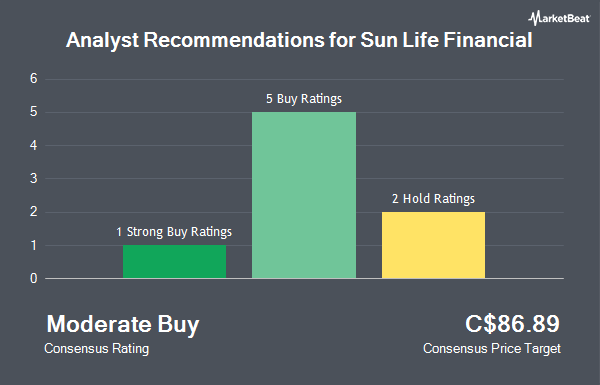

Shares of Sun Life Financial Inc. (TSE:SLF - Get Free Report) NYSE: SLF have been assigned an average rating of "Hold" from the nine brokerages that are currently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell recommendation, four have assigned a hold recommendation and four have given a buy recommendation to the company. The average 1 year target price among brokers that have covered the stock in the last year is C$86.67.

A number of research analysts have weighed in on SLF shares. Scotiabank cut their price objective on shares of Sun Life Financial from C$88.00 to C$83.00 and set a "sector perform" rating on the stock in a research report on Monday, August 11th. National Bankshares downgraded shares of Sun Life Financial from an "outperform" rating to a "sector perform" rating and cut their price target for the company from C$93.00 to C$87.00 in a report on Friday, August 8th. CIBC reduced their price objective on shares of Sun Life Financial from C$94.00 to C$89.00 and set an "outperform" rating on the stock in a research report on Thursday, May 1st. TD Securities increased their price objective on shares of Sun Life Financial from C$83.00 to C$86.00 and gave the stock a "hold" rating in a research report on Friday, May 9th. Finally, National Bank Financial lowered Sun Life Financial from a "strong-buy" rating to a "hold" rating in a research report on Thursday, August 7th.

View Our Latest Research Report on SLF

Insiders Place Their Bets

In other Sun Life Financial news, Director Kevin Strain bought 3,850 shares of the firm's stock in a transaction dated Thursday, June 5th. The stock was acquired at an average cost of C$89.10 per share, for a total transaction of C$343,035.00. Also, Senior Officer Daniel Fishbein sold 37,662 shares of the business's stock in a transaction on Tuesday, May 27th. The shares were sold at an average price of C$87.60, for a total transaction of C$3,299,191.20. Insiders own 0.03% of the company's stock.

Sun Life Financial Trading Down 0.2%

Shares of TSE SLF traded down C$0.18 during trading hours on Wednesday, hitting C$81.49. 4,098,009 shares of the company traded hands, compared to its average volume of 2,082,900. The company's 50 day moving average price is C$84.99 and its 200 day moving average price is C$83.31. Sun Life Financial has a 12 month low of C$72.14 and a 12 month high of C$91.11. The stock has a market capitalization of C$46.55 billion, a price-to-earnings ratio of 12.29, a price-to-earnings-growth ratio of 1.33 and a beta of 0.94. The company has a current ratio of 92.19, a quick ratio of 84,866.00 and a debt-to-equity ratio of 26.00.

Sun Life Financial Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Investors of record on Monday, September 29th will be issued a dividend of $0.88 per share. The ex-dividend date is Wednesday, August 27th. This represents a $3.52 dividend on an annualized basis and a yield of 4.3%. Sun Life Financial's payout ratio is presently 48.87%.

Sun Life Financial Company Profile

(

Get Free Report)

Sun Life Financial is one of Canada's Big Three life insurance companies along with Great-West Lifeco and Manulife. Sun Life provides insurance, retirement, and wealth-management services to individual and corporate customers in Canada, the United States, and Asia. It also owns MFS Investment Management, a Boston-based asset-management firm.

Further Reading

Before you consider Sun Life Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Life Financial wasn't on the list.

While Sun Life Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.