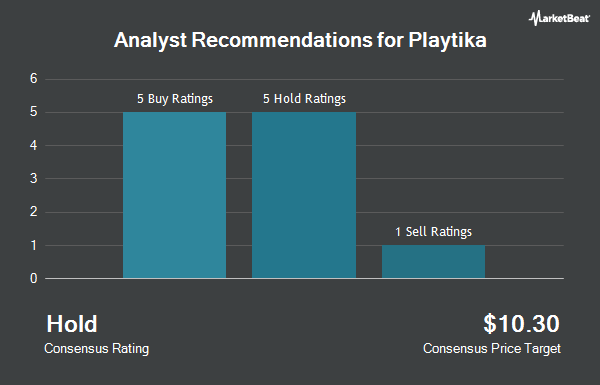

Shares of Playtika Holding Corp. (NASDAQ:PLTK - Get Free Report) have been assigned an average rating of "Moderate Buy" from the eight ratings firms that are covering the company, MarketBeat reports. Five analysts have rated the stock with a hold rating, two have assigned a buy rating and one has issued a strong buy rating on the company. The average 1-year price target among analysts that have issued a report on the stock in the last year is $7.68.

Several analysts recently commented on PLTK shares. Wedbush upgraded Playtika to a "strong-buy" rating in a report on Tuesday, July 1st. Morgan Stanley dropped their price target on Playtika from $7.25 to $5.75 and set an "equal weight" rating for the company in a research report on Thursday, April 17th.

Get Our Latest Report on PLTK

Playtika Trading Down 3.5%

Shares of PLTK traded down $0.17 during midday trading on Friday, hitting $4.53. The stock had a trading volume of 452,390 shares, compared to its average volume of 1,678,616. The firm has a market cap of $1.70 billion, a P/E ratio of 11.91, a price-to-earnings-growth ratio of 1.24 and a beta of 0.85. The business has a 50-day simple moving average of $4.74 and a two-hundred day simple moving average of $5.40. Playtika has a fifty-two week low of $3.97 and a fifty-two week high of $8.80.

Playtika (NASDAQ:PLTK - Get Free Report) last released its earnings results on Thursday, May 8th. The company reported $0.09 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.11 by ($0.02). Playtika had a net margin of 5.37% and a negative return on equity of 149.09%. The business had revenue of $706.00 million for the quarter, compared to analyst estimates of $699.67 million. During the same quarter in the previous year, the company posted $0.14 earnings per share. The business's revenue for the quarter was up 8.4% on a year-over-year basis. On average, analysts expect that Playtika will post 0.65 earnings per share for the current fiscal year.

Playtika Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, July 7th. Investors of record on Monday, June 23rd were paid a dividend of $0.10 per share. The ex-dividend date of this dividend was Monday, June 23rd. This represents a $0.40 annualized dividend and a yield of 8.84%. Playtika's dividend payout ratio (DPR) is 105.26%.

Insider Activity

In other news, major shareholder Holding Uk Ltd Playtika II sold 389,053 shares of the company's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $4.70, for a total value of $1,828,549.10. Following the completion of the sale, the insider directly owned 199,510,511 shares in the company, valued at $937,699,401.70. This represents a 0.19% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Over the last ninety days, insiders sold 739,922 shares of company stock valued at $3,548,194. Insiders own 5.10% of the company's stock.

Institutional Trading of Playtika

A number of hedge funds and other institutional investors have recently bought and sold shares of PLTK. CWM LLC lifted its position in shares of Playtika by 99.6% during the 2nd quarter. CWM LLC now owns 74,309 shares of the company's stock valued at $351,000 after acquiring an additional 37,080 shares during the period. Monument Capital Management lifted its holdings in Playtika by 102.2% in the 2nd quarter. Monument Capital Management now owns 40,484 shares of the company's stock worth $191,000 after buying an additional 20,463 shares in the last quarter. SummerHaven Investment Management LLC raised its stake in shares of Playtika by 2.7% in the 2nd quarter. SummerHaven Investment Management LLC now owns 106,151 shares of the company's stock valued at $502,000 after purchasing an additional 2,817 shares in the last quarter. Diversified Trust Co acquired a new stake in shares of Playtika in the 2nd quarter worth about $210,000. Finally, Wealth Enhancement Advisory Services LLC raised its stake in shares of Playtika by 148.3% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 74,237 shares of the company's stock valued at $368,000 after purchasing an additional 44,333 shares in the last quarter. 11.94% of the stock is currently owned by institutional investors and hedge funds.

Playtika Company Profile

(

Get Free ReportPlaytika Holding Corp., together with its subsidiaries, develops mobile games in the United States, Europe, Middle East, Africa, Asia pacific, and internationally. The company owns a portfolio of casual and social casino-themed games. It distributes its games to the end customer through various web and mobile platforms and direct-to-consumer platforms.

Read More

Before you consider Playtika, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Playtika wasn't on the list.

While Playtika currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.