Investors have been looking at robotics companies for several decades. But artificial intelligence (AI) is taking robotics beyond basic automation by bringing more precision, flexibility, and adaptability into the sector.

Many investors are choosing to invest in AI infrastructure via hyperscalers (e.g., Meta Platforms, Microsoft) and semiconductor stocks, notably NVIDIA. However, investing in robotics stocks may provide exposure to the next wave of AI with companies that offer unique moats with large total addressable markets (TAMs).

Even though many of these stocks may look “cheaper” relative to AI stocks, many come with different concerns for investors to consider. Nevertheless, it’s a sector that merits thoughtful consideration, and here are three robotics stocks that address distinct growth areas.

Specialized Exposure with Defensive Qualities

Intuitive Surgical Today

ISRG

Intuitive Surgical

$429.59 -14.17 (-3.19%) As of 10/10/2025 04:00 PM Eastern

- 52-Week Range

- $425.00

▼

$616.00 - P/E Ratio

- 59.91

- Price Target

- $589.43

Robotics in surgery is one of the most compelling, long-term applications for this technology. Investors know Intuitive Surgical Inc. NASDAQ: ISRG as a pioneer in this field.

The company’s da Vinci surgical system is the unquestioned leader in this sector with a user base of over 11,000 installed systems worldwide. Intuitive Surgical also benefits from a significant services business that provides annual recurring revenue (ARR) beyond the one-time purchase of a da Vinci system. This ARR is now over 80% of the company’s total revenue.

The overlay of AI into the da Vinci system provides surgeons with enhanced vision, precision, and training tools with the goals of shortening procedures and improving outcomes.

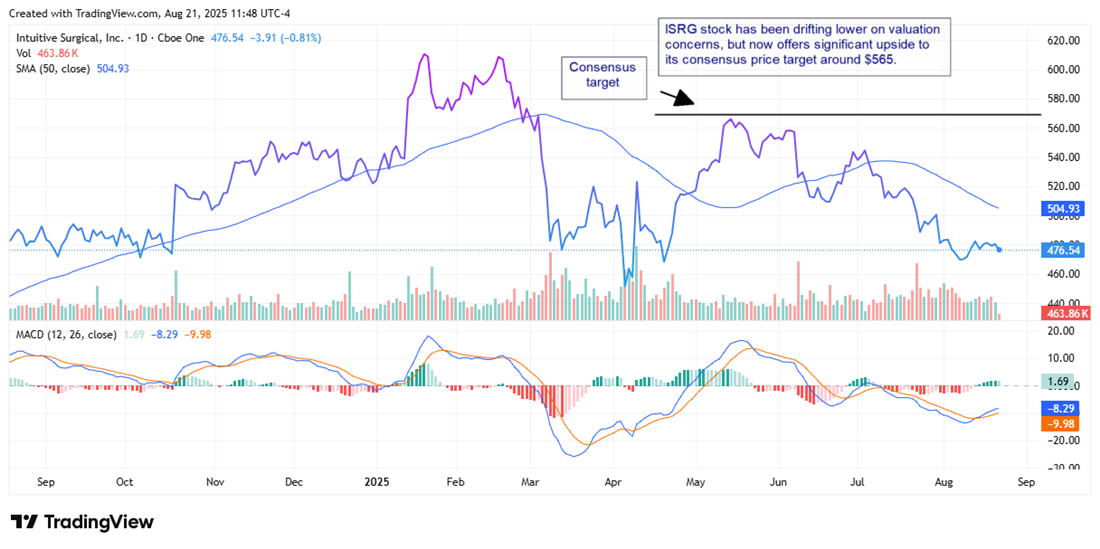

Intuitive Surgical crushed its last earnings report with strong numbers across the board. That’s not reflected in the stock price. ISRG stock is down 8.6% in 2025 and is down approximately 7% since the report. That isn’t simply due to slower international growth. The likely culprit is a stock that’s valued at around 74x forward earnings.

That’s a premium if investors consider the company part of the tech sector, and really expensive if it's classified as a medical stock. It’s also costly relative to its historical average. However, ISRG stock is now trading significantly below the consensus price target of analysts, which is at $565.95 as of this writing. That’s an upside of more than 25%.

Warehouse Robotics Powering the Supply Chain Revolution

Symbotic Today

$63.73 -3.41 (-5.08%) As of 10/10/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $16.32

▼

$71.29 - Price Target

- $44.61

Symbotic Inc. NASDAQ: SYM is another stock pick representing robotics's physical (hardware) side. The company builds autonomous systems that transform warehouses into AI-powered logistics hubs.

Walmart, an investor and key customer, gives the company a massive platform as proof of concept and to scale across the broader retail and logistics industries.

Symbotic’s fleet of robots can store, retrieve, and organize goods at a speed and accuracy unmatched by human labor, a critical advantage in today’s labor-constrained supply chain environment.

Over time, a larger installed base can provide strong recurring revenue from a business model that will resemble that of a software-as-a-service (SaaS) company.

That will require significant capital expenses, which is a key reason the company is not yet profitable. That’s one reason for the high short interest in SYM stock, which is over 29% as of this writing.

SYM stock has also had two analyst downgrades since its last earnings report, in which Symbotic beat on revenue but came in with negative earnings of 5 cents when analysts were expecting positive earnings per share (EPS) of 3 cents. However, risk-tolerant investors may be comfortable overlooking the cyclical weakness for long-term secular growth.

Bringing AI Into the Office

UiPath Today

$17.04 -1.48 (-7.97%) As of 10/10/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $9.38

▼

$18.74 - P/E Ratio

- 567.83

- Price Target

- $13.21

The opportunity in robotics covers both hardware and software. For the latter, investors can consider UiPath Inc. NYSE: PATH. UiPath is a leader in robotic process automation (RPA), which takes robotics beyond handling physical tasks.

The company’s software “bots” streamline repetitive digital processes such as processing invoices, compliance, and HR workflows. The introduction of generative AI into this software allows for adaptive, intelligent workflows (i.e, agentic AI) that move beyond rigid, rules-based automation.

UiPath does have strong customer retention with a dollar-based net retention rate (DBNRR) of 108%. However, the company faces growth headwinds in a higher interest rate environment. In this case, it’s not a cost of capital issue but a cost of acquiring new customers when budgets are under pressure. That could change if the economy picks up steam, perhaps fueled by a rate cut or two in the last few months of the year.

That acquisition cost is one of the most significant risks to investing in PATH stock. This is becoming a crowded market. However, the chart shows signs that there could be some oversold conditions in play.

Before you consider UiPath, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UiPath wasn't on the list.

While UiPath currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.