Motley Fool Wealth Management LLC boosted its holdings in Live Oak Bancshares, Inc. (NASDAQ:LOB - Free Report) by 80.5% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 263,859 shares of the bank's stock after buying an additional 117,674 shares during the period. Motley Fool Wealth Management LLC owned approximately 0.58% of Live Oak Bancshares worth $7,034,000 as of its most recent filing with the Securities and Exchange Commission.

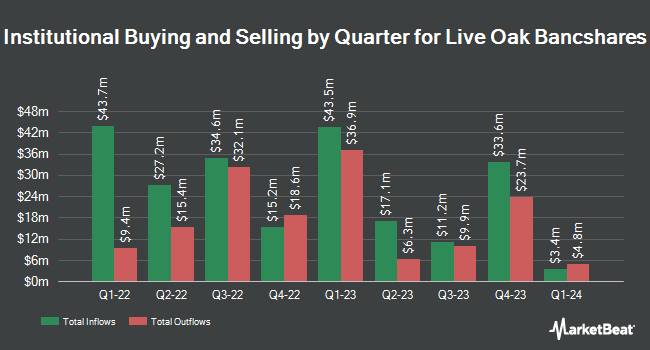

A number of other hedge funds have also bought and sold shares of LOB. LPL Financial LLC grew its stake in Live Oak Bancshares by 7.9% in the 4th quarter. LPL Financial LLC now owns 10,326 shares of the bank's stock valued at $408,000 after buying an additional 757 shares in the last quarter. JPMorgan Chase & Co. grew its stake in Live Oak Bancshares by 54.4% in the 4th quarter. JPMorgan Chase & Co. now owns 126,743 shares of the bank's stock valued at $5,013,000 after buying an additional 44,666 shares in the last quarter. Wells Fargo & Company MN grew its stake in Live Oak Bancshares by 14.1% in the 4th quarter. Wells Fargo & Company MN now owns 69,939 shares of the bank's stock valued at $2,766,000 after buying an additional 8,649 shares in the last quarter. Envestnet Asset Management Inc. grew its stake in Live Oak Bancshares by 64.1% in the 4th quarter. Envestnet Asset Management Inc. now owns 124,687 shares of the bank's stock valued at $4,931,000 after buying an additional 48,699 shares in the last quarter. Finally, Federated Hermes Inc. grew its stake in Live Oak Bancshares by 2.8% in the 4th quarter. Federated Hermes Inc. now owns 39,931 shares of the bank's stock valued at $1,579,000 after buying an additional 1,093 shares in the last quarter. 63.95% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Separately, Keefe, Bruyette & Woods reiterated a "market perform" rating and issued a $37.00 price objective (up from $36.00) on shares of Live Oak Bancshares in a research note on Friday, July 25th.

Get Our Latest Stock Analysis on LOB

Live Oak Bancshares Trading Down 0.5%

Shares of LOB traded down $0.18 during mid-day trading on Friday, reaching $34.31. 84,339 shares of the stock traded hands, compared to its average volume of 287,175. Live Oak Bancshares, Inc. has a 1 year low of $22.68 and a 1 year high of $50.57. The firm has a fifty day moving average price of $31.00 and a 200 day moving average price of $29.46. The company has a market cap of $1.56 billion, a price-to-earnings ratio of 23.68 and a beta of 1.82.

Live Oak Bancshares Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, June 17th. Investors of record on Tuesday, June 3rd were given a $0.03 dividend. The ex-dividend date was Tuesday, June 3rd. This represents a $0.12 annualized dividend and a yield of 0.3%. Live Oak Bancshares's payout ratio is 9.84%.

About Live Oak Bancshares

(

Free Report)

Live Oak Bancshares, Inc operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States. It operates through two segments, Banking and Fintech. The company accepts various deposit products, including noninterest-bearing demand, as well as interest-bearing checking, money market, savings, and time deposits.

Featured Articles

Before you consider Live Oak Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Oak Bancshares wasn't on the list.

While Live Oak Bancshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.