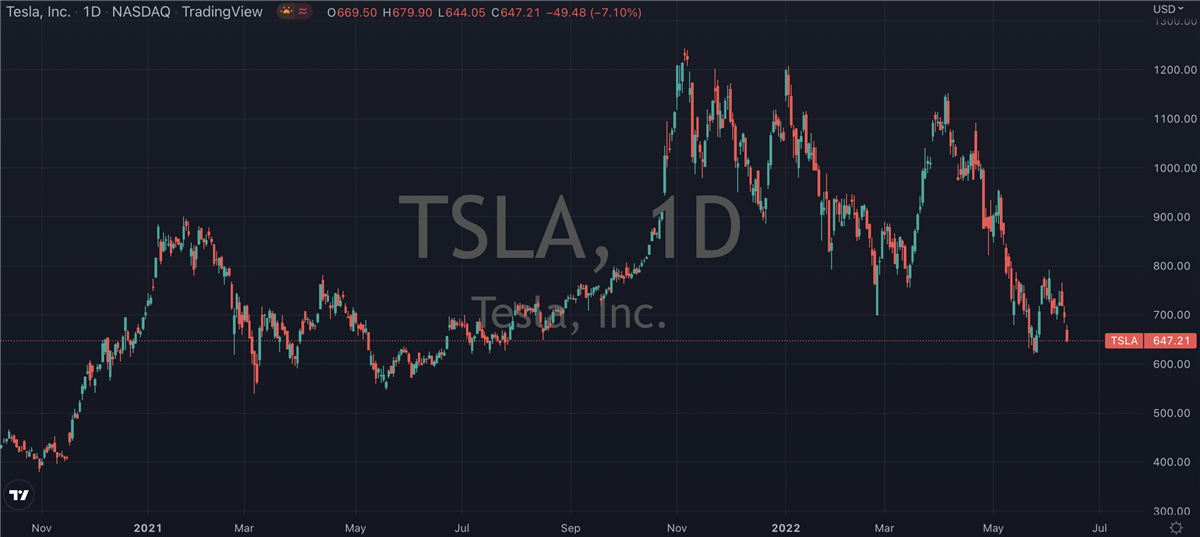

Was yesterday the last time shares of

Tesla (NASDAQ: TSLA) traded below $1,000, at least for the foreseeable future? It will be a while before that’s confirmed but they’re certainly looking good for it right now. The company’s Q1 earnings, released after yesterday’s bell smashed analyst expectations and sent the stock soaring in the after-hours session. Going into Thursday’s pre-market window, shares were up more than 7% on

where they closed on Wednesday.

Non-GAAP EPS came in at $3.22, a full $0.95 ahead of what analysts had been looking for, while revenue also registered a healthy beat and showed year-on-year growth of 80%. Tesla’s automotive gross margin was a record 32.9%, and a marked improvement on the 26.5% seen in the same quarter last year. The report has easily undone any concerns that were starting to grow after the company’s Q1 delivery numbers trailed analyst forecasts earlier this month. At the time, the consensus was looking for 317,000 shipments, but the actual number for the first quarter came in at 310,000. It wasn’t a big miss, but would have been enough to sow some seeds of doubt. Yesterday’s report, and the record $18.7 billion in reported revenue will have put paid to that for now though.

Bullish Comments

On the company’s earnings call, CFO Zachary Kirkhorn and CEO Elon Musk both spoke confidently about the company’s ability to grow at least 50% over 2021 numbers. However, the executives also noted that Tesla has lost about a month of “build volume” in Shanghai due to Covid-related shutdowns. Kirkhorn made it clear though that “production is resuming at limited levels, and we’re working to get back to full production as quickly as possible.”

For his part, Musk was equally bullish, noting that despite the shutdown, “it seems likely that we’ll be able to produce one and a half million cars this year.” He did however give some warning that customers making orders now risk facing a long waitlist, and it could be 2022 before their order is delivered. Interestingly, Musk struck a somewhat pessimistic tone with regards to Tesla’s autonomous driving advances, and acknowledged they were taking longer than he anticipated. He told investors that “with respect to full-self driving, of any technology development I’ve ever been involved in, I’ve never really seen more kinds of false dawns where it seems like we’re going to break through but we don’t.”

Still, investors and Wall Street were more than happy to join the bull camp after the report so are clearly looking beyond the short term challenges. Dan Ives from Wedbush noted the "particularly impressive" margin beat that Tesla had, especially in light of the “dramatic headwinds” in the form of China and increasing component costs across the board. Wells Fargo also weighed in, and said that higher pricing and the leverage of labor and overhead costs helped to offset the underlying material cost inflation.

Looking Ahead

This is all good stuff, and the size of the beat along with the record margin print is all the more impressive in the face of what were some fairly serious supply chain pressures. With Netflix (NASDAQ: NFLX) continuing to disintegrate after its second dismal earnings report in a row, it will be refreshing for tech investors to see at least one other high-flying growth stock continuing to meet and exceed expectations.

Tesla shares have been trading in a fairly confined range, for Tesla that is, since last November, but this report could be just what they need to

start kicking on again with a fresh rally. The risk-off sentiment that swept over equity markets in the first quarter of the year has started to dissipate, and stocks are beginning to trade on their own merits again rather than on negative market sentiment. To the upside, let’s see if shares can take out last month’s $1,150 level and then kick on to last year’s all time high around $1,250. Knowing Tesla, it wouldn’t take much for these numbers to be left in the dust very soon.

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.