shares of U showed a remarkable recovery, surging nearly 15% for the week following the earnings dip. Additionally, analysts remain optimistic, with a consensus price target forecasting more than a 30% upside.

Despite the recent criticism faced by the stock and the company, recent price action points to a prevailing sense of optimism and confidence in management's capability to significantly enhance the company's performance.

Last week, when technology stock Unity Software Inc. NYSE: U reported earnings, shares fell as much as 15% in the after-hours session. The sharp decline came as the company missed on revenue and did not provide guidance.

Unity is currently undergoing internal changes, so management was reluctant to guide because they were not positive about the timing of the improvements and changes.

The uncertainty surrounding the company and said changes, combined with weaker-than-expected earnings, has raised some question marks. That's reflected in the stock's short interest, which has steadily climbed in recent months and perhaps amplified by steady insider selling in recent quarters.

So, given recent price action and company developments, let's take a closer look to understand in greater detail what's going on with Unity Software.

What is Unity Software?

Unity is a game development platform that allows users to create and build interactive 2D and 3D environments for gaming and other applications. Unity was one of the first developers to fully support the iPhone operating system, making it a go-to choice for game developers. Over the years, Unity has expanded its offerings to include desktop, mobile, tablets, consoles, 3D, web-based and virtual reality platforms.

Year-to-date (YTD) shares of Unity are close to flat, up just 1.12%, and considerably underperforming the overall market and its sector. The stock has a market capitalization of just under $11 billion and is trading near the low end of its 52-week range at $29 per share.

Short interest has risen in recent months

Something important to note is the short interest in Unity is currently 10.51% or 24.5 million shares sold short. That is a significant number that makes the short interest in U stand out as well above average. Since mid-September, that figure has risen from 8.25% of the float sold short to 10.51% of the float sold short as of October 31.

It's important for anyone trading or investing in the stock to note the short interest, especially when it's above average, as it could impact the supply and demand of shares and, therefore, greatly influence the volatility of the stock.

Unity posts weaker-than-expected revenue and lacks guidance

Shares of Unity faced a sharp decline in the extended hours after posting a third-quarter revenue miss and a lack of future guidance. The company reported a loss of 32 cents per share with revenue at $544.2 million, falling short of analysts' expected $553.7 million.

In the create solutions segment (game-development tools), revenue hit $189 million, slightly below analyst consensus, affected by reduced income from China due to gaming limitations.

The company encountered backlash in September over new fees tied to game installations through its editor software. CEO John Riccitiello's sudden retirement in October saw Jim Whitehurst taking over as interim chief, acknowledging challenges and planning to reassess fee structures. It is yet to be confirmed whether he will remain a permanent CEO.

The grow solutions segment recorded revenue growth to $355.3 million but felt pressure from the new fees. Management aims to revamp pricing strategies, potentially leading to discontinuations, layoffs and office space reductions. The company plans these changes by the first quarter of 2024.

Recent price action indicates a prevailing sense of optimism

Despite recent uncertainties and underwhelming results, shares of U showed a remarkable recovery, surging nearly 15% for the week following the earnings dip. Additionally, analysts remain optimistic, with a consensus price target forecasting more than a 30% upside.

Despite the recent criticism faced by the stock and the company, recent price action points to a prevailing sense of optimism and confidence in management's capability to significantly enhance the company's performance.

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report