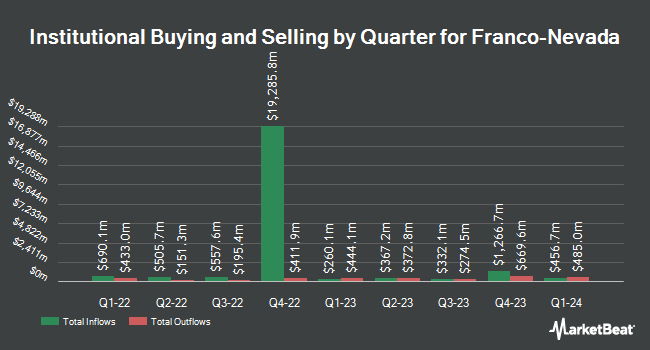

Astoria Portfolio Advisors LLC. acquired a new stake in shares of Franco-Nevada Corporation (NYSE:FNV - Free Report) TSE: FNV during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm acquired 1,568 shares of the basic materials company's stock, valued at approximately $267,000.

Other hedge funds have also made changes to their positions in the company. CX Institutional acquired a new position in shares of Franco-Nevada during the first quarter valued at approximately $30,000. Nexus Investment Management ULC acquired a new position in shares of Franco-Nevada during the first quarter valued at approximately $35,000. Golden State Wealth Management LLC increased its stake in shares of Franco-Nevada by 100.0% during the first quarter. Golden State Wealth Management LLC now owns 230 shares of the basic materials company's stock valued at $36,000 after acquiring an additional 115 shares during the period. Versant Capital Management Inc acquired a new position in shares of Franco-Nevada during the first quarter valued at approximately $55,000. Finally, Physician Wealth Advisors Inc. acquired a new position in shares of Franco-Nevada during the fourth quarter valued at approximately $49,000. Institutional investors and hedge funds own 77.06% of the company's stock.

Analyst Ratings Changes

A number of analysts recently weighed in on FNV shares. BMO Capital Markets restated an "outperform" rating on shares of Franco-Nevada in a report on Wednesday, May 28th. Royal Bank Of Canada raised their target price on shares of Franco-Nevada from $160.00 to $190.00 and gave the stock a "sector perform" rating in a report on Wednesday, June 4th. UBS Group raised their target price on shares of Franco-Nevada from $205.00 to $210.00 and gave the stock a "buy" rating in a report on Thursday. National Bankshares restated a "sector perform" rating on shares of Franco-Nevada in a report on Tuesday, June 24th. Finally, Scotiabank raised their target price on shares of Franco-Nevada from $165.00 to $169.00 and gave the stock a "sector perform" rating in a report on Monday, May 12th. Six investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $172.13.

Check Out Our Latest Report on Franco-Nevada

Franco-Nevada Price Performance

NYSE FNV traded up $1.10 on Friday, hitting $165.54. 395,450 shares of the stock were exchanged, compared to its average volume of 747,510. Franco-Nevada Corporation has a 52-week low of $112.70 and a 52-week high of $179.99. The company has a market capitalization of $31.89 billion, a price-to-earnings ratio of 51.73, a P/E/G ratio of 2.26 and a beta of 0.41. The company's 50-day moving average price is $166.74 and its two-hundred day moving average price is $150.59.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last posted its quarterly earnings data on Thursday, May 8th. The basic materials company reported $1.07 earnings per share for the quarter, topping the consensus estimate of $1.00 by $0.07. Franco-Nevada had a net margin of 50.39% and a return on equity of 11.40%. The firm had revenue of $368.40 million for the quarter, compared to analysts' expectations of $328.79 million. During the same period in the previous year, the company posted $0.76 EPS. The company's quarterly revenue was up 43.5% compared to the same quarter last year. Equities analysts predict that Franco-Nevada Corporation will post 3.09 EPS for the current fiscal year.

Franco-Nevada Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, June 26th. Shareholders of record on Thursday, June 12th were paid a dividend of $0.38 per share. This represents a $1.52 dividend on an annualized basis and a dividend yield of 0.92%. The ex-dividend date was Thursday, June 12th. Franco-Nevada's dividend payout ratio (DPR) is currently 47.50%.

Franco-Nevada Company Profile

(

Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Featured Articles

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.