If you look at the chart of Apple’s NASDAQ: AAPL stock price and wonder if it can bob to another new high, the odds are high that it can do so. This is among the world’s most-followed, most-traded, and widely held names. When the economy is doing well, it goes hand-in-hand that Apple will also do well.

While there are many headwinds in the economy, the recession that everyone feared has yet to materialize, and there are signs of strength. Amazon NASDAQ: AMZN, for 1, reported a record Prime Day event with rising volume and average ticket prices.

Apple products aren’t on par with the average Amazon purchase, but Amazon’s strength is a sign of consumer strength that bodes well for all consumer stocks. Apple is only the most visible.

#1 - Apple Is A Most-Followed Stock

Apple is high on the list of Marketbeat.com’s Most Followed Stocks. The name ranks 2nd behind Microsoft NASDAQ: MSFT on the 7-day comparison but takes a firm lead over the long term.

Apple is the #1 most followed stock for the last 3 months and holds the position by a wide margin. This signifies a deep commitment from retail investors, who primarily cause rapid price movements.

They (we) like Apple and will flood into the name given the proper catalysts. Those catalysts can and do include analysts' activity, institutional signals, performance, and charts.

#2 - Apple Is A Most-Upgraded Stock

Apple is also high on the list of Most Upgraded Stocks. The Most Upgraded Stocks have the most support from the analysts' community, which can support the market in 2 ways. The 1st is their following, the institutional and “big money” investors who rely on them for advice and management services.

They represent a significant portion of the market; a lot of that capital is “buy-and-hold” generational money and can produce significant head and tailwinds for any market; when the analysts are Buying a stock, so do their clients.

The 2nd is the impact on the retail market. When the analysts are upgraded and raising price targets, the retail market tends to follow the big money into the name. Regarding Apple, it has a large analyst following, 33 tracked by Marketbeat, but not the largest. They rate the stock at Moderate Buy, which has held steady for several years.

The price target may hold the stock back in the near term; it is 5% below the current action but trending higher compared to last month, last quarter, and last year.

The catalyst for the analyst might be the upcoming earnings report when Apple outperforms its estimates. Another round of price target increases could get the market to a new high, and the most recently set stock price targets are already well into the all-time high territory. As for the earnings estimates, the bar is set low, with most analysts lowering their targets since last quarter.

#3 - The Institutions Are Buying Apple

The institutions are the single greatest force within the stock market. They physically represent managed money by analysts, managers, banks, retirement funds, and private investment firms. They own 58% of Apple stock and have bought it on balance for the last 12 months. The buying has been strong and outpaced selling by 2.4:1. Coincidentally, institutional activity ramped up in Q1 and Q2, coincident with the current rally in share prices.

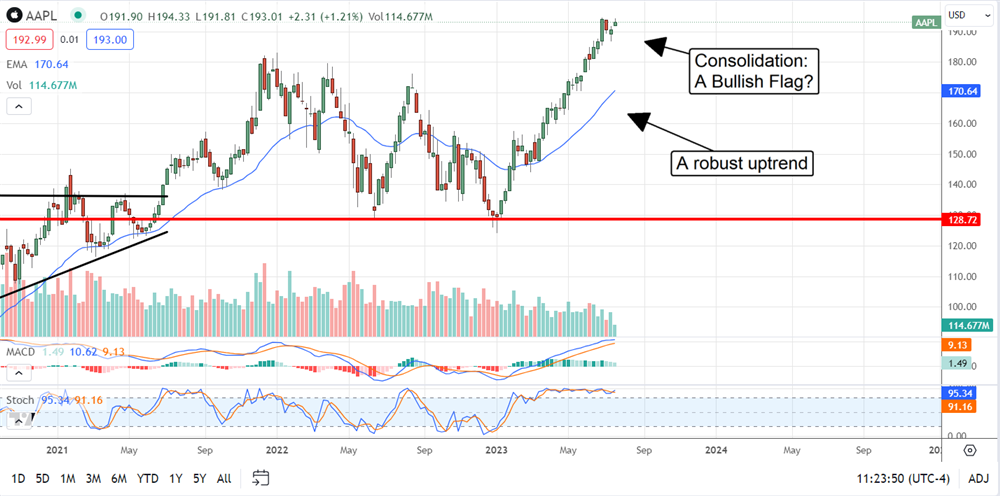

The Technical Outlook: Apple Is In Rally Mode

Apple shares are in rally mode, which looks like a strong one. The market is solidly up at +50% for the year and forming a bullish flag pattern. Assuming the Q2 results are good, the market should break to a new high by late summer. In that scenario, based on the technical indications, it could gain another $40 to $60.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.