Global digital marketplace platform

eBay NASDAQ: EBAY stock has fallen (-43.7%) for 2022. eBay is commonly known as the world’s largest auction marketplace for every sort of item you can imagine. However, it’s also the world’s largest marketplace for collectibles. Collectibles range from vintage video games, jewelry, art, coins, trading cards, Funko pops to sneakers and comic books. The

pandemic triggered lockdowns, stimulus checks, and decades’ worth of

e-commerce growth in months. It also triggered an unprecedented surge in the collectibles market. Fear of missing out (FOMO) caused new speculators to chase and drive up prices to nosebleed levels. Media giants like

Disney NYSE: DIS producing live-action and

streaming Marvel Cinematic Universe (MCU) movies, and

Warner Brothers Discovery NYSE: WBD building up their slate of superhero releases has helped drive the growth of the collector’s markets. The hobby has turned into a business for many collectors thanks to e-commerce platforms and the advent of certified grading.

Certified Grading Bolsters Collectibles Values

Grading the condition of a collectible can be very subjective. Having a trusted authority decide the official grade and preserve it through encapsulation has been a driving force attracting new speculators into the market. The advent of certified grading has also standardized conditions grading which also adds a premium to the value. Comic Guaranty Corporation (CGC) is the largest grading company for comic books, and they were purchased by BlackRock NYSE: BLK. Graded and encapsulated collectible items adds a premium to the value of the items. For example, a near mint CGC graded 9.8 copy of New Mutants #98 recently sold for $2,025. Compare that to a non-graded near mint copy of the same issue which sold for $573.58. The graded copy commands a 4X premium to a “raw” or ungraded copy which was only originally sold for just $1.00 in 1991. This is what’s driving more and more collectors towards getting their collectibles graded. CGC has dominated the comic book market and has expanded into trading cards, original art, and video games.

Enter the Whatnot Marketplace

Whatnot is a new online auction marketplace that combined both livestreaming and auctions as the magic formula for success. The success of QVC and HSN has proven that live selling through television works. When it’s done through the internet, it’s livestreaming. Livestream shopping is an $11 billion business in the U.S. in 2022 but is expected to grow to $35 billion in sales by 2024 according to Coresight research. Whatnot is a privately-owned livestream collectibles auction marketplace. The Company was launched in 2019 and has gone through three rounds of funding. Whatnot doubled its valuation to $3.7 billion after a $260 million Series D round in July 2022. According to its co-CEO Grant LaFontaine Whatnot is a cross between the streaming platform Twitch and the auction site eBay. Whatnot is the country’s fastest growing marketplace according to Andreesen Horowitz. It provides real time auctions where customers can engage with the seller and each other with auctions lasting as fast as 30 seconds. This enables sellers to move a lot more products than traditional listings due to the sheer speed of turnaround. Other such marketplaces include Drip, Facebook NASDAQ: META and Instagram live, Popshop, and Upmesh.

eBay Taking Aim

Whatnot has been drawing many eBay sellers to the platform based on the real-time aspect and cheaper fees. Whatnot charges an 8% commission and 2.9% payments processing and a +$0.30 fee. eBay charges 10% on its listed auctions and 3% payment processing for 13% versus 10.9% for WhatNot. But eBay is the behemoth with a much larger audience. While that can be a plus, it can also be a negative since too many auction sellers can mean getting lost in the shuffle and risking selling a high value collectible at a very low bid price due to time and bidder constraints. Both sites work best for influencers with an existing audience. eBay appears to be aiming for Whatnot and competitors with its eBay Live platform currently still in beta. It could be a gamechanger when its widely launched.

