Big-box retailers

Walmart NYSE: WMT and

Target NYSE: TGT are still trading at multi-year lows after gapping down following their most recent earnings reports.

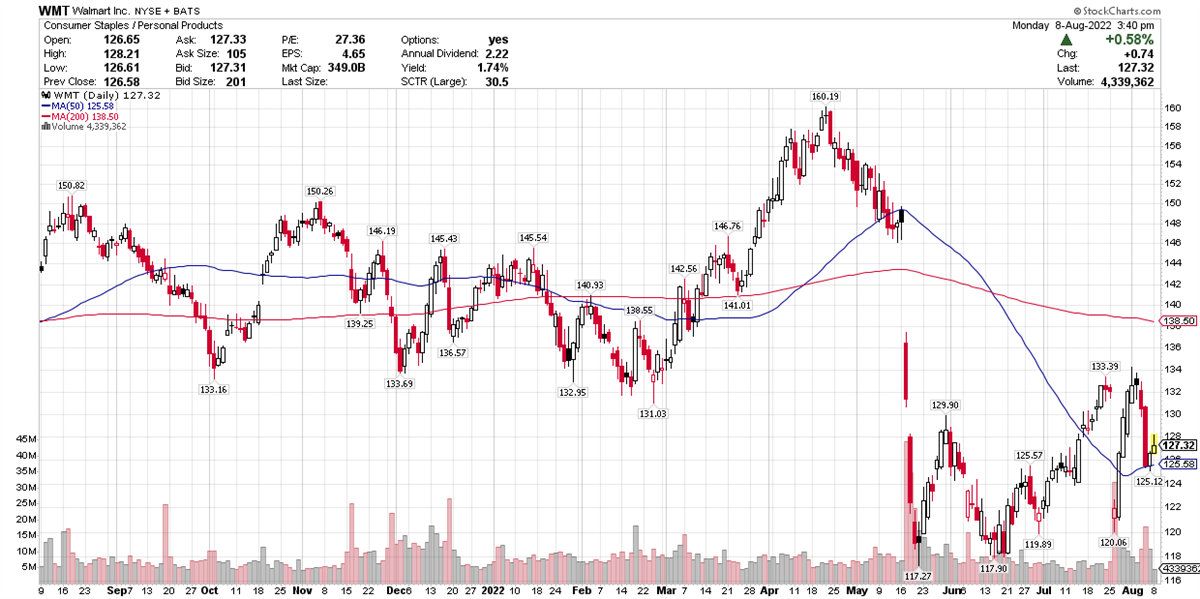

Walmart is trading at July 2020 levels, after advancing 1.88% in the past week.

Last week, the company said it would lay off about 200 people from its corporate workforce.

In an interview with retail publication WWD, a Walmart spokesperson said, “We’re updating our structure and evolving select roles to provide clarity and better position the company for a strong future. At the same time, we’re further investing in key areas like e-commerce, technology, health and wellness, supply chain and advertising sales and creating new roles to support our growing number of services for our customers, suppliers and the business community.”

It’s still unknown as to whether Walmart is slashing its corporate workforce, as opposed to the in-store workforce. The company did not offer a reason for the layoffs, although it recently slashed its profit guidance for the current quarter and the full year, saying inflation is taking a bite out of discretionary spending on electronics and clothing. Naturally, consumers are opting to focus their reduced spending power on necessities such as food.

In its July 25 announcement, the company reduced second-quarter earnings guidance by 8% to 9% and full-year guidance by 11% to 13%.

In a statement, CEO Doug McMillon said, “The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars. We’re now anticipating more pressure on general merchandise in the back half; however, we’re encouraged by the start we’re seeing on school supplies in Walmart U.S.”

Shares gapped down on May 17 and May 18, following the company’s most recent earnings report. Walmart reported earnings of $1.30 per share. MarketBeat earnings data show the company missing analysts’ views of $1.48 per share. That also marked a year-over-year decline of 23%.

The stock gapped down again after the July cut in profit guidance. It’s since rebounded 4.5%.

Walmart reports again on August 16. Analysts expect earnings per share of $1.60 on revenue of $150.51 billion.

Naturally, Walmart is not the only mass-market retailer facing inflation-related challenges. Target, too, gapped down hard following its most recent earnings report, when it warned that earnings would be battered in the short run due to markdowns on excess, unpurchased merchandise.

The inventory glut comes as shoppers, feeling the pinch from inflation, as well as the demise of Covid-era restrictions, opt for different merchandise categories than retailers had stocked.

In its May report, Target also lowered its operating margin rate.

The company earned $2.19 per share on revenue of $25.2 billion. Those marked a year-over-year decline of 41% on the bottom line and an increase of 4% on the top line.

Target next reports on August 17, with Wall Street eyeing earnings per share of $0.72 on revenue of $26.08 billion. That would be a significant year-over-year decline in earnings, but a small increase in revenue.

According to earnings numbers compiled by MarketBeat, the most recent quarter marked the first time since November 2018 that Target missed earnings views.

It’s worth noting: The unofficial “whisper number” for both Walmart and Target hovers below the official expectations. The whisper number represents a forecast that some analysts truly believe, but don’t publish.

When it comes to which stock is the better buy, each has pros and cons. Target boasts a better up/down volume ratio, meaning buyers have been in control recently. In fact, the stock advanced 14.01% in the past month, 645% better than Walmart’s price performance.

On the other hand, Target can be more volatile than the broader market. Although Walmart has a much larger market capitalization, both are institutional-quality stocks tracked by the S&P 500, meaning they will be included in any index fund purchases.

At the end of the day, always watch for stocks with strong price momentum in a confirmed market uptrend. By some measures, the market is already in rally mode, although it may not always feel that way. At this juncture, Walmart is struggling to gain upside traction, while Target notched gains for the past three weeks. As always, use extra caution in the days prior to a company’s earnings reports, as any small piece of information can send the stock tumbling and erase any short-term gains.

Before you consider Walmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walmart wasn't on the list.

While Walmart currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report