One of the benefits of living in an age of technological advancement is reaping the conveniences these innovations bring.

But what is disruptive technology exactly, and how is it defined in investments? In this article, you’ll learn how to spot some disruptive technology characteristics, how innovation influences markets and how you can benefit personally and financially from these products and companies.

What is Disruptive Technology?

What is a disruptive technology, exactly? Technology disruption isn’t an asset class or stock sector. Instead, it's more of a vague concept describing an innovation that creates a new market or systematically changes an existing one. The disruptive technology definition comes from Clay Christensen’s 1997 book "The Innovator’s Dilemma: When New Technologies Cause Old Firms To Fail." In the book, Christensen discusses how disruptors can fundamentally alter the landscape of business and society, but will inevitably face strong headwinds from incumbents, skeptical consumers and low margins.

The term may have been coined in the 1990s, but examples predate the phrase by hundreds or thousands of years. An example of a disruptive technology is an item as simple as the telephone, refrigerator or automobile. The basic tools created by our ancient ancestors could be considered the biggest technological disruptions of all time. The point here is that disruption has occurred for millennia and likely will continue to occur for millennia to come. The difficulty becomes separating true disruptors from the countless startups and firms that will fail to advance their ideas.

Understanding Disruptive Technology

Looking beyond the disruptive technologies definition, investing in disruptive technology requires an understanding of both markets and human psychology. Many of the technologies we use daily were laughed at by investors and media when first proposed. Founders at Netflix Inc. NASDAQ: NFLX were told that no one would want to receive movies in the mail or watch TV shows over the internet. Amazon Inc. NASDAQ: AMZN was told no one would want to shop for expensive items online. History is littered with such examples. Inventors like Robert Fulton and the Wright Brothers were laughed at until they changed the world.

The trick, of course, is buying into the companies that do change the world — far easier sound than done. For every Uber and Amazon, dozens of companies like Fitbit, MoviePass and WebVan exist. So how do you separate the wheat from the chaff? Some investors, like venture capitalists, use a "spray and pray" approach and take dozens or even hundreds of smaller stakes looking to hit big on just a few winners. Others heavily research specific industries or niches, using their field expertise to select the firms with the highest possibility of success.

Examples of Disruptive Technology

The NASDAQ index contains many disruptive technology examples. One of the biggest innovators of the last few decades has been Apple Inc. NYSE: AAPL, which claims disruptive tech products like the iPhone, AirPods, Mac laptop series and the Apple Watch. Apple investors have seen the rewards — the company now has the largest market cap in the entire world and has significantly outpaced the S&P 500 over the last five years.

Apple has become one of the largest incumbents in the tech sector, and many competitors have attempted to disrupt the iPhone and Mac over the last decade with minimal success. In fact, at the end of 2007, when the iPhone was just coming to market, Apple’s split-adjusted stock price was barely over $6. A $10,000 investment in Apple shares at the end of 2007 would be worth more than $320,000 today.

How to Invest in Disruptive Technology

Here’s how to get started with an investment in disruptive technologies:

Step 1: Develop an investment plan.

It might be tempting just to buy a bunch of NVIDIA stock call yourself a disruptive tech investor, but you'll need a plan with a bit more detail. If you have expertise in a niche area like robotics or computing, that could be tenet to build your investment plan around. Even if you prefer the "spray and pray" approach, you want to develop a thesis and know your timeline for each investment.

Step 2: Decide which type of securities to invest in.

Stocks or ETFs? Robotics and AI or cloud computing? Or all of the above? The answer will vary depending on your goals, but you’ll need to make some decisions about the direction of your portfolio before putting any cash to work.

Step 3: Research different companies or funds and build a portfolio.

Once you know which industries and securities you’ll be investing in, it’s time to get to work. Researching companies and funds is tedious and time-consuming, but you must understand what you own and why. Ensure you know what’s in the prospectus or balance sheet of stock or fund you buy.

Step 4: Monitor your investments and be ready to pivot quickly.

"Set and forget it" isn’t a luxury disruptive tech investors enjoy. Trends change quickly in the tech industry and your investment in the next big thing may turn into a fad or bubble. Disruptive technologies are often volatile, reflected in the price of the companies’ stocks.

