Summer finally arrives this week, and temperatures aren’t the only thing heating up in the U.S. Consumer sentiment finally rebounded last month after a disappointing start to 2025, keyed by a trend reversal in domestic stocks and a softening tariff stance from the Trump administration.

Consumer surveys are notoriously fickle, and answers aren’t guaranteed to be truthful. But a sentiment reversal could bode well for the travel industry, which spent most of Q1 lowering expectations for 2025. Today, we’ll look at three travel stocks that could have upside surprises in store this summer.

Uptick in Consumer Surveys: A Bullish Signal for Travel Sector

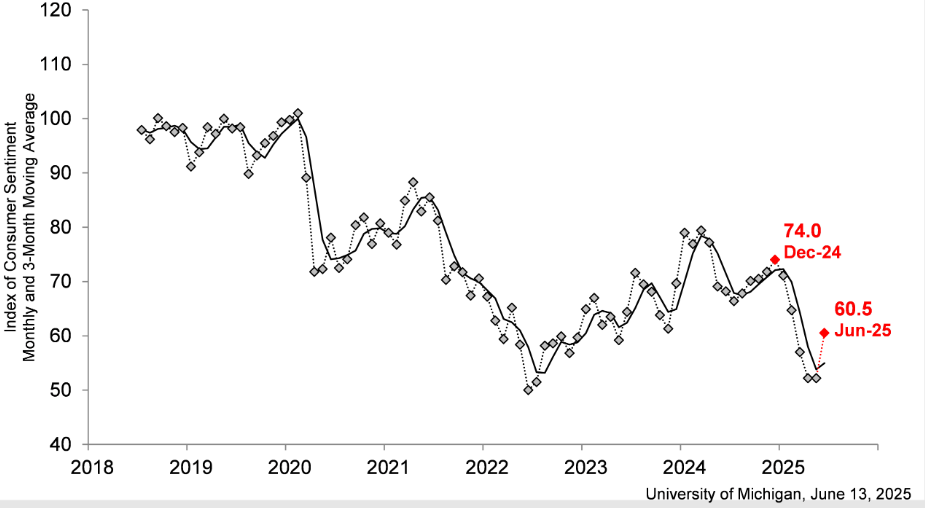

The Survey of Consumers from the University of Michigan is one of the primary methods economists use to measure consumers' feelings about the economy. Consumer sentiment takes into account factors such as business conditions, inflation expectations, and personal financial situations.

Released monthly, the survey is conducted through at least 500 phone calls, asking business owners and consumers a series of 50 questions about the state of the economy. An index is created with these aggregated answers, shown in the chart below.

After six straight months of pessimistic readings, consumer sentiment rebounded sharply in May, posting a nearly 16% uptick from the previous month. Consumers cited a moderating trade war and tariff reductions as the most significant contributing factor. However, the latest reading of 60.5 is still well below the 74.0 figure from December that factored in the post-election bump, and nearly 40% below the pre-pandemic number.

Consumer sentiment surveys are merely one part of the macro puzzle, and people frequently act differently than they say they’re going to do. For example, consumer sentiment remained subdued in 2021 and 2023, despite spending data indicating consumer strength, and corporate earnings from Q1 were solid, despite anxious survey data. However, the correlation in the other direction likely remains strong—when consumers report feeling positive, their spending often increases. And naturally, the biggest beneficiary of an optimistic summertime consumer is the travel sector.

Top Three Travel Stocks to Ride the Rebound

The travel sector comprises various components, including airlines, hotels and accommodations, cruise lines, and reservation services. Many of these industries have struggled in 2025, missing earnings expectations and revising guidance downward. However, now that sentiment is rebounding, here are three promising stocks at the top of their respective industries that investors should watch in the second half of 2025.

United Airlines: Best Value in the Airline Industry

United Airlines Today

UAL

United Airlines

$75.12 +0.85 (+1.14%) As of 01:41 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $37.02

▼

$116.00 - P/E Ratio

- 6.83

- Price Target

- $104.64

United Airlines Holdings Inc. NASDAQ: UAL is one of the three major carriers in the United States, along with Delta Air Lines Inc. NYSE: DAL and American Airlines Group Inc. NASDAQ: AAL. United and Delta were the only two airlines to turn a profit in Q1, and United managed to surpass EPS projections, while Delta missed its estimates significantly.

Strong Q1 earnings aren’t the only reason to prefer United to the competition. United has better net margins than Delta or American, along with the most cash flow per share ($2 billion in free cash flow on the balance sheet). But it also trades at just 5.1x forward earnings with a price-to-earnings (P/E) growth rate of 1.19, indicating a reasonable valuation and sustainable growth metrics.

Royal Caribbean: King of the Cruise Lines

Royal Caribbean Cruises Today

RCL

Royal Caribbean Cruises

$270.31 -2.08 (-0.76%) As of 01:41 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $130.08

▼

$279.89 - Dividend Yield

- 1.11%

- P/E Ratio

- 22.44

- Price Target

- $276.90

Like the airline industry, the cruise lines are categorized into a Big Three: Royal Caribbean Cruises Ltd. NYSE: RCL, Carnival Corp. NYSE: CCL, and Norwegian Cruise Line Holdings Ltd. NYSE: NCLH. RCL may not be the biggest or travel to the most ports, but it's the cruise line stock with the most promise thanks to its impressive margins and dividend.

Royal Caribbean’s high-margin cruises make it the envy of the industry, and its sales have been experiencing tremendous growth. In Q1, the company reported net margins of 19.38%, well above Carnival’s 8.07% and Norwegian’s 9.05%. It was also the only cruise line to turn a profit, which justifies its higher valuation compared to its peers. RCL is also the only cruise line to pay dividends, which currently yields 1.12%.

Booking Holdings: A Firm Grip on Reservations

Booking Today

$5,315.60 +11.57 (+0.22%) As of 01:41 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $3,180.00

▼

$5,639.70 - Dividend Yield

- 0.72%

- P/E Ratio

- 33.09

- Price Target

- $5,388.37

If you’re long enough in the tooth, you might remember booking a vacation through a travel agent, who would arrange your flight, hotel accommodations, rental car, or any other amenity you may need on the trip. Today, most of this service is conducted through websites or mobile apps, such as Priceline, Agoda, Booking.com, Kayak, or OpenTable, all of which are properties of Booking Holdings Inc. NASDAQ: BKNG.

The company’s Q1 2025 earnings report was a canary in the coal mine of the sentiment rebound. BKNG reported on April 9 and smashed top and bottom line expectations, while also raising guidance. The Q1 performance made it a big earnings season winner, and we’re now seeing why executives raised guidance at the time despite prevailing wisdom. BKNG also has superior metrics to its largest competitor, Expedia Group Inc. NASDAQ: EXPE, including higher EPS and better profit margins (22.58% vs. 8.78%). EXPE also missed on EPS and revenue in Q1, giving Booking Holdings a significant advantage at the moment.

Before you consider United Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Airlines wasn't on the list.

While United Airlines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report