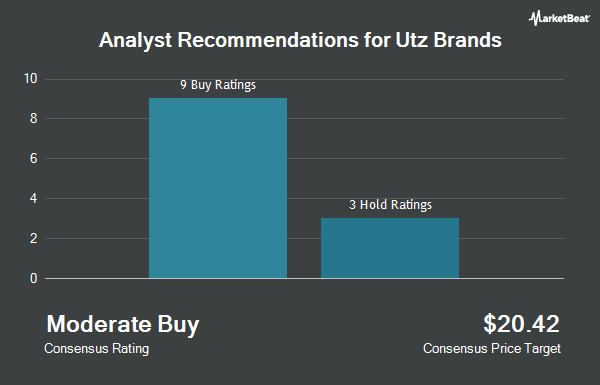

Utz Brands, Inc. (NYSE:UTZ - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the eight analysts that are presently covering the firm, Marketbeat.com reports. Two analysts have rated the stock with a hold recommendation and six have given a buy recommendation to the company. The average 1 year price objective among analysts that have issued ratings on the stock in the last year is $17.81.

Several brokerages recently weighed in on UTZ. Royal Bank of Canada cut their price objective on shares of Utz Brands from $23.00 to $20.00 and set an "outperform" rating on the stock in a research report on Monday, February 24th. Mizuho dropped their price objective on Utz Brands from $21.00 to $19.00 and set an "outperform" rating on the stock in a research note on Monday, February 10th. UBS Group dropped their price objective on Utz Brands from $15.00 to $13.50 and set a "neutral" rating for the company in a research report on Friday, May 2nd. TD Cowen cut Utz Brands from a "buy" rating to a "hold" rating and decreased their target price for the stock from $17.00 to $15.00 in a research note on Tuesday, April 22nd. Finally, DA Davidson upgraded Utz Brands from a "neutral" rating to a "buy" rating and set a $16.00 target price on the stock in a research note on Thursday, April 24th.

Check Out Our Latest Stock Analysis on UTZ

Insider Activity

In other Utz Brands news, insider Cc Collier Holdings, Llc sold 496,038 shares of the stock in a transaction dated Thursday, March 6th. The shares were sold at an average price of $13.40, for a total transaction of $6,646,909.20. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, Director William Jr. Werzyn acquired 8,000 shares of the business's stock in a transaction dated Wednesday, May 7th. The stock was acquired at an average cost of $11.81 per share, for a total transaction of $94,480.00. Following the transaction, the director now owns 22,970 shares of the company's stock, valued at $271,275.70. This represents a 53.44% increase in their ownership of the stock. The disclosure for this purchase can be found here. Company insiders own 16.32% of the company's stock.

Institutional Trading of Utz Brands

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Newton One Investments LLC bought a new stake in Utz Brands in the 4th quarter valued at about $26,000. Caitong International Asset Management Co. Ltd purchased a new stake in Utz Brands in the first quarter worth $32,000. Venturi Wealth Management LLC bought a new stake in Utz Brands during the fourth quarter valued at about $54,000. First Horizon Advisors Inc. raised its stake in shares of Utz Brands by 44.8% in the first quarter. First Horizon Advisors Inc. now owns 7,887 shares of the company's stock worth $111,000 after purchasing an additional 2,441 shares during the last quarter. Finally, Tower Research Capital LLC TRC boosted its stake in shares of Utz Brands by 112.7% in the fourth quarter. Tower Research Capital LLC TRC now owns 7,697 shares of the company's stock worth $121,000 after acquiring an additional 4,078 shares during the last quarter. Institutional investors and hedge funds own 95.97% of the company's stock.

Utz Brands Stock Performance

Shares of NYSE:UTZ traded up $0.13 on Friday, reaching $13.13. 846,813 shares of the company's stock were exchanged, compared to its average volume of 934,016. The firm has a market capitalization of $1.86 billion, a price-to-earnings ratio of 72.97, a PEG ratio of 0.86 and a beta of 1.20. Utz Brands has a fifty-two week low of $11.53 and a fifty-two week high of $18.89. The business's 50-day moving average is $13.10 and its two-hundred day moving average is $14.27. The company has a quick ratio of 0.85, a current ratio of 1.21 and a debt-to-equity ratio of 0.56.

Utz Brands (NYSE:UTZ - Get Free Report) last released its quarterly earnings data on Thursday, May 1st. The company reported $0.16 earnings per share for the quarter, hitting analysts' consensus estimates of $0.16. The business had revenue of $352.08 million for the quarter, compared to analysts' expectations of $345.44 million. Utz Brands had a net margin of 1.13% and a return on equity of 7.92%. The company's revenue for the quarter was up 1.6% compared to the same quarter last year. During the same quarter last year, the company earned $0.14 EPS. As a group, equities research analysts forecast that Utz Brands will post 0.85 EPS for the current year.

Utz Brands Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, April 24th. Investors of record on Monday, April 7th were paid a dividend of $0.011 per share. This represents a $0.04 annualized dividend and a yield of 0.34%. The ex-dividend date of this dividend was Monday, April 7th. Utz Brands's dividend payout ratio (DPR) is 75.00%.

About Utz Brands

(

Get Free ReportUtz Brands, Inc engages in manufacture, marketing, and distribution of snack foods. It offers a range of salty snacks, including salty snacks, including potato chips, tortilla chips, pretzels, cheese snacks, pork skins, veggie snacks, pub/party mixes, tortilla chips, salsa and dips, ready-to-eat popcorn, and other snacks under the Utz, Zapp's, ON THE BORDER, Golden Flake, Boulder Canyon, Hawaiian, TORTIYAHS!, etc.

Further Reading

Before you consider Utz Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Utz Brands wasn't on the list.

While Utz Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.