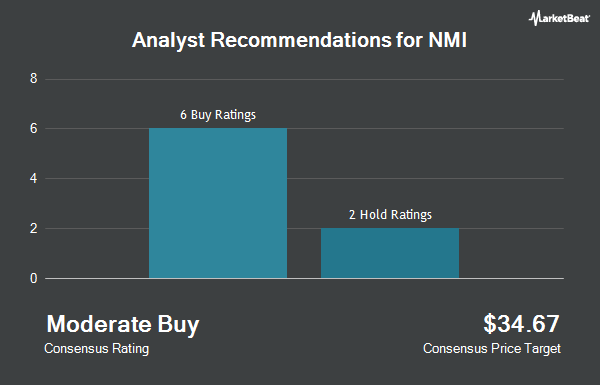

NMI Holdings Inc (NASDAQ:NMIH - Get Free Report) has been given a consensus rating of "Moderate Buy" by the seven research firms that are currently covering the firm, MarketBeat Ratings reports. Three equities research analysts have rated the stock with a hold recommendation and four have given a buy recommendation to the company. The average 1 year price objective among analysts that have covered the stock in the last year is $42.3333.

A number of equities research analysts have commented on NMIH shares. Weiss Ratings reissued a "buy (b)" rating on shares of NMI in a research note on Wednesday, October 8th. JPMorgan Chase & Co. reduced their price objective on NMI from $44.00 to $43.00 and set an "overweight" rating for the company in a research note on Tuesday, October 7th. Keefe, Bruyette & Woods cut NMI from an "outperform" rating to a "market perform" rating and raised their price objective for the company from $42.00 to $43.00 in a research note on Monday, July 7th. Wall Street Zen cut NMI from a "buy" rating to a "hold" rating in a research note on Saturday, July 12th. Finally, Barclays reissued a "cautious" rating on shares of NMI in a research note on Monday, October 6th.

Get Our Latest Stock Analysis on NMIH

Insider Activity

In related news, Director Steven Scheid sold 19,926 shares of NMI stock in a transaction that occurred on Monday, September 15th. The stock was sold at an average price of $39.31, for a total transaction of $783,291.06. Following the transaction, the director owned 78,960 shares of the company's stock, valued at $3,103,917.60. The trade was a 20.15% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 3.00% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the stock. Sound Income Strategies LLC purchased a new position in shares of NMI during the first quarter valued at approximately $25,000. Maseco LLP purchased a new position in shares of NMI during the second quarter valued at approximately $32,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. purchased a new position in shares of NMI during the second quarter valued at approximately $36,000. Harbor Capital Advisors Inc. boosted its position in NMI by 51.5% in the third quarter. Harbor Capital Advisors Inc. now owns 856 shares of the financial services provider's stock worth $33,000 after purchasing an additional 291 shares during the last quarter. Finally, Elevation Point Wealth Partners LLC purchased a new position in NMI in the second quarter worth $49,000. Hedge funds and other institutional investors own 94.12% of the company's stock.

NMI Trading Down 1.0%

Shares of NMIH stock opened at $35.91 on Thursday. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.74 and a current ratio of 0.74. NMI has a fifty-two week low of $31.90 and a fifty-two week high of $43.20. The stock has a 50 day simple moving average of $38.67 and a two-hundred day simple moving average of $38.14. The company has a market cap of $2.79 billion, a P/E ratio of 7.62, a PEG ratio of 1.05 and a beta of 0.56.

NMI (NASDAQ:NMIH - Get Free Report) last announced its quarterly earnings data on Tuesday, July 29th. The financial services provider reported $1.22 EPS for the quarter, beating analysts' consensus estimates of $1.16 by $0.06. NMI had a return on equity of 16.51% and a net margin of 55.57%.The firm had revenue of $149.07 million during the quarter, compared to analysts' expectations of $173.39 million. During the same quarter last year, the firm posted $1.20 earnings per share. The company's revenue for the quarter was up 7.2% compared to the same quarter last year. Research analysts forecast that NMI will post 4.62 earnings per share for the current year.

NMI Company Profile

(

Get Free Report)

NMI Holdings, Inc provides private mortgage guaranty insurance services in the United States. The company offers mortgage insurance services, such as primary and pool insurance; and outsourced loan review services to mortgage loan originators. It serves national and regional mortgage banks, money center banks, credit unions, community banks, builder-owned mortgage lenders, internet-sourced lenders, and other non-bank lenders.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NMI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NMI wasn't on the list.

While NMI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.