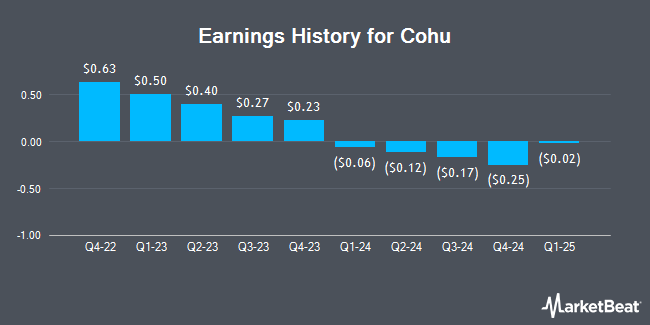

Cohu (NASDAQ:COHU - Get Free Report) announced its earnings results on Thursday. The semiconductor company reported $0.02 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.02) by $0.04, Briefing.com reports. The business had revenue of $107.68 million for the quarter, compared to analyst estimates of $106.00 million. Cohu had a negative net margin of 22.11% and a negative return on equity of 3.74%. The company's revenue for the quarter was up 2.9% compared to the same quarter last year. During the same period last year, the firm posted ($0.01) earnings per share. Cohu updated its Q3 2025 guidance to EPS.

Cohu Price Performance

Shares of NASDAQ:COHU traded down $0.03 during midday trading on Wednesday, hitting $18.44. 169,559 shares of the stock were exchanged, compared to its average volume of 469,615. The stock has a market cap of $860.78 million, a P/E ratio of -9.87 and a beta of 1.25. The company has a current ratio of 4.88, a quick ratio of 3.51 and a debt-to-equity ratio of 0.01. Cohu has a twelve month low of $12.57 and a twelve month high of $29.42. The company has a 50 day moving average price of $19.09 and a 200-day moving average price of $18.39.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on the company. Wall Street Zen downgraded Cohu from a "hold" rating to a "sell" rating in a report on Tuesday, May 13th. Stifel Nicolaus reduced their target price on Cohu from $35.00 to $28.00 and set a "buy" rating for the company in a report on Friday, May 2nd. TD Cowen reduced their target price on Cohu from $27.00 to $22.00 and set a "buy" rating for the company in a report on Friday, May 2nd. Finally, Needham & Company LLC reissued a "hold" rating on shares of Cohu in a report on Friday, May 2nd. Two research analysts have rated the stock with a sell rating, one has given a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, Cohu has a consensus rating of "Hold" and a consensus target price of $27.17.

Get Our Latest Research Report on COHU

Institutional Trading of Cohu

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in Cohu by 3.4% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 27,214 shares of the semiconductor company's stock worth $400,000 after purchasing an additional 905 shares in the last quarter. Caxton Associates LLP purchased a new stake in Cohu during the 1st quarter worth about $276,000. Finally, Jane Street Group LLC increased its position in Cohu by 2,042.7% during the 1st quarter. Jane Street Group LLC now owns 162,674 shares of the semiconductor company's stock worth $2,393,000 after purchasing an additional 155,082 shares in the last quarter. Hedge funds and other institutional investors own 94.67% of the company's stock.

Cohu Company Profile

(

Get Free Report)

Cohu, Inc, through its subsidiaries, provides semiconductor test equipment and services in China, the United States, Taiwan, Malaysia, the Philippines, and internationally. The company supplies semiconductor test and inspection handlers, micro-electromechanical system (MEMS) test modules, test contactors, thermal sub-systems, and semiconductor automated test equipment for semiconductor manufacturers and test subcontractors.

See Also

Before you consider Cohu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cohu wasn't on the list.

While Cohu currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.