PTC (NASDAQ:PTC - Get Free Report) had its price target hoisted by BMO Capital Markets from $187.00 to $231.00 in a research note issued to investors on Thursday, MarketBeat Ratings reports. The firm presently has an "outperform" rating on the technology company's stock. BMO Capital Markets' price target suggests a potential upside of 8.91% from the stock's previous close.

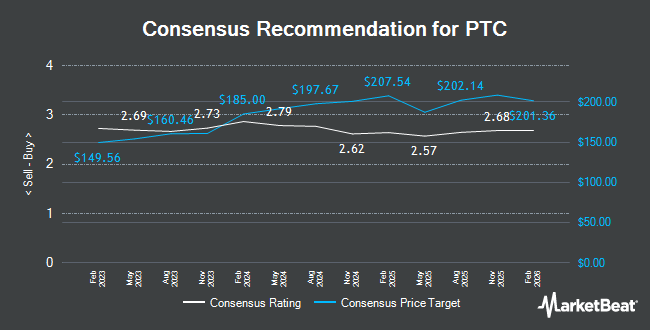

A number of other equities research analysts also recently weighed in on PTC. Wells Fargo & Company reaffirmed an "overweight" rating on shares of PTC in a research note on Tuesday. Stifel Nicolaus lowered their target price on shares of PTC from $230.00 to $200.00 and set a "buy" rating on the stock in a research note on Thursday, May 1st. Oppenheimer raised their target price on shares of PTC from $210.00 to $225.00 and gave the company an "outperform" rating in a research note on Friday, July 25th. Barclays reaffirmed an "overweight" rating and issued a $233.00 target price (up from $203.00) on shares of PTC in a research note on Tuesday. Finally, Mizuho decreased their price target on shares of PTC from $190.00 to $160.00 and set a "neutral" rating on the stock in a research note on Tuesday, April 15th. Six analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $202.14.

Read Our Latest Analysis on PTC

PTC Price Performance

Shares of PTC stock traded down $2.70 on Thursday, reaching $212.11. The stock had a trading volume of 1,598,374 shares, compared to its average volume of 1,547,054. PTC has a 1 year low of $133.38 and a 1 year high of $219.69. The company has a market cap of $25.44 billion, a P/E ratio of 50.03, a price-to-earnings-growth ratio of 2.89 and a beta of 1.17. The company has a current ratio of 1.17, a quick ratio of 0.99 and a debt-to-equity ratio of 0.35. The business's 50 day moving average is $181.28 and its two-hundred day moving average is $169.88.

PTC (NASDAQ:PTC - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The technology company reported $1.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.22 by $0.42. PTC had a net margin of 20.74% and a return on equity of 17.09%. The firm had revenue of $643.94 million for the quarter, compared to the consensus estimate of $582.12 million. During the same period in the prior year, the firm posted $0.98 earnings per share. The company's revenue for the quarter was up 24.2% on a year-over-year basis. As a group, research analysts anticipate that PTC will post 4.46 EPS for the current year.

Insiders Place Their Bets

In other news, EVP Staats Aaron C. Von sold 1,988 shares of the business's stock in a transaction on Wednesday, May 7th. The shares were sold at an average price of $160.00, for a total transaction of $318,080.00. Following the sale, the executive vice president owned 17,731 shares in the company, valued at approximately $2,836,960. The trade was a 10.08% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. 0.32% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On PTC

A number of hedge funds have recently bought and sold shares of the business. Aster Capital Management DIFC Ltd bought a new stake in shares of PTC during the 4th quarter valued at about $30,000. Bartlett & CO. Wealth Management LLC bought a new stake in shares of PTC during the 1st quarter valued at about $26,000. Motco bought a new stake in shares of PTC during the 1st quarter valued at about $29,000. Migdal Insurance & Financial Holdings Ltd. bought a new stake in shares of PTC during the 1st quarter valued at about $33,000. Finally, Zions Bancorporation National Association UT bought a new stake in shares of PTC during the 1st quarter valued at about $39,000. Hedge funds and other institutional investors own 95.14% of the company's stock.

PTC Company Profile

(

Get Free Report)

PTC Inc operates as software company in the Americas, Europe, and the Asia Pacific. The company provides Windchill, a suite that manages all aspects of the product development lifecycle(PLM) that provides real-time information sharing, dynamic data visualization, collaborate across geographically distributed teams, and enabling manufacturers to elevate product development, manufacturing, and field service processes; ThingWorx, a platform for Industrial Internet of Things; ServiceMax, a field service management solutions enable companies to asset uptime with optimized in-person and remote service and technician productivity with mobile tools.

Featured Stories

Before you consider PTC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PTC wasn't on the list.

While PTC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.