Key Points

- Online retailers have made waves since the COVID-19 pandemic.

- Tech-forward structure, brand recognition and ease-of-use are all features to consider when deciding which retail stocks to invest in.

- Learn more about online and direct marketing retail stocks to invest in with MarketBeat.

- 5 stocks we like better than adidas

If you're like most shoppers, you order many of the items you use daily online. In recent years, online shopping has evolved and adapted to people's needs, and very successful companies work exclusively online to address the specific needs of their consumers.

Savvy investors have noticed this trend and begun to invest in direct-to-consumer online marketplaces. With many direct marketing retail stocks gaining traction in the post-pandemic economy, some data allows us to determine possible buys, both in the short term and as long-term holds.

Read on to learn more about some of the best online retail stocks. By the time you finish reading, you should have a few solid options for your investment consideration.

What are online and direct marketing retail stocks?

Internet and direct marketing retail companies, also known as "e-tailers," specialize in providing products to consumers through online ordering and direct shipping. While some retailers might have a smaller brick-and-mortar store presence, most operate exclusively online.

Online retailers might sell everything from consumer staples like groceries and household cleaning products to specialty products like luxury watches and designer clothing.

These stocks were already gaining popularity before the pandemic, but lockdowns accelerated their growth to the point where now these online services are ingrained in many people's everyday lives. The growth of online retailers accounted for $343 billion in 2015 — and in 2020, the online retail industry reached a total market capitalization of $1.4 trillion. This number should expand further as online retail powerhouses like Amazon and Alibaba expand into new arenas like healthcare and pharmaceutical products.

If you have an Amazon account, use Chewy for your pet supplies or had your dinner DoorDashed this week, it's obvious why these companies thrive. For stock traders, the question of which online retail stocks to buy becomes a question of exploring product offerings and the online infrastructure of each company.

The booming landscape of online retail stocks

Online retail was one of the few market sectors actually to get a boost from the COVID-19 pandemic. As consumers were stuck inside, online shopping exploded and consumers began getting their everyday goods delivered from companies ranging from Amazon and Wayfair to the local grocery store.

E-commerce revenue totaled over $900 billion in 2023, and that number is expected to exceed $1.5 trillion by 2028. Clothes and shoes remain the top items purchased by online shoppers, but more and more are turning to e-commerce sources for groceries, home goods, furniture and other types of merchandise.

Analyzing market dynamics

The last two years have been interesting times for e-commerce. The digital footprint continues to grow as e-commerce gains more and more market share away from brick-and-mortar retailers. However, surging inflation increased production costs and turned customers frugal, and the subsequent rate hikes have limited growth opportunities in e-commerce, which is still heavily dominated by tech.

But market analysis from Grand View Research expects a 14.7% compound annual growth rate (CAGR) through 2027 as companies court both individual and business clients. Coupled with the fact that smartphones are ubiquitous and online shopping can be done from anywhere in the world, the online retail outlook looks rosy for the next four to five years.

Key metrics for evaluating online retail stocks

A few key metrics include:

- Revenue and profit analysis: Online retail is a growth-focused industry and companies that can consistently grow revenue will be rewarded. Companies that grow revenue year after year are gaining market share, but revenue doesn’t equal profit. Analyze company balance sheets and make sure revenue is being consistently turned into profit as well.

- Customer acquisition/retention costs: How much does the company need to spend to acquire a new customer? And wow does that figure compare with the cost of retaining customers? The more a company spends in this area, the less they’ll retain in earnings. In the easy money era following the Great Recession, many firms spent heavily to acquire market share at the expense of profitability. However, that strategy has changed in the new era of high interest rates. Investors should always listen to conference calls and review earnings reports to find out how businesses are adapting marketing budgets in this environment.

- Margins: Online retailers must acquire or make inventory, operate factories or warehouses, and sell consumer goods. Like most retailers, profits are amplified by keeping margins at appropriate levels. Always review metrics like the cost of goods sold (COGS) or cost of revenue when evaluating retailers.

