Membership warehouse club operator BJ’s Wholesale Club Holdings NYSE: BJ stock is one of the rare stocks actually trading up 3% for 2022. Rising inflation and fuels prices have driven the consumers to warehouse clubs away from traditional retailers as households tighten their budgets. BJ’s operates 227 warehouse clubs, and 159 gas stations in 17 states in the U.S. It has a nearly 8% market share in the U.S. warehouse club segment. This is smaller than the behemoth Costco NASDAQ: COST with 833 warehouses across 46 states, and Sam’s Club NYSE: WMT with 600 warehouses in 44 U.S. states. The Company saw its comparable store sales rise 14.4% as EPS rose 39% in fiscal Q1 2022 and grew its membership to 6.5 million. BJ’s now has full control over its perishable food supply chain thanks to its network acquisition from Burris Logistics. Its digital-enabled sales grew 26% in the quarter. The economic landscape is ripe for membership warehouse clubs which are benefactors in an inflationary environment. Consumers seek value while stretching their wallets in the face of a recession. Prudent investors looking for exposure in the membership warehouse club segment with a brand that has more room to grow can watch for opportunistic pullbacks in shares of BJ’s Warehouse Club.

Fiscal Q1 2022 Earnings Release

On May 19, 2022, BJ’s released its fiscal first-quarter 2022 results for the quarter ending April 2022. The Company reported an earnings-per-share (EPS) profit of $0.87 excluding non-recurring items versus consensus analyst estimates for a profit of $0.72, a $0.15 beat. Revenues grew $16.2% year-over-year (YoY) to $4.5 billion, beating consensus analyst estimates for $4.24 billion. Comparable club sales rose 14.4% YoY. Membership fee income rose 11.9% to $96.6 million. Digitally enabled sales grew 26%. Earnings per diluted share rose 20.8% to $0.87. BJ’s CEO Bob Eddy commented, “Our performance in the first quarter was strong, as gains in member traffic underscored the value we provide. Our business model remains more relevant than ever in the current inflationary environment. We also continued to build on the transformational gains we have driven over the last two years. Our membership has never been stronger. We reached 6.5 million members in the first quarter, which serves as a testament to the value that we consistently deliver to our members. Our digital business remains a key competitive advantage. We’re quickly expanding our footprint and we recently closed the acquisition of our perishable distribution network, which will support our future growth efforts and drive long-term shareholder value.”

Reaffirmed Guidance

The Company reaffirmed fiscal full-year 2023 guidance with flat YoY EPS versus $3.28 consensus analyst estimates, compared to $3.25 last year’s estimates.

Conference Call Takeaways

CEO Eddy pointed out its all-time high membership north of 6.5 million in the quarter. The Company is opening three new clubs already this year. The acquisition of a perishable distribution network from Burris Logistics will support its future growth and help stretch consumer wallets in the face of high inflation. Comparable sales grew 4%, but comparable gasoline sales grew 23% YoY and up 51% on a two-year stack basis. Membership count rose 5% YoY, and renewal enrollment grew 76% YoY, over the 72% in the year-ago period. The Company is driving towards its goal of 90% renewal rates. Higher tier membership grew 36% in the quarter. The Company will have full control over its perishable food supply chain with the acquisition of Burris Logistics. He noted that BJ’s clubs carry more SKUs than its warehouse club peers. The Company continues penetration of its private label Wellsley Farms and Berkley Jenson brands. They plan on opening 11 new warehouses this year and 10 more next year.

