If It’s A Rotation They Want, Here’s Where The Value Is

If It’s A Rotation They Want, Here’s Where The Value Is

The new buzzword on Wall Street is rotation, rotation, rotation. The market (at least in the minds of the mainstream media) is rotating out of growth and big-tech into value. Oddly enough, this is something I’ve been saying for over a year. The market darlings are trading well above fair value while other stocks with equally attractive business, growth, and dividend are lagging. That’s opened up some deep values in the market and these are just a few.

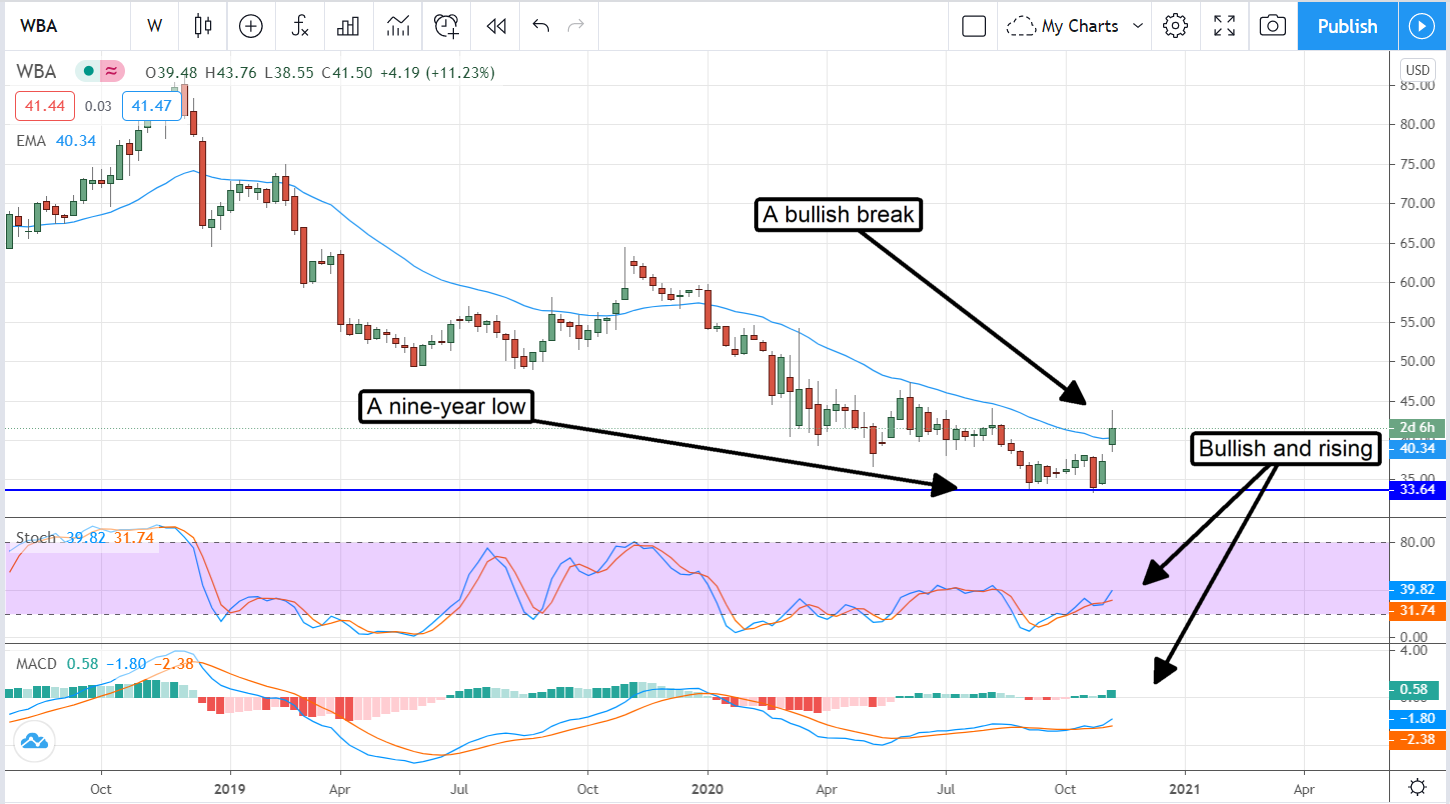

Walgreen’s Boots Alliance Is Ripe For Reversal

Walgreen’s Boots Alliance (NASDAQ:WBA) has been struggling with growth and competition for years. As my colleague Sam Quirke puts it, it’s been death by a thousand cuts as one stumbling block after another gets in the way. The latest was COVID-19 but even that headwind is passing. After years of effort, the company is on track to deliver growth in the coming years.

CEO update: "We are seeing gradual improvement in key U.S. and UK markets and continued strong performance in our wholesale business. I'm also encouraged by the accelerating growth in our e-commerce platforms. Now, more than ever, our pharmacy-centered business is at the heart of community healthcare and we are expanding on that role for the future."

In terms of its value, Walgreens Boots Alliance is trading at only 9X this year’s earnings and 8X times next providing a deep value relative to the broad market. Relative to its peers Rite Aid (NYSE:RAD) and CVS (NYSE:CVS) the value story is a little different but still compelling. CVS is trading about 9.5X this year’s and next year’s earnings while Rite Aid won’t produce a profit for years. And then there is the dividend to consider. Walgreens Boots Alliance pays a safely growing dividend that yields nearly 4.5% compared to CVS smaller 3.4% yield and Rite Aid’s lack of distribution.

The 4th quarter results are a great example of why this stock is ripe for reversal. The company delivered 2.4% YOY growth to beat consensus, delivered free-cash-flow growth, and provided positive guidance for fiscal 2021. Looking at the chart, it appears as if the reversal is in-play.

Over the past two weeks, the stock touched a 9-week low and unleashed a round of vigorous buying. Since then, shares have rallied 30%, confirmed support at the short-term EMA, and set a three-month high. The indicators are also supportive showing bullish crossovers and convergence with the new highs. A continuation of this trend could easily lead to double-digit gains in the near-term and triple-digit gains in the long.

Kraft-Heinz Is Your High-Yield Turnaround In Consumer Staples

Kraft-Heinz (NASDAQ:KHC) has a lot of things going for it besides its value, and the value is compelling. The company is trading about 10X this year’s earnings and 12X next which not only highlights the stock value but also a recent divestiture. The broad market is trading at a mind-boggling 22X times earnings while the highest valued stocks in the consumer staples group (Hormel – NYSE:HRL) are closer to 30X. And Hormel is not in the final stages of a major business turn-around.

Kraft-Heinz began a tough turnaround about two years ago when it cut the dividend and focused on paying down debt. The pandemic helped those efforts by spurring demand for consumer staples and the company took full advantage of it. Management not only accelerated its debt-reduction plan but it also pared off an under-performing segment in favor of growth avenues. The cash will be used to pay down debt, increased ad-spend, and growth acquisitions. Now, the company’s balance sheet is in the best shape its been in for years.

And then there is the dividend. The stock is yielding 5.25% with shares trading near $30 and the payout is safe. The payout ratio is an easily managed 50% with plenty of free cash flow for an increase but I wouldn’t count on that. What I would count on is Kraft paying the current $1.60 annual distribution for the next couple of years while it focuses on growth and pays down more of its debt.

The chart of Kraft Heinz is also compelling. The weekly chart shows a stock near the end of a Head & Shoulders pattern that could lead to a 40% upside in the near-term and upwards of 100% upside over the next two to three years.

Before you consider Kraft Heinz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kraft Heinz wasn't on the list.

While Kraft Heinz currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.