Features to look for in online retail stocks

Identifying the best online retail stocks is a key skill that new investors must develop. While we all might enjoy using different online retailers in our personal lives, a smart investor must have tangible evidence that a company will succeed before buying shares. Consider the following major factors before buying an online retail stock.

Competitive advantage

When considering and identifying the best online retailer stock, it's important to consider their advantages over the other players they compete with. While it's now easier than ever before to open an e-commerce operation and gain media attention, this boom in competition has made it more difficult to stand out with customers.

Before investing in an online retail stock, look for competitive advantages the company may have in the current sphere. If they offer better pricing, faster shipping, a more convenient way to buy or a superior product compared to their direct competition, the stock might be worth buying. If you cannot identify a sustainable advantage over other companies in the space, it might be best to explore other options.

Brand recognition

If an online retailer is a go-to brand in its space, it can greatly impact its overall longevity and profitability. This isn't to say an emerging company can't make waves and give quick profits in the right situation, but if your goal is to invest in the best-performing retail stock in the long term, then a strong brand with a positive reputation and multiple years experience in the online market sphere could make one stock better than another.

Ease of use

The biggest determining factor in which retailer people will choose to order from online often isn't price — it's how easy the service is to use. Convenience is the name of the game for online retailers, and this does tie into the competitive advantage category. However, companies with top-rated mobile apps or special shopping features (like Amazon Prime's One-Click ordering feature) can stand out in this competitive space.

Tech features and focus

A company's ease of use perfectly leads us into their ability to focus on technology and adapt to make a service ideal for the end user. Read almost any online news article or turn on any financial channel and you'll hear some of the most used terms: AI, Chat GPT and other talking points about new machine learning tech.

If a company has been on the AI bandwagon for a while, that's a good sign. If they're just now getting into advanced tech, they may be too late, especially in the competitive world of online retail. As you compare retail and direct marketing stocks, features like augmented reality and AI-assisted customer service bots can make a retailer stand out in a particular sector.

6 best retail and direct marketing stocks

Which stocks you pick to invest in will depend on your own financial goals, but there are a few overall market leaders that investors may want to pay special attention to. Read on to learn about a few of the top retail and direct marketing stocks to consider adding to your portfolio based on the above qualities.

Wayfair Inc.

Wayfair Inc. NYSE: W is one of the strongest home decor and furniture brands and has had consistent leadership since its foundation in 2002. Wayfair's easy-to-use platform offers homeowners thousands of interior design choices and a simple buying process.

During the pandemic, Wayfair stock soared to unthinkable heights, powered by stimulus money, people rearranging their homes and the inability to shop at traditional stores. At one point, Wayfair stock traded for $315 per share. Despite this huge boom, the stock has faltered in recent months, returning to pre-pandemic levels, subject to seasonal fluctuation surrounding holidays and special promotions.

Image: Wayfair’s recent struggles could present opportunities to retail investors.

While investing in this online retailer is not without risks, Wayfair has experienced some tough financial times recently, and the stock has potential to perform well in the future. This can be especially true with one of its main competitors (Bed, Bath and Beyond) recently filing for bankruptcy. Investors should monitor trends and news to generate short-term wins when investing with Wayfair.

Amazon.com Inc.

For investors who want to buy and hold a stock, there are few better options in any space than Amazon.com Inc. NASDAQ: AMZN. While it's undoubtedly the strongest and most recognizable brand in online retail, Amazon's stock has not been immune to recent economic changes.

After a meteoric rise in 2020, similar to most online retailers, the stock dropped significantly in 2022, but it's on the rise in 2023 and looks like a solid long-term hold for investors. Amazon could present new opportunities in the direct retail space, especially for those interested in blue-chip choices.

