There are multiple stop orders, and the best order type for each circumstance might vary depending on the asset type, your investing style and volatility. Read on to learn more about how a stop market order works, the pros and cons of these orders and when to use a stop order vs stop limit order.

What is a Stop Order?

You’ll place an order through your brokerage account when you buy a stock. The type of order that you place determines the price at which you execute your order. For example, if you place a limit order to purchase stock at $100 per share, a limit order will not execute the purchase unless the price falls to $100 or less. This is contrary to the other most common type of order, a market order, which executes at the current price the stock is trading at when market forces allow the order to fill.

Stop orders are another important type of market order that help to prevent excessive losses or to enter the market only under specific conditions. You can use a stop order to buy or sell an asset at the current market price once the asset reaches a specific price target. However, unlike a limit order, the stop order is not viewable in the stock’s order book until you reach the target price. If the stock does not reach the specified price needed to execute, the order remains in the broker’s queue or is canceled at the end of the trading day.

Stop orders can be useful in several unique scenarios:

- When you own a stock that has already risen in value, you can use a stop order to protect a portion of profit that you’ve already earned should the stock fall in price later.

- If you’re using a short-term trading strategy like scalping or day trading, you can use a stop order to protect your capital up to a percentage of loss.

- When you want to buy a stock but only after it hits a specific price target, a stop-buy order can help you open a position at a predetermined price. It can be useful if you think that a stock breaking above a certain price target will be the beginning of a bull run.

A stop-buy order varies from a limit order in how the order enters the market once the price target. The order will only execute with a limit order if the broker can fill the order at or below the limit price. On the other hand, a stop-buy order converts to a market order once price conditions have been met under most broker’s systems.

How Stop Orders Work

The specifics of how a stock stop order will work will vary depending on the type of order you’re placing. We’ll go over a few of the most common types of stop orders you’ll see and some examples of how you might use them in later sections. However, the most basic steps of setting a stop order include the following.

- Choose a stop price: Opening a stop order may mean specifying a price to trigger your stop sell or stop buy, which converts your order into a market order. You might also need to specify a limit price: the price you’ll buy or sell the stock at. You should choose stop and limit prices in line with your investment strategy and risk tolerance.

- Review the order details: Before placing the order, review when a buy or sell order will be placed in the broker’s book. Understand that stop orders often do not guarantee complete protection from loss, especially in volatile markets.

- Monitor your investment: One of the downsides of stop orders is that they may not be a completely hands-off option, depending on market conditions. As your goals change, you may need to adjust your stop and limit prices over time.

Different brokers may have slight variations on how stop orders are entered. For example, while some brokers offer the choice to set a stop-loss order that immediately converts to a limit order, most input stop-loss orders to execute as market orders.

Types of Stop Orders

What is a stop order in stocks, and how exactly are they used? Now that you understand the basic stop order definition, we can get into the multiple types of stop orders. The following are three common stop trade order options between brokerage platforms.

Stop-Loss Orders

Stop-loss orders are essential protective orders to limit loss after entering a position. These orders can limit losses by automatically selling a security when its price falls to a specified level — the stop price. Some investors who take a short-term investing strategy set a stop-loss order shortly after investing in an asset to ensure they don’t lose more than a certain percentage of their trade.

When setting a stop-loss order, start by looking at the price you’ve purchased an asset at. You’ll then set a stop-loss order below the stock's current price. If the stop-loss order is reached, it will convert to a market order and liquidate the number of shares indicated by the original order. When the stop price is reached, you’ll receive the best possible price for each share at the current market rate.

Stop-Entry Orders

While a stop-loss order can help you exit the market at a particular time, a stop-entry order can help you enter the market when a stock’s value begins moving in a particular direction. When you place a stop-entry buy order, you’ll choose a stop price above the stock's current market price. If a stock rises to the stop price, it will convert to a market order, which your broker will execute at the best possible price when the stop price is reached.

Stop-entry orders can be used if you believe that there is a particular breakout point that may signal the beginning of an upward trend. You may want to use a stop-entry order over a limit order if you believe that a price breakout will result in a sudden price increase, which might result in the broker being unable to fill the order at a particular limit price. Stop-entry orders are often used in conjunction with technical analysis.

Trailing Stop-Loss Orders

A trailing stop-loss order is a dynamic type that can help lock in profits while allowing for potential gains if the market moves in your favor. These orders adjust the stop-loss price automatically as the market price of an asset moves in a profitable direction. They’re most useful when you want to protect your gains in a trending market but still give your position room to grow.

When setting a trailing stop-loss order, you’ll start by specifying a standard stop price. However, this stop price is set as a certain percentage below the current market price in most circumstances. If an asset’s price moves in a favorable direction to you, the trailing stop price automatically adjusts to maintain a certain distance from the current market price. This distance is determined by the specified trailing amount or percentage you’ll place when you set the order.

How to Use a Stop Order in Your Investment Strategy

Stop orders protect against loss in a variety of buying situations. For example, a short-term trader may have reason to believe that a stock will rise in value, but not be willing to risk more than 5% of their total capital. After entering their position, the investor might place a stop-loss order that’s 5% below the price they entered the market at. You can keep a stop-loss order in place for up to 90 days with most brokerages, meaning that you can also use them in conjunction with a long-term trading strategy.

