Allianz Asset Management GmbH reduced its holdings in Genworth Financial, Inc. (NYSE:GNW - Free Report) by 3.7% in the 2nd quarter, according to the company in its most recent filing with the SEC. The firm owned 1,542,001 shares of the financial services provider's stock after selling 58,693 shares during the quarter. Allianz Asset Management GmbH owned approximately 0.37% of Genworth Financial worth $11,997,000 as of its most recent SEC filing.

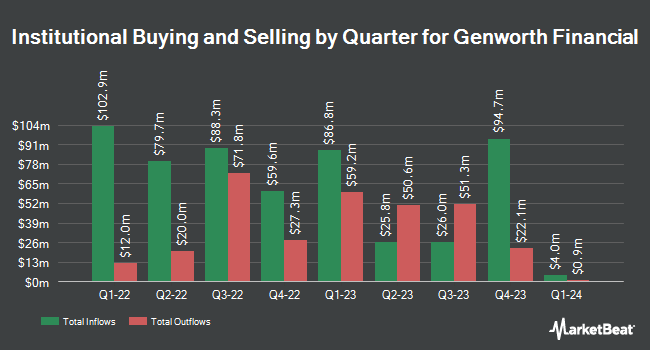

Other hedge funds also recently modified their holdings of the company. Nuveen LLC acquired a new stake in Genworth Financial in the first quarter valued at $24,661,000. Donald Smith & CO. Inc. grew its position in shares of Genworth Financial by 4.5% in the 1st quarter. Donald Smith & CO. Inc. now owns 27,114,581 shares of the financial services provider's stock valued at $192,242,000 after buying an additional 1,165,112 shares during the last quarter. American Century Companies Inc. increased its stake in shares of Genworth Financial by 11.6% in the first quarter. American Century Companies Inc. now owns 8,056,534 shares of the financial services provider's stock valued at $57,121,000 after buying an additional 836,192 shares during the period. Trexquant Investment LP increased its stake in shares of Genworth Financial by 162.4% in the first quarter. Trexquant Investment LP now owns 1,330,661 shares of the financial services provider's stock valued at $9,434,000 after buying an additional 823,470 shares during the period. Finally, Cubist Systematic Strategies LLC raised its position in shares of Genworth Financial by 56.8% during the first quarter. Cubist Systematic Strategies LLC now owns 1,765,607 shares of the financial services provider's stock worth $12,518,000 after acquiring an additional 639,676 shares during the last quarter. Institutional investors and hedge funds own 81.85% of the company's stock.

Insiders Place Their Bets

In other Genworth Financial news, CEO Rohit Gupta sold 86,406 shares of the firm's stock in a transaction that occurred on Wednesday, August 27th. The stock was sold at an average price of $8.68, for a total value of $750,004.08. Following the completion of the sale, the chief executive officer owned 794,630 shares of the company's stock, valued at approximately $6,897,388.40. This trade represents a 9.81% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Company insiders own 1.80% of the company's stock.

Analysts Set New Price Targets

GNW has been the topic of several analyst reports. Keefe, Bruyette & Woods upped their target price on Genworth Financial from $9.50 to $10.00 and gave the company an "outperform" rating in a report on Thursday, October 9th. Wall Street Zen lowered shares of Genworth Financial from a "hold" rating to a "sell" rating in a research note on Saturday, October 11th. Finally, Weiss Ratings reissued a "hold (c+)" rating on shares of Genworth Financial in a research note on Wednesday, October 8th. One investment analyst has rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $10.00.

Check Out Our Latest Stock Report on Genworth Financial

Genworth Financial Price Performance

Shares of GNW opened at $8.68 on Tuesday. The firm has a market cap of $3.56 billion, a PE ratio of 19.28 and a beta of 0.99. Genworth Financial, Inc. has a 52-week low of $5.99 and a 52-week high of $9.15. The business's 50 day moving average price is $8.68 and its two-hundred day moving average price is $7.73. The company has a debt-to-equity ratio of 0.16, a quick ratio of 0.29 and a current ratio of 0.29.

Genworth Financial (NYSE:GNW - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The financial services provider reported $0.16 earnings per share for the quarter, beating the consensus estimate of $0.05 by $0.11. Genworth Financial had a net margin of 2.61% and a return on equity of 1.91%. The company had revenue of $1.80 billion during the quarter.

Genworth Financial Company Profile

(

Free Report)

Genworth Financial, Inc, together with its subsidiaries, provides mortgage and long-term care insurance products in the United States and internationally. It operates in three segments: Enact, Long-Term Care Insurance, and Life and Annuities. The Enact segment offers private mortgage insurance products primarily insuring prime-based, individually underwritten residential mortgage loans; and pool mortgage insurance products.

Further Reading

Want to see what other hedge funds are holding GNW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Genworth Financial, Inc. (NYSE:GNW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Genworth Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genworth Financial wasn't on the list.

While Genworth Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.