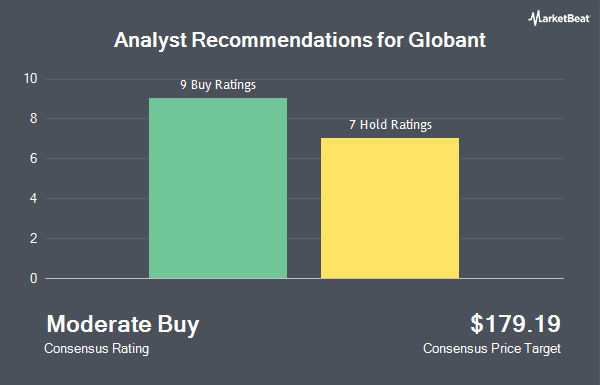

Shares of Globant S.A. (NYSE:GLOB - Get Free Report) have been assigned an average rating of "Moderate Buy" from the sixteen brokerages that are presently covering the company, Marketbeat Ratings reports. Six investment analysts have rated the stock with a hold recommendation and ten have given a buy recommendation to the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $165.6875.

Several research firms recently weighed in on GLOB. Canaccord Genuity Group reiterated a "hold" rating and set a $97.00 target price (down from $165.00) on shares of Globant in a research report on Thursday, June 26th. Deutsche Bank Aktiengesellschaft started coverage on shares of Globant in a research report on Thursday, July 17th. They set a "hold" rating and a $87.00 price target for the company. Scotiabank raised shares of Globant from a "sector perform" rating to a "sector outperform" rating and set a $115.00 price objective for the company in a research report on Monday, July 21st. Piper Sandler downgraded Globant from an "overweight" rating to a "neutral" rating and lowered their target price for the company from $154.00 to $116.00 in a research note on Friday, May 16th. Finally, The Goldman Sachs Group lowered Globant from a "buy" rating to a "neutral" rating and cut their target price for the company from $225.00 to $120.00 in a research report on Friday, May 16th.

Read Our Latest Report on GLOB

Globant Stock Down 1.2%

Globant stock opened at $78.70 on Thursday. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.56 and a quick ratio of 1.56. Globant has a 1-year low of $77.74 and a 1-year high of $238.32. The stock's 50 day moving average price is $91.17 and its 200 day moving average price is $126.77. The company has a market cap of $3.47 billion, a PE ratio of 23.29, a price-to-earnings-growth ratio of 3.27 and a beta of 1.16.

Globant (NYSE:GLOB - Get Free Report) last posted its earnings results on Thursday, May 15th. The information technology services provider reported $1.50 earnings per share for the quarter, missing the consensus estimate of $1.58 by ($0.08). The business had revenue of $611.09 million for the quarter, compared to analysts' expectations of $622.18 million. Globant had a net margin of 6.16% and a return on equity of 11.08%. The business's revenue was up 7.0% compared to the same quarter last year. During the same quarter last year, the business posted $1.53 earnings per share. On average, sell-side analysts predict that Globant will post 5.73 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of the business. Brooklyn Investment Group lifted its stake in Globant by 194.4% in the first quarter. Brooklyn Investment Group now owns 212 shares of the information technology services provider's stock valued at $25,000 after buying an additional 140 shares during the last quarter. Physician Wealth Advisors Inc. grew its position in shares of Globant by 140.9% during the first quarter. Physician Wealth Advisors Inc. now owns 265 shares of the information technology services provider's stock worth $31,000 after acquiring an additional 155 shares during the last quarter. Bessemer Group Inc. acquired a new stake in shares of Globant in the 1st quarter worth about $39,000. Farther Finance Advisors LLC lifted its position in Globant by 186.7% in the 1st quarter. Farther Finance Advisors LLC now owns 387 shares of the information technology services provider's stock valued at $45,000 after purchasing an additional 252 shares during the last quarter. Finally, Signaturefd LLC lifted its position in Globant by 29.7% in the 1st quarter. Signaturefd LLC now owns 389 shares of the information technology services provider's stock valued at $46,000 after purchasing an additional 89 shares during the last quarter. 91.60% of the stock is owned by institutional investors and hedge funds.

About Globant

(

Get Free Report)

Globant SA, together with its subsidiaries, provides technology services worldwide. It provides digital solutions comprising blockchain, cloud technologies, cybersecurity, data and artificial intelligence, digital experience and performance, code, Internet of Things, metaverse, and engineering and testing; and enterprise technology solutions and services, such as Agile organization, Cultural Hacking, process optimization services, as well as AWS, Google Cloud, Microsoft, Oracle, SalesForce, SAP, and ServiceNow technology solutions.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Globant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globant wasn't on the list.

While Globant currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.