Avantax Advisory Services Inc. grew its stake in GSK PLC Sponsored ADR (NYSE:GSK - Free Report) by 18.5% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 122,800 shares of the pharmaceutical company's stock after buying an additional 19,147 shares during the period. Avantax Advisory Services Inc.'s holdings in GSK were worth $4,757,000 as of its most recent filing with the Securities and Exchange Commission.

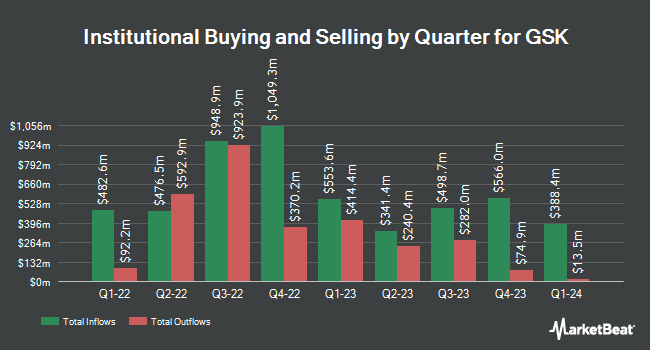

Several other large investors also recently modified their holdings of GSK. Kingsview Wealth Management LLC grew its position in shares of GSK by 1.8% during the 1st quarter. Kingsview Wealth Management LLC now owns 15,227 shares of the pharmaceutical company's stock worth $590,000 after buying an additional 271 shares during the period. Rehmann Capital Advisory Group boosted its stake in shares of GSK by 4.6% in the 1st quarter. Rehmann Capital Advisory Group now owns 6,407 shares of the pharmaceutical company's stock worth $248,000 after buying an additional 279 shares during the last quarter. First PREMIER Bank boosted its position in GSK by 6.5% in the first quarter. First PREMIER Bank now owns 4,659 shares of the pharmaceutical company's stock worth $181,000 after purchasing an additional 286 shares during the last quarter. Northwest Bank & Trust Co boosted its holdings in shares of GSK by 1.3% in the 4th quarter. Northwest Bank & Trust Co now owns 22,405 shares of the pharmaceutical company's stock worth $765,000 after buying an additional 289 shares during the last quarter. Finally, OneAscent Financial Services LLC boosted its stake in GSK by 3.9% in the first quarter. OneAscent Financial Services LLC now owns 7,700 shares of the pharmaceutical company's stock valued at $297,000 after acquiring an additional 292 shares during the last quarter. 15.74% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts have recently commented on the company. BNP Paribas initiated coverage on GSK in a research report on Tuesday, April 15th. They set a "neutral" rating and a $35.25 price target on the stock. Wall Street Zen cut GSK from a "buy" rating to a "hold" rating in a report on Saturday, July 26th. Hsbc Global Res upgraded shares of GSK to a "strong sell" rating in a research report on Monday, April 28th. Finally, Berenberg Bank reissued a "hold" rating on shares of GSK in a report on Tuesday, June 3rd. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $37.38.

Check Out Our Latest Stock Analysis on GSK

GSK Trading Down 2.3%

Shares of GSK stock traded down $0.88 during mid-day trading on Thursday, reaching $38.09. The stock had a trading volume of 3,769,097 shares, compared to its average volume of 5,349,360. The stock's 50-day moving average price is $39.02 and its two-hundred day moving average price is $37.60. The company has a current ratio of 0.87, a quick ratio of 0.58 and a debt-to-equity ratio of 1.21. The firm has a market capitalization of $77.77 billion, a PE ratio of 19.65, a price-to-earnings-growth ratio of 1.53 and a beta of 0.50. GSK PLC Sponsored ADR has a 52-week low of $31.72 and a 52-week high of $44.67.

GSK (NYSE:GSK - Get Free Report) last released its earnings results on Wednesday, July 30th. The pharmaceutical company reported $1.23 EPS for the quarter, topping the consensus estimate of $1.12 by $0.11. GSK had a net margin of 9.89% and a return on equity of 48.82%. The firm had revenue of $10.64 billion for the quarter, compared to the consensus estimate of $7.92 billion. During the same quarter in the previous year, the firm earned $0.43 earnings per share. The company's quarterly revenue was up 1.3% compared to the same quarter last year. Equities analysts expect that GSK PLC Sponsored ADR will post 4.14 earnings per share for the current fiscal year.

GSK Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, July 10th. Stockholders of record on Friday, May 16th were issued a $0.4216 dividend. This represents a $1.69 annualized dividend and a dividend yield of 4.43%. The ex-dividend date was Friday, May 16th. This is an increase from GSK's previous quarterly dividend of $0.39. GSK's payout ratio is 78.70%.

GSK Profile

(

Free Report)

GSK plc, together with its subsidiaries, engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through two segments, Commercial Operations and Total R&D.

See Also

Before you consider GSK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GSK wasn't on the list.

While GSK currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.