Example of Investing in Disruptive Technology

One of the most recent examples of disruptive digital technology is artificial intelligence. Companies working on AI technology have seen their stock prices go supernova, with NVIDIA being the most prominent example. But if you want to invest in AI, you have a few different avenues to consider. Large-cap behemoths like NVIDIA are one choice, but you could also consider smaller firms like C3.ai Inc. NYSE: AI.

C3.ai spent most of the last five years in a bear market, but recent investor enthusiasm for AI tech has increased their stock price (albeit on a volatile track). However, looking at the larger picture is important when considering stocks like AI for disruptive tech investments. The company spent years floundering and needed an exuberant market to make a turnaround.

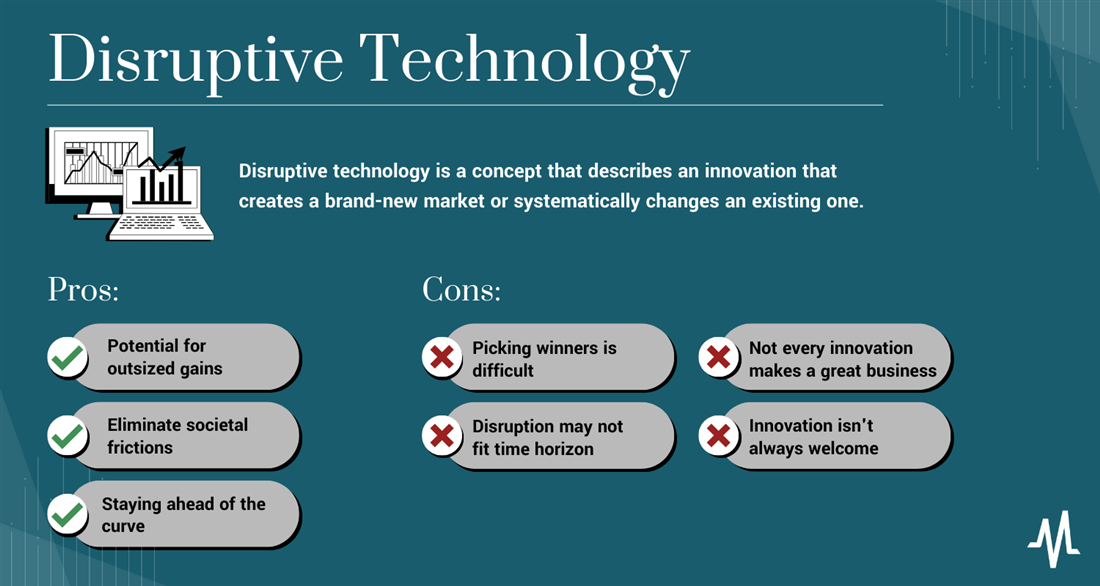

Pros and Cons of Investing in Disruptive Technology

Disruptive tech investing can be exhilarating, so understand the benefits and drawbacks of buying these volatile companies.

Pros

The benefits include:

- Potential for outsized gains: Investors who saw blockchain as a disruptive technology before 2017 saw meteoric gains if they invested in cryptocurrencies like Bitcoin and Ethereum. Even considering the recent crypto collapse, early adopters were able to make extraordinary profits. This will always be the primary allure of disruptive tech: the ability to make life-changing money.

- Eliminate societal frictions and inconveniences: Yes, making money is the goal of investing, but disruptive tech’s also inherently exciting due to its potential to improve society. For example, the robotics industry has greatly improved outcomes for surgeries and medical procedures, including invasive surgeries, bariatric surgery, and knee and hip replacements.

- Staying ahead of the curve: Research into disruptive tech allows investors to stay ahead regarding new innovations and businesses. Investors who were early to innovative companies like Tesla Inc. NASDAQ: TSLA likely understood the progress of artificial intelligence better than an investor concentrated on the banking sector. Disruptive tech always resides at the edge of the horizon, which can give forward-thinking investors an advantage.

