Shares of the enigmatic athleisure brand

Under Armour (NYSE: UAA) (NYSE: UA) have been in a downtrend since peaking in July 2019 at $27.72 on the heels of its last upbeat earnings report. Management ate crow in the following quarters as they missed guidance and continued to lose credibility with shrinking forecasts underscoring the inept performance. The COVID-19 pandemic was the (convenient) nail in the coffin plunging shares to lows of $7.15 as the Company had reason to pull all forecasts going forward adding further uncertainty amidst the downward spiraling operations. Meanwhile, competitors like

Nike (NYSE: NKE) have seen a 70% recovery off pandemic lows and shares of

Lululemon Athletica (NASDAQ: LULU) have thrived to reach new all-time highs. What used to be a three-way race for dominance in the athleisure segment has narrowed to just two as Under Armor’s wheel’s fell off. With shares setting up for another leg down, long-term bargain hunters might consider this potential turnaround play at opportunistic entry levels.

Q1 2020 Earnings Takeaways

Under Armour released it Q1 2020 earnings for the quarter ending in March. The Company reported a loss of (-$0.34) per share compared to consensus analyst estimates for a loss of (-$0.19) per shares, a (-$0.15) miss. Sales fell to $930.2 million versus analyst estimates of $939.22 million, a (-22.8%) YoY decline. Due to the uncertainty from the COVID-19 pandemic triggering stay-in-shelter mandates closing up distribution channels and wreaking supply chain disruption, Under Armour pulled all forecasts for 2020. The Company’s largest retail distribution outlet Dick’s Sport Goods (NYSE: DKS) closed all retail stores in mid-March 2020. This was mirrored but literally all Under Armor’s brick and mortar retail distributors through the pandemic.

COVID-19 Material Impacts

The isolation mandates have also caused sporting events to cancel or postpone games thereby plunging demand for sports apparel. Under Armour reported a (-28%) drop in sports apparel sales in North America, which accounts for 60% of total revenues alone. The Company had already guided down North American revenues by 5% to 9% on its Q4 2019 release which set the bar low but managed to come in much lower. The Company has neglected its digital online channel for years as competitors Nike and Lululemon thrived on their digital channel top-line growth explosion. Direct-to-consumer digital sales accounted for only 10% of total sales in prior quarters. During the conference call, the Company noted Q1 2020 digital sales grew by an embarrassing 2% YoY. Compare this to the 41% digital sales growth for Lululemon for their quarter ended Feb 2020 or the 30% digital sales growth (in China) reported by Nike in its recent Q3 release.

Survival to Turnaround Mode

Under Armour has gone into cost-cutting mode by chopping $325 from its 2020 operating expenses and furloughing 600 employees. The cash burn for Q1 2020 was (-$366.7 million) of the $959 million in cash on hand (including its revolver) with $2.24 billion in debt. The Company raised $440 million on May 22, 2020, in an upsized offering of the 1.50% convertible senior note due 2024 with conversion to Class C shares at management’s discretion. Convertible notes are always a raw deal for shareholders due to the dilutive nature and relation to the common stock conversion price. However, this does beef up the cash position pumping up cash-per-share (CPS) to nearly $3.20. As malls re-open and states lift restriction mandates and sports leagues start to tentatively resume schedules, UAA should start to see some recovery. While LULU and NKE have embodied the restart narrative turning sentiment positive, UAA just needs to show an uptick in improvement to paint itself as a value play especially when trading at just 2-3X CPS. However, the technicals signal the potential for cheaper entry levels if the monthly inverse pup breakdown pattern materializes.