BJ Opportunistic Pullback Price Levels

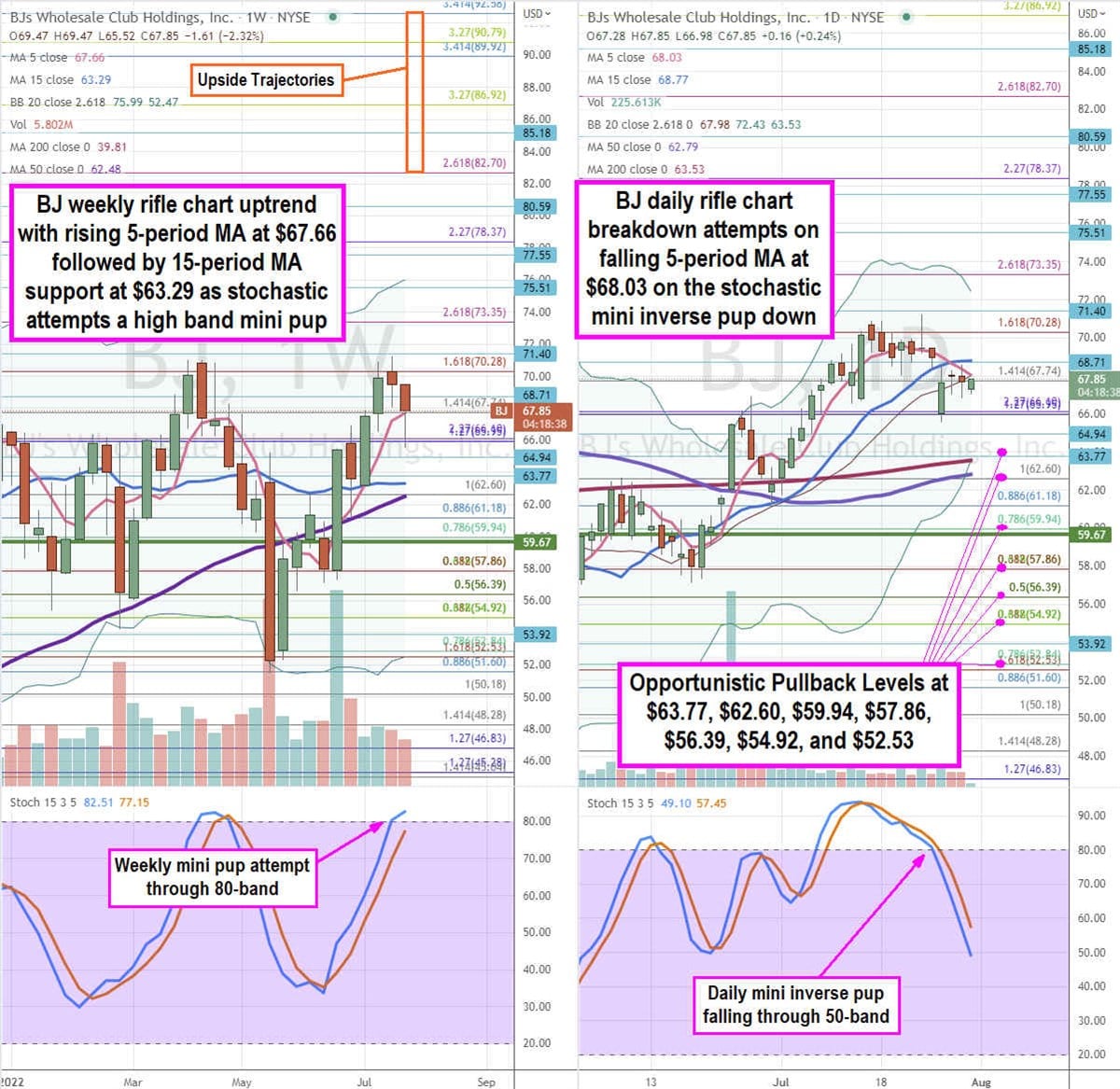

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for BJ stock. The weekly rifle chart bottom is near the $51.60 Fibonacci (fib) level. The weekly reversed back up for a breakout turning into an uptrend with a rising 5-period moving average (MA) at $67.66 followed by the 15-period MA at $63.29. The weekly 50-period MA is rising at $62.48. The weekly upper Bollinger Bands (BBs) sit at $75.99. The weekly market structure low (MSL) buy triggered a breakout above $59.67. The daily rifle chart formed a breakdown on a falling 5-period MA resistance at $68.02 followed by the 15-period MA at $68.77. The daily 200-period MA support sits at $63.53, and 50-period MA support sits at $62.79 below the daily lower BBs sit at $63.53. The daily stochastic formed a mini inverse pup slip triggered on the 80-band break as it falls through the 50-band. Prudent investors can watch for opportunistic pullback levels at the $63.77, $62.60 fib, $59.94 fib, $57.86 fib, $56.39 fib, $54.92 fib, and $52.53 fib. Upside trajectories range from the $82.70 fib up to the $92.58 fib level.

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.