Stratos Wealth Advisors LLC acquired a new stake in shares of Abercrombie & Fitch Company (NYSE:ANF - Free Report) in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 22,543 shares of the apparel retailer's stock, valued at approximately $1,722,000.

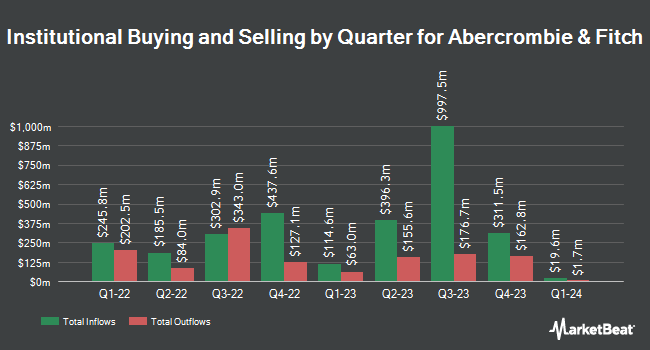

A number of other large investors also recently bought and sold shares of the business. Invesco Ltd. lifted its holdings in shares of Abercrombie & Fitch by 150.7% in the 4th quarter. Invesco Ltd. now owns 1,484,643 shares of the apparel retailer's stock worth $221,910,000 after buying an additional 892,492 shares during the period. Assenagon Asset Management S.A. purchased a new stake in shares of Abercrombie & Fitch in the 1st quarter worth $56,569,000. Norges Bank purchased a new stake in shares of Abercrombie & Fitch in the 4th quarter worth $88,478,000. Wellington Management Group LLP lifted its holdings in shares of Abercrombie & Fitch by 20.8% in the 4th quarter. Wellington Management Group LLP now owns 1,229,875 shares of the apparel retailer's stock worth $183,829,000 after buying an additional 212,155 shares during the period. Finally, Raymond James Financial Inc. purchased a new stake in shares of Abercrombie & Fitch in the 4th quarter worth $31,371,000.

Abercrombie & Fitch Stock Performance

NYSE:ANF traded up $1.10 during mid-day trading on Friday, hitting $89.34. 1,470,159 shares of the company's stock traded hands, compared to its average volume of 2,213,869. The company has a fifty day moving average of $79.69 and a 200 day moving average of $93.67. Abercrombie & Fitch Company has a twelve month low of $65.40 and a twelve month high of $173.69. The company has a market capitalization of $4.26 billion, a P/E ratio of 8.79 and a beta of 1.46.

Abercrombie & Fitch (NYSE:ANF - Get Free Report) last announced its quarterly earnings data on Wednesday, May 28th. The apparel retailer reported $1.59 earnings per share for the quarter, beating analysts' consensus estimates of $1.35 by $0.24. The business had revenue of $1.10 billion for the quarter, compared to analyst estimates of $1.08 billion. Abercrombie & Fitch had a return on equity of 42.32% and a net margin of 10.60%. The company's revenue was up 7.5% on a year-over-year basis. During the same period in the prior year, the company earned $2.14 earnings per share. On average, research analysts expect that Abercrombie & Fitch Company will post 10.62 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several brokerages have weighed in on ANF. UBS Group reiterated a "buy" rating on shares of Abercrombie & Fitch in a report on Wednesday, May 28th. Raymond James Financial lowered their target price on Abercrombie & Fitch from $110.00 to $90.00 and set an "outperform" rating for the company in a report on Tuesday, May 27th. Telsey Advisory Group reissued an "outperform" rating and issued a $125.00 price target on shares of Abercrombie & Fitch in a research report on Wednesday, May 28th. Jefferies Financial Group reduced their price target on Abercrombie & Fitch from $170.00 to $135.00 and set a "buy" rating for the company in a research report on Wednesday, May 21st. Finally, Morgan Stanley boosted their price target on Abercrombie & Fitch from $78.00 to $82.00 and gave the stock an "equal weight" rating in a research report on Thursday, May 29th. Three investment analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $110.63.

Get Our Latest Stock Analysis on Abercrombie & Fitch

Abercrombie & Fitch Profile

(

Free Report)

Abercrombie & Fitch Co engages in the retail of apparel, personal care products, and accessories. The firm operates through following geographical segments: Americas, EMEA and APAC. The Americas segment includes operations in North America and South America. The EMEA segment includes operations in Europe, the Middle East and Africa.

Featured Stories

Before you consider Abercrombie & Fitch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abercrombie & Fitch wasn't on the list.

While Abercrombie & Fitch currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.