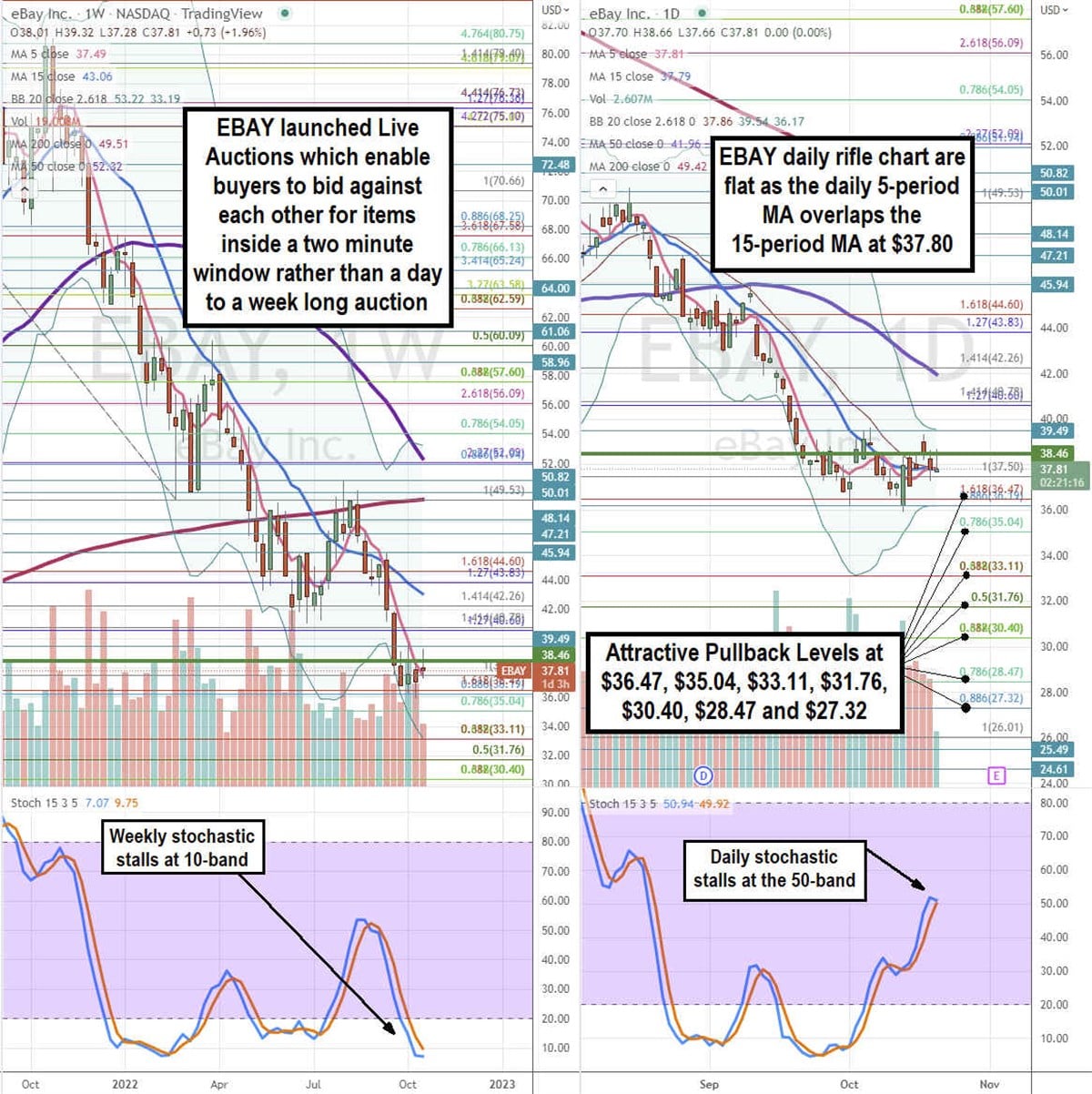

Here’s What the Charts Say

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the price action for EBAY stock. The weekly rifle chart downtrend is attempting to hold a bottom near the $36.19 Fibonacci (fib) level. The weekly downtrend is led by the falling 5-period moving average (MA) resistance testing at $37.49 followed by the weekly 15-period MA resistance falling at $43.06. The weekly 50-period MA is falling at $49.51 and weekly 200-period MA sits at $52.22. The weekly stochastic has fallen under the 20-band to stall near the 10-band on the fall. The weekly market structure low (MSL) buy signal is triggered on a breakout through $38.46. The daily rifle chart downtrend has stalled as the daily 5-period MA and 15-period MA overlap each other at $37.80. The stochastic has been rising but is now stalling just above the 50-band. The daily Bollinger Bands (BBs) have been compressing as the upper BBs sit at $39.54 and lower BBs sit at $36.17. The compression precedes the price expansion which formed by a breakout or breakdown and subsequent trend. Attractive pullback levels sit at the $36.47 fib, $35.04 fib, $33.11 fib, $31.76 fib, $30.40 fib, $28.47 fib, and the $27.32 fib level.

Focus on Growing its Collectibles Business

eBay is clearly looking at the collectibles market to be a growth driver. It joined former Disney CEO Bob Iger and The Chernin Group in a strategic investment purchasing 25% of pop culture toy maker Funko NASDAQ: FNKO. eBay will be the preferred secondary market for Funko products and collaborate on special exclusive product releases. eBay will acquire collectable card game marketplace TCGplayer for $296 million to be closed in Q1 2023 upon regulatory approval. eBay rolled out its beta-version of Live in June 2022. This is not to be mistaken with eBay Live Auctions, which is a collaboration with auction houses like Sotheby’s to let users bid during their events. eBay Live centers around eBay sellers having the ability to livestream their auctions in addition to listing them on the site.

eBay Vault

Some of the largest collectibles auction sits like Heritage or Comic Link usually require auction items to be sent to them first and verified before being included in auctions. eBay Vault is a service where sellers can send in their trading cards to hold for both safekeeping and selling purposes. eBay will make digital copies available when the owners are ready to sell.

Q2 2022 Earnings

On Aug. 23, 2022, eBay released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profit of $0.99 excluding non-recurring items versus consensus analyst estimates for a profit of $0.89, a $0.10 beat. Revenues fell (-9.2%) and (-6% on an FX-neutral basis) year-over-year (YoY) to $2.42 billion beating $2.36 billion consensus analyst estimates. Gross merchandise volume (GMV) fell (-18%) to $18.5 billion.

What to Expect for Q3 2022

eBay lowered the bar for its upcoming Q3 2022 results. It expects EPS between $0.89 to $0.95 versus $0.92 consensus analyst estimates. It expects Q3 2022 revenues to come in between $2.29 billion to $2.37 billion versus $2.3 billion consensus analyst estimates. eBay’s third-quarter earnings are due out after the bell on Nov. 2, 2022. The Company should provide more color on the progress of its eBay Live offering.

Before you consider eBay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eBay wasn't on the list.

While eBay currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.