Solar energy solutions provider

SunPower NASDAQ: SPWR stock has been a

pandemic winner in 2020 hitting multi-year highs of $57.52 in January 2021 before plummeting by more than half to lows of $27.39 by March. The Company entered the year on the heels of the powerful

clean and renewable energy themed momentum driven by the extension of the Federal solar investment tax credit (ITC) through 2023. However, the wind was taken out of its sails during the

Nasdaq 100 correction, lowered Q1 2021 guidance and further punished by the effects of the Texas snowstorm disaster that rendered solar panels and wind turbines helpless for thousands of consumers. However, the global decarbonization movement and

clean energy initiatives embraced by Biden administration are powerful lasting tailwinds that investors need to consider as opportunistic pullback levels present themselves in shares of SunPower.

Q4 2020 Earnings Release

On Feb. 17, 2021, SunPower released Q4 2020 results for the quarter ending in December 2020. The Company reported earnings per share (EPS) of $0.14 excluding non-recurring items, versus consensus analyst estimates of $0.07, a $0.07 beat. Revenues fell (-15.6%) year-over-year (YoY) to $341.8 million, missing analyst estimates for $354.67 million. The Company added 13,000 new Residential customers to an installation base of over 350,000 achieving new record homes backlog with 24% gross margins on $36 million adjusted EBITDA. The Commercial and Industrial Solutions saw a greater than 65% sequential MW growth with 18% gross margins and $8 million adjusted EBITDA.

Lowered Guidance Estimates

The Company issued lowered guidance for Q1 2021 with revenues expected between $270 million to $330 million compared to $337.74 million consensus analyst estimates. The Company expects a GAAP net loss between (-$10 million) to (-$20 million). For full-year 2021, SunPower expects to meet or exceed its 2021 guidance for revenue growth of 35% and MW growth of 25% YoY versus consensus analyst estimates for 26% growth. SunPower expects 2022 Adjusted EBITDA growth of over 40%.

Solar ITC

The federal solar investment tax credit (ITC) was enacted in 2006 to promote the acceptance of the solar energy. It is credited for growing the U.S. solar industry by over 10,000% since then. The tax credit has been extended multiple times including the December 2020 extension that pushes the tax credit phasedown to 2023. The ITC provides a federal tax credit of 26% of the costs for the installation of solar energy systems for residential and businesses. The credit drops to 22% for projects started in 2023. The credit is set to expire in 2024 as the residential credit disappears and commercial credit drops to 10% permanently. CEO Werner noted, “U.S. residential solar growth is set to accelerate over the next five years driven by the recent extension of the ITC, the increasing affordability of solar, as well as broader acceptance of solar as an integral part of combating climate change.” SunPower expects its new homes growth rate to exceed 40% over the next several years. The Biden pro clean energy agenda and a democratic controlled Congress will likely delay the phasedown again. In fact, Biden is arguably setting out to be one of the most pro-clean energy and renewables advocates in the history of the U.S. Presidency. Additionally, the buy domestic initiative also serves as strong tailwinds for U.S. solar companies like SunPower. Prudent investors looking for exposure can scale in at opportunistic pullback levels.

