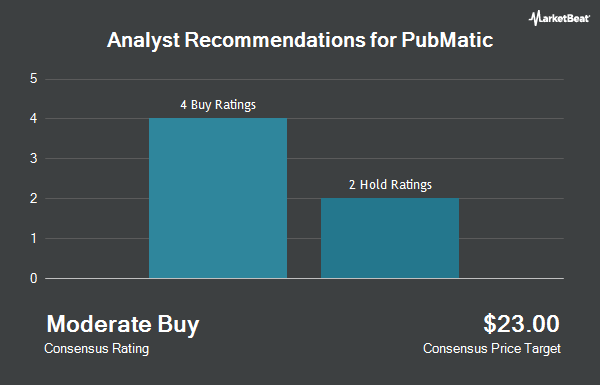

Shares of PubMatic, Inc. (NASDAQ:PUBM - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the ten analysts that are currently covering the firm, Marketbeat Ratings reports. Four investment analysts have rated the stock with a hold rating and six have given a buy rating to the company. The average 12-month price objective among brokers that have updated their coverage on the stock in the last year is $19.11.

Several equities research analysts recently weighed in on PUBM shares. Lake Street Capital reduced their price target on PubMatic from $21.00 to $19.00 and set a "buy" rating on the stock in a research note on Friday, May 9th. Royal Bank Of Canada reduced their price target on PubMatic from $17.00 to $14.00 and set an "outperform" rating on the stock in a research note on Friday, May 2nd.

View Our Latest Stock Report on PUBM

Insider Transactions at PubMatic

In other PubMatic news, CEO Rajeev K. Goel sold 44,000 shares of the stock in a transaction dated Monday, July 7th. The stock was sold at an average price of $12.53, for a total value of $551,320.00. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO Rajeev K. Goel sold 33,001 shares of the stock in a transaction dated Wednesday, July 2nd. The shares were sold at an average price of $12.56, for a total value of $414,492.56. Following the completion of the transaction, the chief executive officer directly owned 32,515 shares in the company, valued at approximately $408,388.40. This represents a 50.37% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 226,294 shares of company stock valued at $2,675,306. 26.42% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of PUBM. Graham Holdings Co lifted its holdings in PubMatic by 21.4% in the first quarter. Graham Holdings Co now owns 2,831,462 shares of the company's stock valued at $25,880,000 after acquiring an additional 500,000 shares during the period. Nuveen LLC bought a new position in PubMatic in the first quarter valued at about $3,963,000. Acadian Asset Management LLC raised its stake in shares of PubMatic by 483.6% in the first quarter. Acadian Asset Management LLC now owns 457,033 shares of the company's stock worth $4,174,000 after buying an additional 378,714 shares during the period. Pacer Advisors Inc. bought a new position in shares of PubMatic in the first quarter worth about $2,455,000. Finally, Wellington Management Group LLP raised its stake in shares of PubMatic by 20.0% in the first quarter. Wellington Management Group LLP now owns 1,077,921 shares of the company's stock worth $9,852,000 after buying an additional 179,951 shares during the period. Institutional investors own 64.26% of the company's stock.

PubMatic Trading Down 3.4%

PUBM stock traded down $0.44 during midday trading on Friday, hitting $12.38. The company had a trading volume of 304,824 shares, compared to its average volume of 498,567. The stock has a market cap of $600.70 million, a price-to-earnings ratio of 155.02 and a beta of 1.54. The stock's 50 day moving average price is $11.73 and its 200 day moving average price is $11.97. PubMatic has a 52 week low of $7.46 and a 52 week high of $22.99.

PubMatic (NASDAQ:PUBM - Get Free Report) last issued its quarterly earnings data on Thursday, May 8th. The company reported ($0.20) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.02) by ($0.18). The company had revenue of $63.83 million for the quarter, compared to analysts' expectations of $62.07 million. PubMatic had a net margin of 1.90% and a return on equity of 1.99%. The firm's revenue for the quarter was down 4.3% compared to the same quarter last year. During the same period in the previous year, the firm posted ($0.05) earnings per share. Analysts predict that PubMatic will post 0.22 earnings per share for the current year.

About PubMatic

(

Get Free ReportPubMatic, Inc, a technology company, engages in the provision of a cloud infrastructure platform that enables real-time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide. Its PubMatic SSP, a sell-side platform, used for the purchase and sale of digital advertising inventory for publishers and buyers.

Featured Stories

Before you consider PubMatic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PubMatic wasn't on the list.

While PubMatic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.