Korea Investment CORP cut its stake in shares of Owens Corning Inc (NYSE:OC - Free Report) by 9.1% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The fund owned 109,987 shares of the construction company's stock after selling 10,957 shares during the period. Korea Investment CORP owned 0.13% of Owens Corning worth $15,708,000 as of its most recent filing with the SEC.

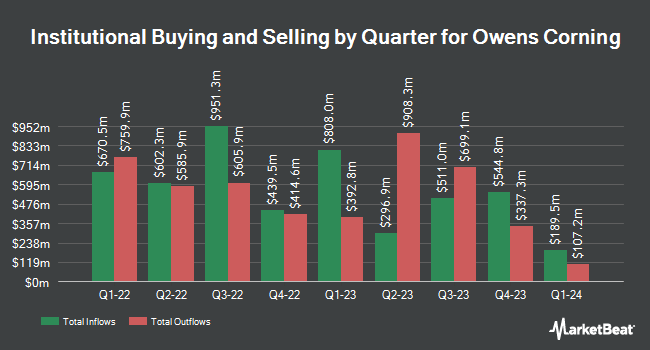

Several other institutional investors have also recently made changes to their positions in OC. Vanguard Group Inc. raised its stake in shares of Owens Corning by 12.0% during the 1st quarter. Vanguard Group Inc. now owns 9,815,685 shares of the construction company's stock worth $1,401,876,000 after purchasing an additional 1,053,855 shares in the last quarter. LSV Asset Management increased its holdings in Owens Corning by 1.9% during the first quarter. LSV Asset Management now owns 1,476,067 shares of the construction company's stock worth $210,812,000 after buying an additional 27,185 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in Owens Corning by 41.1% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 1,422,828 shares of the construction company's stock worth $242,337,000 after acquiring an additional 414,770 shares in the last quarter. Northern Trust Corp lifted its stake in Owens Corning by 27.4% in the fourth quarter. Northern Trust Corp now owns 964,861 shares of the construction company's stock valued at $164,335,000 after acquiring an additional 207,677 shares during the last quarter. Finally, Bank of New York Mellon Corp lifted its stake in Owens Corning by 0.7% in the first quarter. Bank of New York Mellon Corp now owns 865,665 shares of the construction company's stock valued at $123,634,000 after acquiring an additional 5,819 shares during the last quarter. Institutional investors and hedge funds own 88.40% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently weighed in on OC shares. UBS Group lowered their price objective on shares of Owens Corning from $218.00 to $210.00 and set a "buy" rating on the stock in a research note on Thursday, August 7th. Loop Capital reduced their price target on Owens Corning from $203.00 to $180.00 and set a "buy" rating for the company in a report on Thursday, May 8th. Royal Bank Of Canada dropped their price objective on Owens Corning from $184.00 to $180.00 and set an "outperform" rating on the stock in a research note on Thursday, August 7th. Evercore ISI raised their price objective on Owens Corning from $165.00 to $169.00 and gave the company an "in-line" rating in a research report on Friday, August 8th. Finally, Barclays boosted their target price on Owens Corning from $167.00 to $173.00 and gave the stock an "overweight" rating in a report on Thursday, August 7th. Eight equities research analysts have rated the stock with a Buy rating and four have given a Hold rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $184.60.

View Our Latest Stock Report on OC

Owens Corning Trading Down 2.4%

Shares of NYSE:OC opened at $148.6690 on Thursday. Owens Corning Inc has a 12-month low of $123.40 and a 12-month high of $214.53. The business has a 50 day moving average of $142.35 and a 200-day moving average of $145.44. The company has a quick ratio of 0.95, a current ratio of 1.52 and a debt-to-equity ratio of 0.98. The stock has a market cap of $12.43 billion, a PE ratio of 38.62, a P/E/G ratio of 10.89 and a beta of 1.32.

Owens Corning (NYSE:OC - Get Free Report) last announced its earnings results on Wednesday, August 6th. The construction company reported $4.21 earnings per share for the quarter, topping analysts' consensus estimates of $3.80 by $0.41. The company had revenue of $2.75 billion for the quarter, compared to analyst estimates of $2.70 billion. Owens Corning had a return on equity of 24.49% and a net margin of 2.98%.The firm's quarterly revenue was up 10.0% compared to the same quarter last year. During the same quarter last year, the company earned $4.64 earnings per share. As a group, equities research analysts forecast that Owens Corning Inc will post 15.49 earnings per share for the current year.

Owens Corning declared that its board has approved a stock buyback plan on Wednesday, May 14th that allows the company to repurchase 12,000,000 outstanding shares. This repurchase authorization allows the construction company to repurchase shares of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's board believes its stock is undervalued.

Owens Corning Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, August 7th. Stockholders of record on Monday, July 21st were issued a dividend of $0.69 per share. The ex-dividend date of this dividend was Monday, July 21st. This represents a $2.76 dividend on an annualized basis and a dividend yield of 1.9%. Owens Corning's dividend payout ratio (DPR) is currently 71.69%.

Owens Corning Company Profile

(

Free Report)

Owens Corning manufactures and sells building and construction materials in the United States, Europe, the Asia Pacific, and internationally. It operates in three segments: Roofing, Insulation, and Composites. The Roofing segment manufactures and sells laminate and strip asphalt roofing shingles, oxidized asphalt materials, and roofing components used in residential and commercial construction, and specialty applications.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Owens Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens Corning wasn't on the list.

While Owens Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.