Cadence Design Systems (NASDAQ:CDNS - Free Report) had its price objective lifted by Wells Fargo & Company from $365.00 to $405.00 in a research note released on Tuesday morning, MarketBeat reports. The brokerage currently has an overweight rating on the software maker's stock.

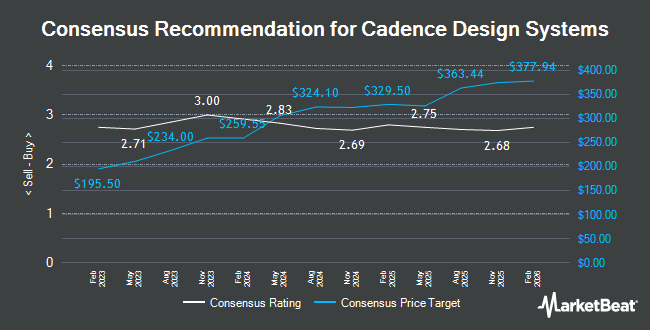

A number of other research firms have also recently issued reports on CDNS. JPMorgan Chase & Co. raised shares of Cadence Design Systems from a "neutral" rating to an "overweight" rating and increased their price objective for the stock from $300.00 to $325.00 in a research report on Thursday, April 24th. Rosenblatt Securities reissued a "neutral" rating and set a $300.00 price objective on shares of Cadence Design Systems in a research report on Friday, July 25th. Stifel Nicolaus increased their price objective on shares of Cadence Design Systems from $350.00 to $395.00 and gave the stock a "buy" rating in a research report on Tuesday. Wall Street Zen cut shares of Cadence Design Systems from a "buy" rating to a "hold" rating in a research report on Sunday, July 20th. Finally, Bank of America upped their target price on shares of Cadence Design Systems from $320.00 to $350.00 and gave the stock a "buy" rating in a report on Tuesday, April 29th. One research analyst has rated the stock with a sell rating, three have issued a hold rating and twelve have given a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $364.33.

View Our Latest Report on Cadence Design Systems

Cadence Design Systems Trading Down 1.6%

Shares of NASDAQ:CDNS traded down $5.95 during mid-day trading on Tuesday, hitting $358.62. The company had a trading volume of 462,972 shares, compared to its average volume of 2,085,731. The firm has a fifty day moving average price of $312.60 and a 200 day moving average price of $290.37. The company has a market capitalization of $97.92 billion, a PE ratio of 96.90, a price-to-earnings-growth ratio of 4.88 and a beta of 0.99. The company has a debt-to-equity ratio of 0.49, a current ratio of 2.82 and a quick ratio of 2.90. Cadence Design Systems has a one year low of $221.56 and a one year high of $376.45.

Cadence Design Systems (NASDAQ:CDNS - Get Free Report) last released its quarterly earnings data on Monday, July 28th. The software maker reported $1.65 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.56 by $0.09. The company had revenue of $1.28 billion for the quarter, compared to analysts' expectations of $1.25 billion. Cadence Design Systems had a net margin of 19.88% and a return on equity of 29.65%. The business's revenue was up 20.2% on a year-over-year basis. During the same quarter in the prior year, the firm earned $1.28 EPS. As a group, research analysts forecast that Cadence Design Systems will post 5.41 EPS for the current year.

Insider Buying and Selling at Cadence Design Systems

In other Cadence Design Systems news, Director Ita M. Brennan sold 180 shares of the stock in a transaction dated Tuesday, June 10th. The shares were sold at an average price of $304.00, for a total value of $54,720.00. Following the completion of the sale, the director owned 8,010 shares in the company, valued at approximately $2,435,040. This trade represents a 2.20% decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, VP Paul Cunningham sold 1,000 shares of the stock in a transaction dated Tuesday, July 1st. The shares were sold at an average price of $306.35, for a total transaction of $306,350.00. Following the completion of the sale, the vice president owned 105,499 shares of the company's stock, valued at approximately $32,319,618.65. This trade represents a 0.94% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 3,698 shares of company stock worth $1,126,667. Insiders own 1.99% of the company's stock.

Institutional Investors Weigh In On Cadence Design Systems

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. GAMMA Investing LLC grew its position in shares of Cadence Design Systems by 31,049.1% during the 1st quarter. GAMMA Investing LLC now owns 1,218,241 shares of the software maker's stock valued at $309,835,000 after acquiring an additional 1,214,330 shares during the period. Nuveen LLC bought a new position in shares of Cadence Design Systems during the 1st quarter valued at approximately $289,744,000. Jennison Associates LLC grew its position in shares of Cadence Design Systems by 13.2% during the 1st quarter. Jennison Associates LLC now owns 9,064,953 shares of the software maker's stock valued at $2,305,489,000 after acquiring an additional 1,054,702 shares during the period. Assenagon Asset Management S.A. grew its position in shares of Cadence Design Systems by 466.4% during the 2nd quarter. Assenagon Asset Management S.A. now owns 786,849 shares of the software maker's stock valued at $242,468,000 after acquiring an additional 647,931 shares during the period. Finally, FMR LLC grew its position in shares of Cadence Design Systems by 8.7% during the 4th quarter. FMR LLC now owns 7,978,652 shares of the software maker's stock valued at $2,397,266,000 after acquiring an additional 639,146 shares during the period. Hedge funds and other institutional investors own 84.85% of the company's stock.

Cadence Design Systems Company Profile

(

Get Free Report)

Cadence Design Systems, Inc provides software, hardware, services, and reusable integrated circuit (IC) design blocks worldwide. The company offers functional verification services, including emulation and prototyping hardware. Its functional verification offering consists of JasperGold, a formal verification platform; Xcelium, a parallel logic simulation platform; Palladium, an enterprise emulation platform; and Protium, a prototyping platform for chip verification.

Recommended Stories

Before you consider Cadence Design Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cadence Design Systems wasn't on the list.

While Cadence Design Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.