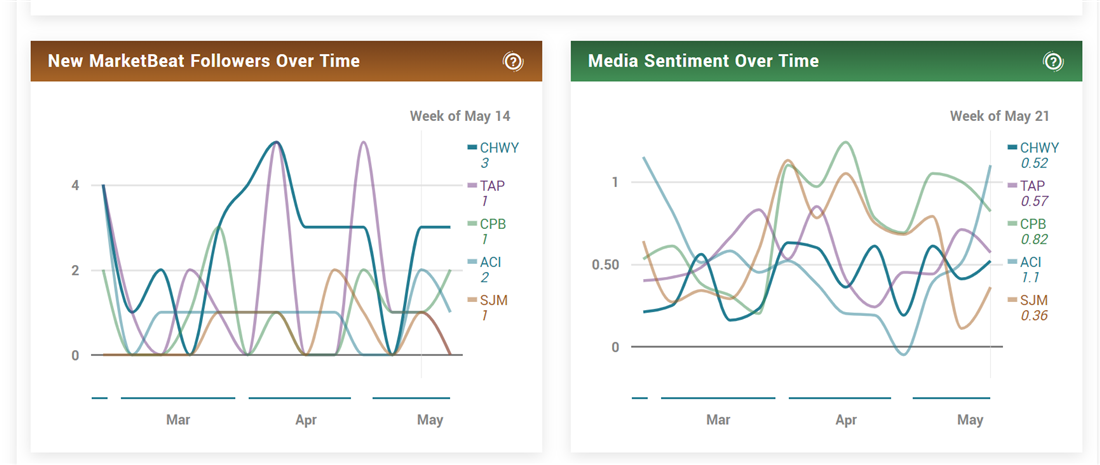

Chewy Inc.

Another recognizable brand that experienced significant growth during the pandemic, Chewy Inc. NYSE: CHWY is the top online retailer for pet food and accessories. Comparing Chewy's rapid growth to established conventional pet supply retailer Petco gives a snapshot of how online retail can be superior to traditional retail. Even though Chewy has seen the same post-pandemic decline as other online retailers, it's still in a much better position than Petco and has over 10 times the current market cap.

Image: Chewy has consistently outperformed competitors in the pet food industry in 2023.

Chewy is in a similar position to the other stocks we have covered, and investors will want to determine if they think the current stock position (similar to pre-pandemic levels) is at its floor and can bounce back or if losses can continue. We think the stock will rebound since it's the dominant force in the online pet supply market, and people will care for their pets even through a recession.

Alibaba Group

If you're unfamiliar with the Alibaba Group NYSE: BABA, know it's one of the largest online retailers in China — and the world. While Alibaba experienced the same bell curve of success during the pandemic, followed by losses, its stock price has yet to reach pre-pandemic levels again. However, it has been consistently rebounding since 2020, providing a simple way to invest in the health of the Chinese retail economy. In May 2023, the Alibaba Group also had a total market capitalization of more than $200 billion, making it another top mega-cap stock choice.

Adidas AG

While Adidas AG ETR: ADS might not come to mind as a strictly online retailer, it does the lion's share of its business online, and it's an interesting case study for retail stocks right now. Adidas recently changed leadership after enduring a great deal of negative publicity.

Image: While Adidas stock has not yet reached pre-pandemic levels, it is making a consistent rebound.

If the company's new leader can reestablish confidence in the athletic apparel giant, Adidas' stock is poised for a rebound. There is room to grow for Adidas, as it had a strong stock price even before the pandemic. In May of 2023, Adidas showed a total market capitalization of more than $20 billion, proving that it was making a solid path toward recovery.

