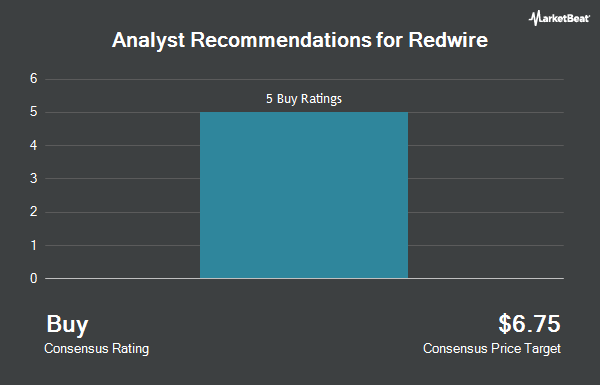

Redwire Corporation (NYSE:RDW - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the eight brokerages that are currently covering the stock, MarketBeat Ratings reports. Two investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. The average 12 month price target among analysts that have issued ratings on the stock in the last year is $19.46.

RDW has been the subject of a number of recent analyst reports. Roth Capital restated a "buy" rating on shares of Redwire in a research note on Tuesday, June 24th. Canaccord Genuity Group began coverage on Redwire in a research report on Wednesday, July 9th. They set a "buy" rating and a $20.00 target price on the stock. HC Wainwright reiterated a "buy" rating and set a $26.00 price target on shares of Redwire in a report on Tuesday, June 24th. Wall Street Zen downgraded Redwire from a "hold" rating to a "sell" rating in a research note on Saturday, June 14th. Finally, Truist Financial set a $16.00 price target on Redwire and gave the company a "hold" rating in a report on Thursday, June 26th.

View Our Latest Report on RDW

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently added to or reduced their stakes in RDW. Quarry LP acquired a new position in shares of Redwire during the fourth quarter worth about $33,000. Summit Investment Advisors Inc. raised its holdings in Redwire by 64.2% during the fourth quarter. Summit Investment Advisors Inc. now owns 2,382 shares of the company's stock worth $39,000 after acquiring an additional 931 shares in the last quarter. KLP Kapitalforvaltning AS bought a new stake in Redwire during the first quarter worth about $42,000. FNY Investment Advisers LLC bought a new stake in Redwire during the first quarter worth about $47,000. Finally, GAMMA Investing LLC raised its holdings in Redwire by 69,077.8% during the first quarter. GAMMA Investing LLC now owns 6,226 shares of the company's stock worth $52,000 after acquiring an additional 6,217 shares in the last quarter. 8.10% of the stock is owned by institutional investors and hedge funds.

Redwire Price Performance

Shares of RDW stock traded up $1.16 during trading hours on Friday, reaching $17.80. 5,224,793 shares of the company's stock were exchanged, compared to its average volume of 2,380,789. The company has a market cap of $2.54 billion, a P/E ratio of -7.87 and a beta of 2.54. The company's 50 day moving average is $15.10 and its two-hundred day moving average is $14.84. Redwire has a 1 year low of $4.87 and a 1 year high of $26.66.

Redwire (NYSE:RDW - Get Free Report) last released its quarterly earnings data on Monday, May 12th. The company reported ($0.20) earnings per share for the quarter, meeting the consensus estimate of ($0.20). The firm had revenue of $61.40 million during the quarter, compared to analysts' expectations of $74.54 million. As a group, analysts predict that Redwire will post -0.85 EPS for the current fiscal year.

About Redwire

(

Get Free ReportRedwire Corporation provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally. The company provides avionics and sensors including star trackers, sun sensors, critical for navigation, and control of spacecraft; camera systems; solar array solutions for spacecraft spanning the spectrum of size, power needs, and orbital location; and strain composite booms, coilable booms, truss structures, telescope baffles, and deployable booms to position sensors or solar arrays away from the spacecraft.

Featured Articles

Before you consider Redwire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Redwire wasn't on the list.

While Redwire currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.