Example of a Stop-Loss Order

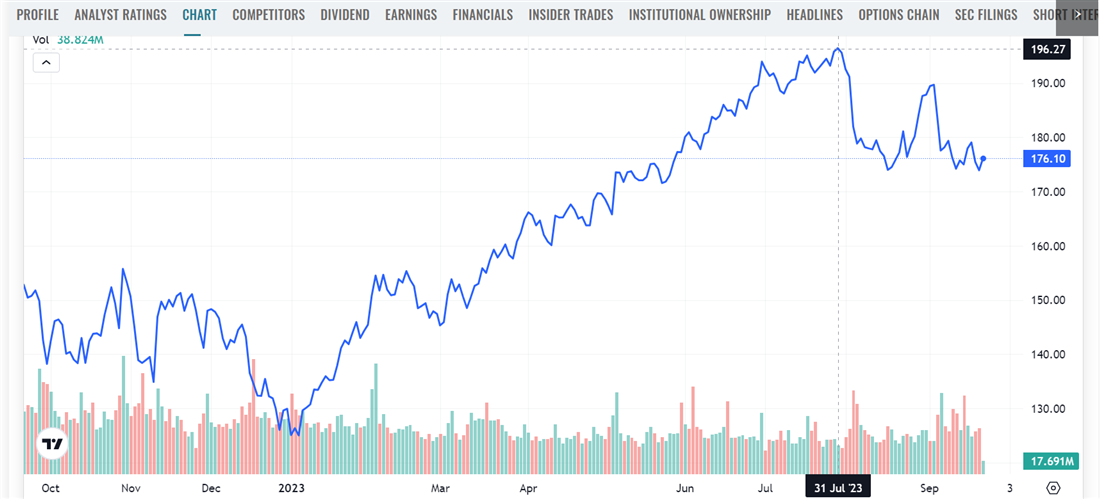

Now that you understand the basic concept of "What is a stop limit order in stocks?" we can look at more specific examples of how to use stop orders. First, imagine you're a tech investor looking to buy stock in Apple NASDAQ: AAPL. The date is July 31, 2023, and you purchase 100 shares at an average price of about $196.

As you can see, the price of Apple stock dropped shortly after the day you entered the market. Thankfully, because you set a stop-loss order to sell your shares at $186 (about 5%) less than the purchase price, the order was executed before you could realize the week’s full losses. In this example, your total capital loss would be about $980 versus the loss of about $2,200 you would see if you waited until the stock reached its low value of about $174 in mid-August.

Example of a Stop-Entry Order

To illustrate a stop-entry order, consider the price breakout that occurred with stock in Microsoft NASDAQ: MSFT in May of 2023. You may have noticed the price resistance occurred at about $313 per share.

You may have wanted to enter the market if Microsoft stock is about to break out of its resistance. To do so, you might set a stop-entry order at $314. When Microsoft stock rose out of the $314 mark, the stop-entry order would automatically convert to a market order and execute at the best possible price.

Example of a Trailing Stop-Loss Order

Finally, let’s look at an example of a trailing stop-loss order. Imagine you invested in Tesla NASDAQ: TSLA on September 22, 2023, at an average price of $255 per share.

Let’s say that you set a trailing stop order with an initial price of $225 per share and a trailing percentage of 5%. If the price of TSLA falls or remains flat, your stop-loss price will remain at $225. If the price rises, your trailing stop will be upgraded to 5% below the current share price. For example, if the price of TSLA rises to $250, your stop-loss price will also rise to $237.50 — that’s 5% below the highest price.

Pros and Cons of Stop Orders

Stop orders, including stop-loss orders and stop-entry orders, have their own advantages and disadvantages you’ll want to know before investing.

Pros

As you can see from our stop order example above, the benefits of stop orders are largely associated with managing risk.

- Avoid excessive loss: Stop orders, especially stop-loss orders, prevent you from losing excessive percentages of your trading funds. This can be essential when making multiple trades a week or a day.

- Helps avoid stress-based mistakes: Stop orders remove the element of human error from your trading, which prevents emotion-based decisions. Because these orders execute automatically, they help you avoid making impulsive orders.

- Price confirmation: Stop-entry orders and trailing stop orders allow you to confirm a price trend or breakout before entering a trade. This can improve the probability of entering trades when conditions are favorable.

Cons

Because stop orders usually execute as market orders, they may give you less control over the price you pay for your investment.

- False triggers: Market noise or sudden price fluctuations can trigger stop orders prematurely, leading to unnecessary trades or losses. For example, if the price of a stock spikes to above your stop-entry point and then suddenly falls, your order will still enter.

- May pay higher prices: Unlike limit orders, stop orders don’t specify a guaranteed price that you’ll enter the market. In fast-moving or illiquid markets, the execution price may differ significantly from the stop price.

Use Stop Orders to Your Advantage

If you’re using a short-term trading strategy, putting a stop order in place is usually a good idea. Even the best short-term trader won’t be profitable 100% of the time — a stop-loss order can be essential in cutting your losses on a bad trade early. When combined with limit orders, stop orders can be an important safeguard in your trading strategy.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.