Opportunistic Buy Levels

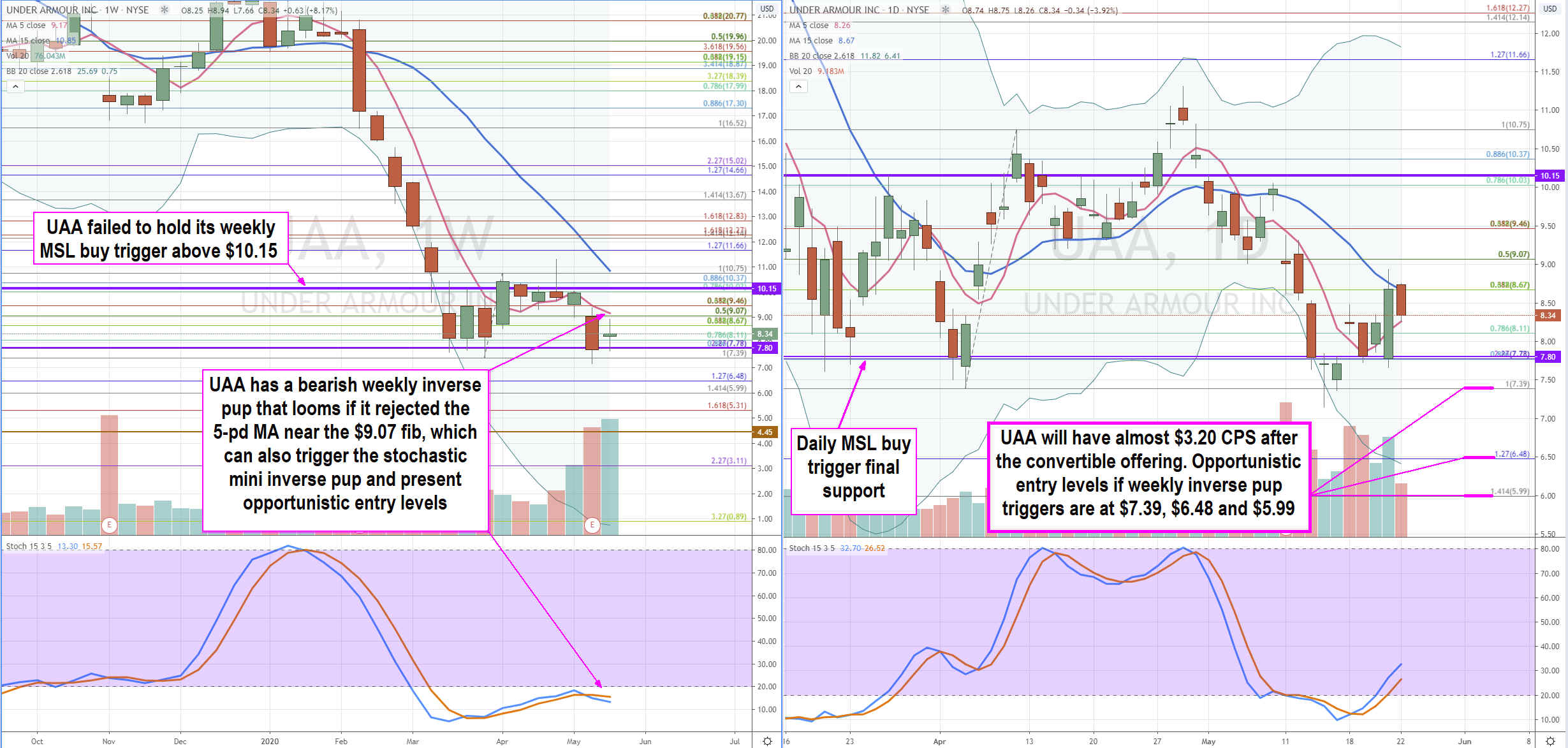

Using the rifle charts on the wider weekly and daily time frames to lay out the playing field is suitable for swing traders and investors. UAA has underperformed its industry peers and the S&P 500 (NYSEARCA: SPY) . The weekly had formed a market structure low (MSL) buy trigger above $10.15 but failed to maintain its ground on the coil attempts. The daily MSL low buy triggered above $7.80 but needs to hold that line in the sand moving forward. The most lethal bearish pattern that currently looks is the weekly inverse pup breakdown with resistance at the daily 5-period moving average (MA) near the $9.07 Fibonacci (fib) level.

If the weekly inverse pup triggers from a rejection off the 5-pd MA in a weekly candle close coupled with the daily stochastic cross down, then opportunistic entry levels sit at $7.39 sticky 5s zone/fib, $6.48 fib and $5.99 fib. Traders can use these and in-between fib levels to scalp reversions utilizing stochastic direction confluence on intraday time frames. Swing traders can scale for overnight to multi-day holds on low band daily stochastic. Long-term investors may consider a dollar-cost averaging approach with income generation through writing covered calls.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.