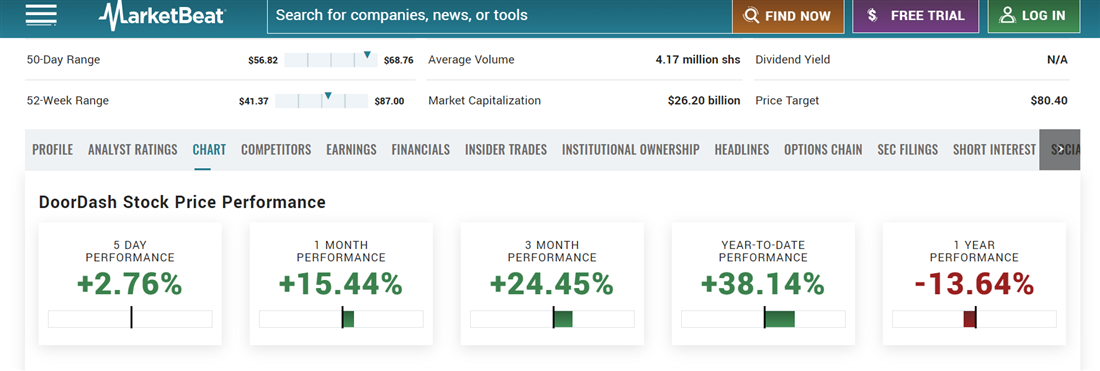

DoorDash Inc.

Restaurant enthusiasts still love the convenience of having their food delivered, even though these locations are no longer restricted due to COVID-19. While DoorDash Inc. NYSE: DASH might not immediately come to mind as an online retailer, it's one of the hotter stocks in this sector, and for a good reason.

Image: Even post-pandemic, DoorDash has continued to show returns for investors.

DoorDash showed the same bell curve we saw with the other online retailers, but since hitting its floor in October 2022, the stock price has trended upward and continues to do so. The strongest brand in food delivery, DoorDash offers an easy-to-use and convenient service and should be set up well for future performance.

Risks and challenges in online retail stock investments

Online retail’s growth prospects may look promising, but markets always have a way of ensuring the journey is a bumpy one. Three risk factors investors should monitor are as follows:

Regulatory challenges and compliance

E-commerce still has a bit of a Wild West feel to it. Firms frequently have trouble keeping customer data safe from breaches, and they also must stay on top of tax legislation, shipping regulations and consumer protection laws.

Market saturation

As online retail market share grows, risks of market saturation will grow as well. Increased competition is good for consumers, but oversaturation can destroy company margins. Plus, unseating incumbents like Amazon will take a Herculean effort. Startups must create unique user experiences to stand out.

Global events

Pandemics, wars, geopolitical movements, climate events — these are just a few global shocks that have affected markets over the last five years. Here’s a guarantee for the next five years: a global shock will affect markets. This is especially true in the online retail sector where companies are seeking a global consumer base.

Strategies for successful investment

The online retail marketplace is expanding, and while some players in this space have made their way to blue-chip status, there’s still plenty of space for new entrants. Here are a few ideas to keep in mind when developing your investment strategy:

- Diversification: Despite the growth projections, e-commerce is still a blossoming industry and investors should never throw too much capital into a single stock or market sector.

- Identify growth opportunities: E-commerce giants like Amazon have rewarded shareholders handsomely, but newer companies like Chewy and DoorDash have found certain niches where they can outperform the larger firms. Investors should always keep an open mind when startups enter this space.

- Risk management: When investing with a sector-based strategy, you’ll need to set risk parameters on your portfolio. If your portfolio becomes too overweight these stocks, sell some and use your assets elsewhere. If you’re underweight, add some shares. Keep your portfolio in line with your pre-set parameters to prevent unexpected losses.

Building a successful online retail stock portfolio

When building your portfolio, set yourself up for success by following these tactics:

- Diversified portfolios are resilient portfolios. Be sure to spread your allocation across several stocks in online retail (or use an ETF to invest in a basket).

- Balance growth with stability. Companies like Amazon have reached blue-chip status and are unlikely to close up shop anytime soon. Use stable stocks like Amazon and Alibaba as anchors to balance high growth stocks.

- Re-evaluate your investment thesis as needed. Are economic conditions changing? Are consumers strapped for cash or eager to spend? When investing by sector, you’ll need to assess the market environment every year and make sure it's conducive to online retail stocks.

Summing up online retail stocks

By now, you should understand what an online retailer does and which features can help make their stocks provide good returns. The online retail space is competitive, but there is room for investors to make wise decisions and profit from smart investments. If you're looking to invest in multiple retail stocks at once, a consumer discretionary ETF could be a better option, as it combines multiple retail stocks into a single asset purchase.

Before you consider adidas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and adidas wasn't on the list.

While adidas currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report