When most people hear the phrase “stock analyst,” they imagine a singular role in a Wall Street hedge fund. However, the truth is that there are multiple types of asset analysts, and their roles vary depending on the type of research the client needs and who the analyst answers to. Buy-side analysts are stock analysts who narrow down assets for inclusion in the analyst’s selected fund, portfolio or other collection.

Understanding the difference between a sell side analyst vs buy side analyst can help you better interpret analyst ratings and incorporate this analysis into your buying strategy. Read on to learn more about sell side vs buy side analysis and what a buy-side analyst does.

What is a buy-side analyst?

If you've ever watched a show like CNBC's Mad Money, CNN's Your Money or other significant financial news programs, you're already familiar with the concept of a stock analyst. Stock analysts are responsible for looking at details of popular stocks and ETFs to provide an unbiased analysis for potential buyers.

There are multiple types of stock analysts, and the specific role of each analyst varies depending on their employers' requests. A buy side analyst is a type of stock analyst responsible for evaluating investments from the perspective of an entity or individual looking to buy or invest in assets such as stocks, bonds, real estate or other financial instruments. They look at assets from the perspective of someone looking to add new assets to their portfolio and who is narrowing down items worthy of inclusion in the analyst's fund, portfolio or list of recommendations.

Buy-side analysts are vital to the buying market, providing more professional insight into asset longevity. But what is a buy-side analyst likely looking for when comparing stock options? Buy-side equity research may involve looking at a stock or ETF's performance using the following technical indicators.

- Price-to-earnings (P/E) ratio: A stock's P/E ratio describes a stock's price relative to the earnings the company brings in per share issued. This metric can help determine if a stock is overvalued or undervalued compared to other companies' P/E ratio in the same industry.

- Earnings growth: Analysts look at historical and projected earnings growth to assess the company's profitability and potential for future growth. Buy-side analysts often look to future projects that could increase earnings potential, a form of fundamental analysis.

- Return on investment (ROI): ROI describes how effectively a company can generate profits from its investments.

- Profit margins: A profit margin is a financial metric that expresses a company's profitability as a percentage of its total revenue or sales. Assessing gross and net profit margins helps gauge the company's efficiency and profitability, which can help give insight into the company's longevity.

Many buy-side analysts also pay attention to market sentiment when considering which stocks to investigate. In summary, the job of a buy-side analyst is to compare assets from the perspective of an investor with capital to buy — and to eliminate assets from the pool that don't fit with the specific goals of the fund or portfolio.

What does a buy-side analyst do?

What is buy-side analysis, and why is it important? The "goal" of buy-side analysis is to help investors decide which assets to include in their portfolio. A buy-side analyst's day-to-day activities can vary depending on the asset class they specialize in and the type of company that they work for. Some of the daily activities of a buy-side analyst might include the following.

- Market research: The most important part of the job of a buy-side analyst is market research. Research analysts use various research tools and methods to investigate stocks and assets and determine which novel assets meet the criteria for inclusion in the fund or portfolio the analyst works for.

- Financial modeling: After researching assets that the buy-side analyst might recommend to their viewers or clients, they might create a financial model that projects potential returns. This may involve using spreadsheet software like Excel to project revenue, expenses and other important details like cash flow.

- Due diligence: The phrase "due diligence" refers to the comprehensive research and analysis conducted by investors to thoroughly assess a company's financial health, performance and potential risks before making an investment decision. Buy-side analysts working with private equity or venture capital investments may review legal documents, financial records and operational details to determine if an investment fits the firm's criteria for inclusion.

- Risk management: Another major role for buy-side analysts is ongoing risk management. After purchasing an asset or recommending it, a buy-side analyst will monitor the risk factors associated with the underlying company. They may also adjust positions or recommend changes to manage risk within the defined risk tolerance.

Buy-side analysts make recommendations to portfolio managers at the investment firms they work for. The only objective of a buy-side analyst is to guide how profitable a particular equity may be to the fund's investing strategy. For this reason, a buy-side analyst is assigned to an aggressive growth technology fund will assign a different value to the FAANG stocks than an investor focused on a conservative income fund.

The role of regulation in a buy-side analyst

Regulation plays a significant role in the work of a buy-side analyst, especially those who work directly with investors or fund managers. The Securities Exchange Commission (SEC) of the United States is the regulatory body that oversees most buy-side analysts. Analysts must ensure their research and recommendations comply with laws set in place by the SEC to prevent fraud and protect investors.

A major area where buy-side analysts must watch out when performing their tasks is the risk of insider trading. Buy-side analysts must adhere to various securities laws and regulations in the United States while maintaining connections with corporate innovators and insiders to determine who they can trust on the sell-side. Regulations prohibit the use of non-public, material information for trading purposes, meaning that buy-side analysts need to be careful in determining the sources they use when recommending assets to clients.

Beyond insider trading, strict rules control the language that buy-side analysts use to recommend products. Analysts as registered financial advisors must be particularly aware of regulations related to their industries and the type of investments they recommend.