SPWR Opportunistic Pullback Levels

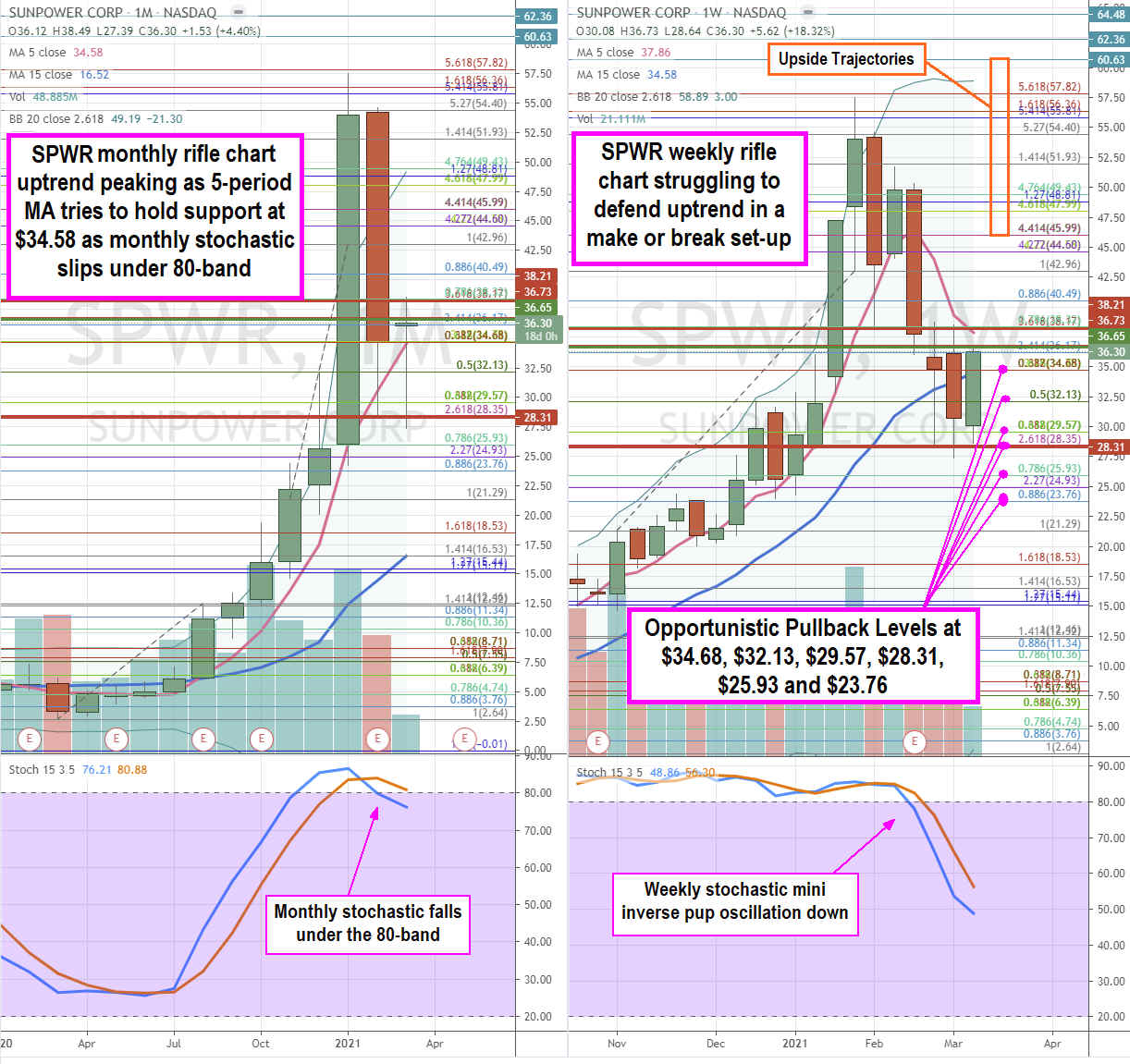

Using the rifle charts on monthly and weekly time frames provides a broader view of the landscape for SPWR stock. The monthly uptrend has stalled out after peaking and pulling back from the $57.48 Fibonacci (fib) level. The monthly 5-period moving average (MA) support is gone flat at $34.68 trying to hold the uptrend but the monthly stochastic has crossed down under the 80-band. The weekly rifle chart formed a market structure low (MSL) buy trigger above $36.30 after the weekly market structure high (MSH) sell triggered under $36.73. The monthly MSH sell triggers under $28.31. The weekly rifle chart is trying hard not to breakdown as the 5-period MA resistance at $37.86 closes the gap with its 15-period MA support at $34.58. The weekly stochastic mini inverse pup continues to oscillate lower which can form a weekly breakdown on the 5 and 15-period MA crossover down. This can produce opportunistic pullback levels at the $34.68 fib, $32.13 fib, $29.57 fib, $28.31 fib, $25.93 fib, and the $23.76 fib. Keep an eye on peers FSLR, JKS and SOL. The upside trajectories range from the $45.99 fib up towards the $60.63 sticky 5’s zone.

Before you consider SunPower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SunPower wasn't on the list.

While SunPower currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report