Parr Mcknight Wealth Management Group LLC acquired a new stake in shares of Barclays PLC (NYSE:BCS - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm acquired 153,115 shares of the financial services provider's stock, valued at approximately $2,352,000.

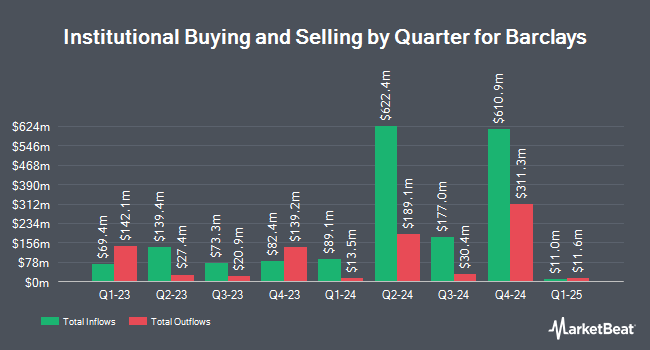

Several other hedge funds and other institutional investors also recently made changes to their positions in the company. Rehmann Capital Advisory Group boosted its holdings in shares of Barclays by 40.8% in the first quarter. Rehmann Capital Advisory Group now owns 52,142 shares of the financial services provider's stock worth $801,000 after buying an additional 15,111 shares during the period. Valeo Financial Advisors LLC boosted its holdings in shares of Barclays by 14.7% in the first quarter. Valeo Financial Advisors LLC now owns 21,230 shares of the financial services provider's stock worth $326,000 after buying an additional 2,724 shares during the period. M&T Bank Corp boosted its holdings in shares of Barclays by 14.3% in the first quarter. M&T Bank Corp now owns 23,607 shares of the financial services provider's stock worth $362,000 after buying an additional 2,955 shares during the period. Pekin Hardy Strauss Inc. acquired a new position in shares of Barclays in the first quarter worth about $169,000. Finally, Callan Capital LLC boosted its holdings in shares of Barclays by 16.5% in the first quarter. Callan Capital LLC now owns 23,226 shares of the financial services provider's stock worth $357,000 after buying an additional 3,296 shares during the period. 3.39% of the stock is currently owned by institutional investors and hedge funds.

Barclays Stock Down 2.1%

Shares of NYSE BCS traded down $0.39 during mid-day trading on Friday, reaching $18.42. The company had a trading volume of 12,656,719 shares, compared to its average volume of 15,114,646. The stock has a fifty day moving average of $17.70 and a two-hundred day moving average of $15.81. The company has a debt-to-equity ratio of 5.75, a quick ratio of 1.39 and a current ratio of 1.39. The company has a market capitalization of $65.21 billion, a price-to-earnings ratio of 9.35, a PEG ratio of 0.45 and a beta of 1.10. Barclays PLC has a 12-month low of $10.23 and a 12-month high of $18.82.

Barclays (NYSE:BCS - Get Free Report) last posted its quarterly earnings results on Wednesday, April 30th. The financial services provider reported $0.65 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.61 by $0.04. The business had revenue of $10.32 billion during the quarter, compared to analyst estimates of $8.37 billion. Barclays had a net margin of 21.27% and a return on equity of 8.04%. As a group, equities research analysts expect that Barclays PLC will post 2 EPS for the current year.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen cut shares of Barclays from a "buy" rating to a "hold" rating in a report on Sunday.

Read Our Latest Stock Analysis on BCS

Barclays Company Profile

(

Free Report)

Barclays PLC provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia. The company operates through Barclays UK and Barclays International division segments. It offers financial services, such as retail banking, credit cards, wholesale banking, investment banking, wealth management, and investment management services.

See Also

Before you consider Barclays, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barclays wasn't on the list.

While Barclays currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.