The United States is not the only country that has introduced limitations on how buy-side analysts can recommend assets and conduct research. The Markets in Financial Instruments Directive (MiFID II) is a new set of regulations introduced to countries aligned as part of the European Union in January 2018.

MiFID II changed several rules that affect how buy-side analysts throughout Europe do their jobs. For example, under MiFID II, there is a requirement to separate the cost of research from execution services. Asset managers must pay for research services separately rather than receiving research as a bundled service from brokers.

Buy-side analysts now need to budget and allocate funds specifically for research, which has increased scrutiny of the value and quality of research they consume. Keeping up-to-date with changing regulatory rules is another essential part of the job of a buy-side analyst.

Buy-side equity research

While the day-to-day responsibilities of multiple types of analysts may overlap, equity research goals may differ. While both analysts will spend most of their day researching and evaluating financial news, buy-side analysts may have a wider range of assets to investigate. For example, a sell-side analyst might determine whether a mutual fund should liquidate its position in a particular company, buy-side analysts might have the job of narrowing down stocks within the tech sector to select an asset for inclusion.

Buy-side analysis can be a higher-pressure role when compared to sell-side analysts because their compensation is usually dependent upon selected asset performance. A buy-side analyst might assign a “rank” to multiple assets within a sector that compare their relative versions — though in some corporate structures, this role is confined to sell-side analysts. These rankings usually range between "strong sell" and “strong buy,” with a neutral ranking of “hold,” splitting the difference between the two extremes.

These ratings can give retail investors and other analysts insights they might want to include in their portfolios. Buy and sell ratings provide immediate insight into how analysts view a stock, which can be helpful for retail investors who may not have time to conduct their independent analysis.

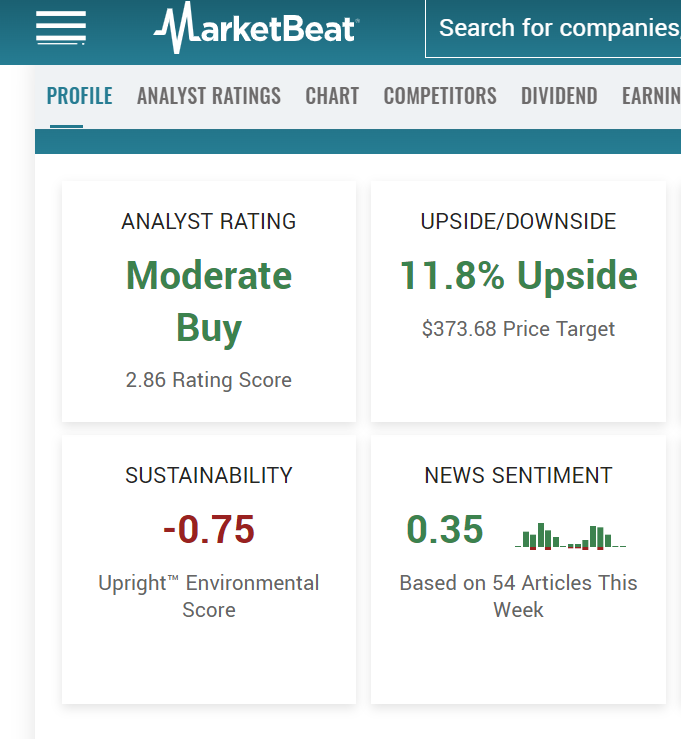

These ratings may change regularly based on the condition and management of the stock — for example, the week of September 12, 2023, the average analyst gave Microsoft Corp. NASDAQ: MSFT a rating of "moderate buy," indicating that it may show stronger fundamentals when compared to other stocks within the same sector.

Buy-side vs. sell-side analysts

It's useful to compare buy side vs sell side analyst roles and examine how they differ. Unlike a buy-side analyst, a sell-side analyst looks at individual companies and funds to generate commissions by attracting clients to their firm's services.

Sell-side analysts usually perform in-depth research of specific industries or companies and may work directly with buy-side analysts to relay this information. Based on the quality of information they provide, buy-side analysts must determine which sell-side analysts they can trust. Buy-side analysts use information from sell-side counterparts because they tend to research companies more in-depth, providing information on the inner workings that surface-level analysis may not provide.

When comparing sell side vs buy side analyst roles, the biggest difference is what analysts evaluate. Specific price targets and financial modeling are important for buy-side analysts, who work with slimmer margins of error than sell-side analysts.

