Sarepta Therapeutics Today

SRPT

Sarepta Therapeutics

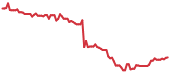

$22.51 -0.83 (-3.56%) As of 10/17/2025 04:00 PM Eastern

- 52-Week Range

- $10.41

▼

$138.81 - Price Target

- $34.42

In another tragic incident, Sarepta Therapeutics NASDAQ: SRPT saw a second death in connection with its Duchenne muscular dystrophy (DMD) treatment ELEVIDYS. The patient passed away due to acute liver failure (ALF) after doctors treated them with ELEVIDYS. Sadly, the same thing happened three months ago.

As a result, Sarepta has suspended shipments of ELEVIDYS for non-ambulatory patients and suspended its revenue guidance. On June 16, MarketBeat tracked a wave of downgrades by Wall Street analysts. By the end of the day, Sarepta’s stock had plunged more than 42%.

Could Sarepta’s latest setback clear the way for a new leader in DMD gene therapy?

Solid Biosciences Today

SLDB

Solid Biosciences

$5.88 -0.28 (-4.55%) As of 10/17/2025 04:00 PM Eastern

- Price Target

- $15.00

Investors seem to think so. Shares of Solid Biosciences NASDAQ: SLDB, a small-cap biotechnology company developing a potentially safer alternative to ELEVIDYS, jumped more than 11% that same day.

Concerns surrounding Sarepta’s ELEVIDYS treatment have certainly shaken the market, raising serious questions about the future of DMD gene therapy. Keep reading to find out how this news affects both pharma stocks.

ELEVIDYS Handcuffed After Tragedy, But Wall Street Still Bets Big on Sarepta

For the time being, this announcement is a devastating blow for Sarepta, evidenced by the massive drop in shares.

Sarepta Therapeutics Stock Forecast Today

12-Month Stock Price Forecast:$34.4252.90% UpsideHoldBased on 29 Analyst Ratings | Current Price | $22.51 |

|---|

| High Forecast | $85.00 |

|---|

| Average Forecast | $34.42 |

|---|

| Low Forecast | $12.00 |

|---|

Sarepta Therapeutics Stock Forecast DetailsLast quarter, ELEVIDYS accounted for 61% of Sarepta's total revenue of $612 million and nearly all the company's growth. ELEVIDYS saw sales growth of 180% last quarter. The company’s other product group grew at only 5%. Largely driven by expected sales growth for ELEVIDYS, Sarepta forecasted full-year 2025 sales of $2.3 billion to $2.6 billion in May. At the midpoint, this figure implies sales growth of around 29% over 2024. That is all out the window now.

Still, there are some mitigating circumstances that help soften the blow for Sarepta. The company will halt shipments of ELEVIDYS only for non-ambulatory patients. Since launching, only 15% of ELEVIDYS patients have been non-ambulatory, and in 2025, 30% of patients dosed were non-ambulatory. Thus, Sarepta should be able to continue selling ELEVIDYS to most patients.

Sarepta also notes that the ambulatory patient group alone allows it to be profitable. The company has come up with an enhanced regime to reduce the risk of ALF. The Food and Drug Administration (FDA) will need to approve and implement it before non-ambulatory sales resume. The company has no timeline for this but hopes to give a guidance update during its Q2 earnings call.

Sarepta's consensus price target among the 25 MarketBeat-tracked analysts is around $70, implying a potential upside of more than 230%. This huge divergence likely reflects the fact that Sarepta can still sell ELEVDYIS to most patients. Still, another patient death would tank Sarepta’s shares once again. At the very least, it is good to see that the company is halting non-ambulatory sales to reduce the likelihood of this happening. However, it could take an extended amount of time for the FDA to review and approve Sarepta’s enhanced regimen.

Solid Biosciences Surges as STG-003 Emerges as Top ELEVIDYS Contender

Solid Biosciences Stock Forecast Today

12-Month Stock Price Forecast:$15.00155.10% UpsideModerate BuyBased on 12 Analyst Ratings | Current Price | $5.88 |

|---|

| High Forecast | $20.00 |

|---|

| Average Forecast | $15.00 |

|---|

| Low Forecast | $10.00 |

|---|

Solid Biosciences Stock Forecast DetailsThis news further promotes Solid Biosciences' case as providing a future alternative to ELEVIDYS. Solid is developing STG-003 to treat DMD and early-stage trial data has shown the drug to be highly efficacious. In February, the company said STG-003’s average microdystrophin expression was the highest of any DMD gene therapy to date. High microdystrophin expression is a key metric used to assess the effectiveness of DMD medicines.

Liver safety has been a concern with gene therapies like ELEVIDYS, which Sarepta acknowledges causes elevated liver enzymes in about 30% of patients—a potential sign of liver stress or injury. In contrast, STG-003 appears to be less damaging to the liver. In data shared at the Jefferies Global Healthcare Conference 2025 on June 4, Solid noted it monitored three types of liver enzymes in trial participants and that levels for two of these enzymes actually fell, while the other was flat.

High-Risk, High-Reward: Will SRPT or SLDB Dominate the Future of DMD?

Given the sad news coming from Sarepta, Solid’s positioning in the DMD market is improving. STG-003 could represent a strong alternative, both in safety and efficacy, if approved. However, it still has a long road ahead of it to gain approval.

Solid plans to meet with the FDA in Q4 2025. The company wants to convince regulators to include STG-003 in the FDA’s accelerated approval program, which would speed up the approval process. Wall Street analysts see an approximate 200% upside in Solid and seem to believe that Sarepta is significantly undervalued. Overall, both remain highly risky stocks with so much uncertainty surrounding their businesses going forward.

Before you consider Solid Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid Biosciences wasn't on the list.

While Solid Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.