Cons

The downsides include:

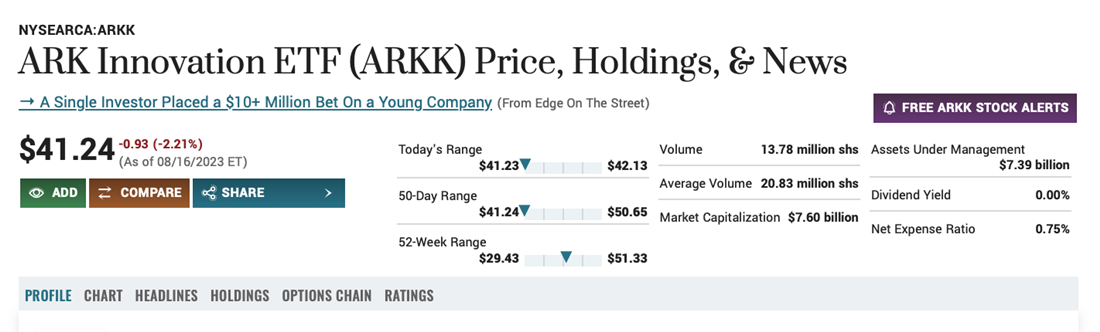

- Picking winners is difficult: No matter how you construct your disruptive tech investments, you’re still attempting to separate the winners from the losers and consistently picking winners is a rare skill. Good companies have downtimes, and great ideas can fail to scale. Even if you want a broader portfolio, you’ll still have to choose between funds like the ARK Innovation ETF NYSE: ARKK, which means you’re simply outsourcing the stock-picking to a manager (and paying for the privilege!)

- Disruption may not fit your time horizon: Many of the companies that failed during the dot-com bubble had good ideas that were poorly executed. Pets.com sold pet supplies online, which Chewy Inc. NYSE: CHWY now does from an app. WebVan delivered groceries, and today many grocery stores have delivery (or at least online ordering and pickup). Sometimes disruption occurs more slowly than our investment time horizon allows as a skeptical public holds out against new ideas.

- Not every innovation makes a great business: We’ve mentioned Uber a few times in this article, and while ridesharing has changed the short-distance transportation industry forever, Uber’s company stock hasn’t exactly rewarded its shareholders.

If you purchased stock at Uber’s IPO, you’d have watched your holdings trade in a flat range over the last five years, despite the increased proliferation of Uber into every major metro area in the country. Uber has stiff competition from Lyft Inc. NASDAQ: LYFT and the incumbent taxi industry, but they’re so dominant that Uber has become a verb. Despite all this success, the stock remains range-bound, showing that even the best ideas don’t always make money or result in huge stock gains.

- Innovation isn't always welcome: New companies and technologies will always receive pushback from incumbents and skeptics. Do you think cab drivers who paid five or six-digit sums for their taxi medallions welcomed the arrival of ridesharing? They did not and lobbied hard against Uber and Lyft to regulators. If the Wright Brothers were laughed at, you can be certain your favorite technological innovation will also have its share of detractors.

The Future of Disruptive Technology

Disruptive tech is full of certainties and uncertainties. Will new and creative innovations continue to change the landscape of business and markets progressively? Of course! But will you (or anyone) be able to predict the path of each tech company of fund successfully? Not all the time!

You’ll hear plenty of baseball analogies about investing, but one that’s true about disruptive tech is that investors are looking for home runs, not singles and doubles.

Disruptive Technology Requires More than Just Hype

Disruptive tech always has plenty of hype surrounding it, but you need more than just hype and excitement to find a successful company or industry. Is the technology or product scalable to a mass audience? Do the companies producing it have quality management and sturdy balance sheets? Is your investment plan deeper than just "buy tons of TSLA and NVDA?" Ensure you can answer these questions before putting any capital at risk in disruptive tech investments.

FAQs

What are disruptive technologies examples? Here are a few frequently asked questions about the products produced by these innovative companies:

What is meant by disruptive technology?

Disruptive tech refers to a product or service drastically changing any industry or sector. Disruptive tech often involves a new and superior product replacing an older and inferior one or the creation of an entirely new market unto itself.

What is the impact of disruptive technologies?

Disruptive technology have a massive impact on certain industries and businesses. For example, commercial air travel greatly disrupted commercial rail services. The internet replaced the daily printed newspaper. Rotary phones were replaced by cordless phones, which replaced by cellphones. Disruptive technology comes in many forms and impacts industries and societies all over the globe.

Is Netflix a disruptive technology?

Yes, Netflix can be considered a disruptive technology in two ways. First, they were one of the first companies to rent movies and games directly through the mail, which opposed the brick-and-mortar Blockbuster model. Then, Netflix pivoted to streaming movies and shows over the internet, disrupting the cable TV and movie studio industries.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...