Example of buy-side analysis

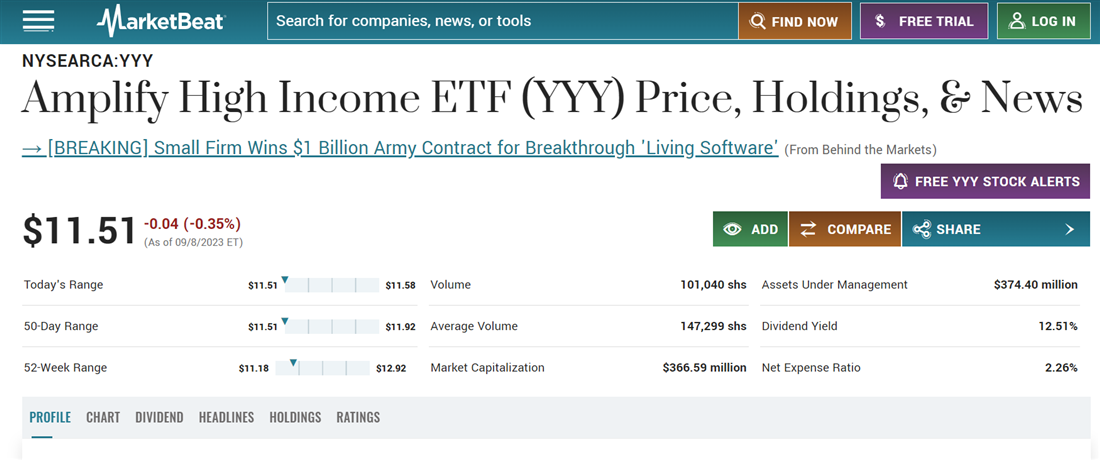

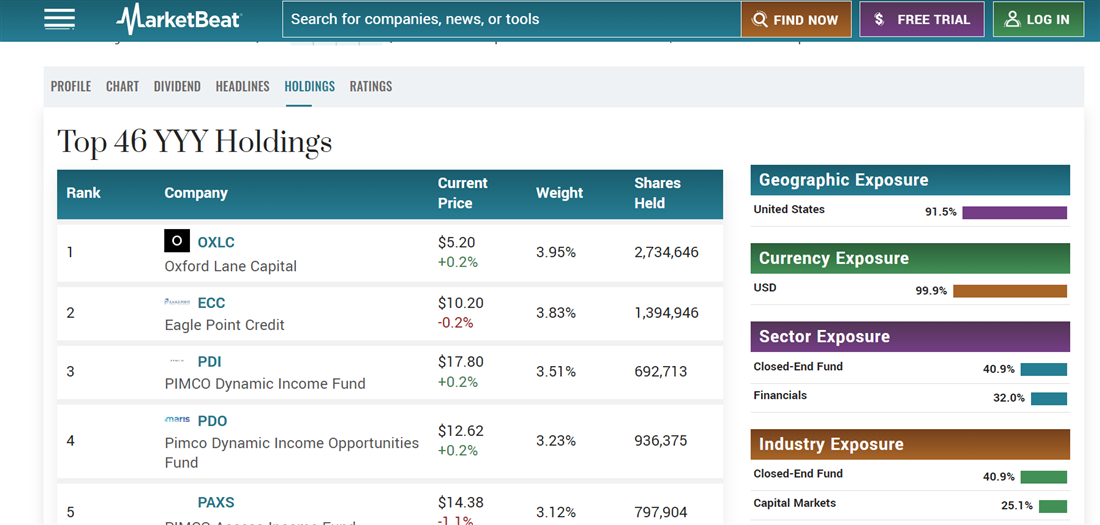

What does buy-side research usually entail? To help imagine how buy-side analysis works, imagine you are a fund manager for the Amplify High Income ETF NYSE: YYY. As the name suggests, this fund invests in income-producing assets, with most of its holdings in the financial services and capital market.

When evaluating assets for inclusion in the fund, buy-side analysts might begin by screening stocks based on their dividend yield. The dividend yield describes the percentage of a stock’s share value that it pays back each year in dividends. While the fund's primary objective is to return value to investors, analysts know that it’s crucial not to look at dividend payments alone when evaluating investments. Some additional indicators YYY buy analysts might look at include the following:

When evaluating assets for inclusion in the fund, buy-side analysts might begin by screening stocks based on their dividend yield. The dividend yield describes the percentage of a stock’s share value that it pays back each year in dividends. While the fund's primary objective is to return value to investors, analysts know that it’s crucial not to look at dividend payments alone when evaluating investments. Some additional indicators YYY buy analysts might look at include the following:

- Dividend growth: Dividend growth tracks the number of years a company has raised its dividend, giving insight into its sustainability.

- Relative strength: Relative strength describes the speed and change of a stock’s price change and can help a buy analyst identify undervalued assets.

- P/E ratio: P/E ratio can help a buy-side analyst differentiate between companies paying consistent dividends from their profits and those artificially rising dividends to attract new investors before cutting payments.

Using these criteria and others, buy-side analysts have selected 46 stocks and funds that meet YYY’s specifications for inclusions. Investors who purchase shares of the fund benefit from this buy-side analysis, as they gain exposure to all of the assets fund managers decided to buy.

The role of a buy-side analyst

The role of a buy-side analyst

Understanding buy-side vs. sell-side analysis and how these roles differ on Wall Street can help guide your investment decisions. Resources like MarketBeat track analyst ratings and how they change over time, allowing you to incorporate this analysis into your buying decisions. The MarketBeat Analyst Rating Screener can help you further investigate assets you're thinking of buying based on what industry experts are saying.

Before you consider Amplify High Income ETF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amplify High Income ETF wasn't on the list.

While Amplify High Income ETF currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.