Whether you are at the onset of your career, halfway through, or nearing retirement, having an individual retirement account (IRA) is a wise financial move. However, many people are confused about IRAs, and most wonder how to invest in an IRA account. While IRAs are a familiar tool, how to invest in IRA accounts and navigate their intricacies is a fairly complex set of concepts. So, let's take a few minutes to explore how to set up an IRA by guiding you through six straightforward steps to secure your future.

Overview of an individual retirement account (IRA)

What is an IRA account, and how does it work? IRAs are powerful tools for building retirement savings, offering tax advantages and various investment options. However, choosing the right one can be confusing with the different types of IRAs available. This initial overview will guide you through the key features of traditional, Roth, SEP, Gold and SIMPLE IRAs, helping you make an informed decision based on your circumstances.

Traditional IRAs

Here's a quick overview of traditional IRAs:

- Eligibility: Anyone with earned income can contribute to a traditional IRA, regardless of employer retirement plan participation.

- Tax benefits: Contributions are typically tax-deductible, lowering your current taxable income. Earnings grow tax-deferred until withdrawn in retirement, and then the earnings are taxed as ordinary income.

- Contribution limits: $7,000 annually ($8,000 if 50 or older) in 2024. Income limits phase out deductibility for higher earners.

- Benefits: Tax-advantaged growth, flexibility in investment choices, potentially lower tax bracket in retirement.

- Limitations: Required minimum distributions at age 73, early withdrawal penalties, and income restrictions for deduction.

Roth IRAs

Here's a quick overview of Roth IRAs:

- Eligibility: Anyone with earned income can contribute to a Roth IRA, regardless of employer retirement plan participation.

- Tax benefits: Contributions are made with after-tax dollars, so there's no upfront tax deduction. However, qualified withdrawals are completely tax-free in retirement (including earnings), provided the account has been open for at least five years, and you are at least 59 ½ years old.

- Contribution limits: $7,000 per year ($8,000 if 50 or older) in 2024. Income limits apply to direct contributions, but conversions from traditional IRAs may be available.

- Benefits: Tax-free growth and withdrawals in retirement, no required minimum distributions or flexibility in investment choices.

- Limitations: No upfront tax deduction, income limits for direct contributions, early withdrawal penalties (except for qualified exceptions).

SEP IRAs

Here's a quick overview of SEP IRAs:

- Eligibility: Designed for small businesses and self-employed individuals. Employers contribute directly to employees' SEP IRAs.

- Tax benefits: Employer contributions are tax-deductible for the business. Earnings grow tax-deferred until withdrawn in retirement and then taxed as ordinary income.

- Contribution limits: Up to 25% of employee's compensation or $69,000 in 2024, whichever is less. Employees cannot contribute directly.

- Benefits: High contribution limits for employers, tax-advantaged growth for employees.

- Limitations: Employers control contributions, no employee contributions allowed, early withdrawal penalties.

Gold IRAs

Gold IRAs offer:

- Eligibility: Gold IRAs are open to any individual with earned income, regardless of employment status or business size. This provides great flexibility for those seeking to chart their course toward retirement security.

- Tax benefits: Similar to traditional IRAs, contributions to a Gold IRA are tax-deductible, lowering your current taxable income. Additionally, your precious metal holdings grow tax-deferred until withdrawn in retirement, where they are taxed as ordinary income. While this may seem daunting, the potential inflation-hedging qualities of gold could offer significant long-term advantages.

- Contribution limits: While contribution limits for gold IRAs aren't as high as other retirement options, they still offer a substantial opportunity for diversification. Individuals under 50 can contribute up to $7,000 per year, and those 50 or older can contribute an additional $1,000, reaching a limit of $8,000.

- Benefits: They introduce a tangible asset historically considered a safe haven during economic uncertainty, balancing your portfolio and providing potential resilience against market downturns. Gold's price often rises with inflation, potentially protecting your retirement nest egg from the eroding effects of rising costs. For some investors, holding physical precious metals can offer security and tangible ownership, contributing to peace of mind during volatile times.

- Limitations: Unlike traditional assets held electronically, physical gold in your IRA must be stored in an IRS-approved depository. This adds logistical considerations and potential storage fees. Selling gold within your IRA can be less immediate than traditional assets, so thorough retirement planning is necessary to ensure access to funds when needed. Gold prices fluctuate, just like any other asset class. Understanding this inherent risk is crucial before investing in a Gold IRA.

SIMPLE IRAs

A Savings Incentive Match PLan for Employees (SIMPLE) IRA offers the following:

- Eligibility: Designed for small businesses (with 100 or fewer employees) to offer retirement savings plans to their employees.

- Tax benefits: Employer and employee contributions are tax-deductible. Earnings grow tax-deferred until withdrawn in retirement, taxed as ordinary income then.

- Contribution limits: Lower than SEP IRAs, $16,000 per year ($19,500 if 50 or older) in 2024 for employees; employers can match up to 3% of employee compensation.

- Benefits: Simple administration for employers, tax-advantaged growth for employees.

Limitations: Lower contribution limits compared to SEP IRAs, employers control contributions, and early withdrawal penalties.

Choosing the right IRA

The best IRA for you depends on your individual circumstances, including your income, tax bracket, employer retirement plan availability, and retirement goals. Consider these factors:

- Tax status: A traditional IRA may be advantageous if you expect to be in a lower tax bracket in retirement. A Roth IRA might be better if you prefer tax-free growth and withdrawals.

- Income level: Income limits may restrict your eligibility for direct contributions to Roth IRAs and deductibility for traditional IRAs.

- Employer retirement plan: If you already have an employer-sponsored retirement plan, consider contribution limits and investment options before opening an IRA.

- Retirement goals: Your desired retirement income and investment timeline will influence your IRA type and investment strategy choice.

How to open an IRA

Setting up an IRA is a crucial step towards a secure financial future. However, navigating the options and setting up your first account can seem daunting. This comprehensive IRA guide will walk you through the process, from defining your financial goals to managing your investments over time.

Step 1: Assess your financial goals.

The first step in learning how to open an IRA account is to take a moment to define your financial aspirations before investing in your IRA. What do you hope to achieve with your retirement savings? Short-term goals (1-5 years) might include building an emergency fund, using your IRA to pay for college or saving for a major purchase.

Long-term goals (10+ years) would likely focus on building a secure retirement nest egg or generating income in retirement. Understanding your goals will guide your IRA selection and investment strategy.

Step 2: Choose your account type.

The next step in learning how to start an IRA is to select the right IRA type, considering several factors:

Tax implications

- Traditional IRA: Offers potential tax-deductible contributions, lowering your current taxable income. However, withdrawals during retirement get taxed as ordinary income. This strategy may be advantageous if you expect a lower tax bracket upon retirement.

- Roth IRA: Allows after-tax contributions, offering no immediate tax benefit. Conversely, qualified withdrawals in retirement are completely tax-free (including earnings), potentially advantageous if you expect to be in a higher tax bracket later.

Income eligibility

- Traditional IRA: Deductibility of contributions may be phased out or eliminated based on your income level.

- Roth IRA: Direct contributions may be restricted or unavailable within certain income ranges. However, conversion options from traditional IRAs to Roth IRAs may exist depending on income qualifications.

Retirement timeline

- Traditional IRA: More suitable for longer retirement horizons as tax deferral benefits accumulate over time.

- Roth IRA: Ideal for shorter retirement horizons as tax-free growth and withdrawals can provide immediate access to funds.

Step 3: Open your IRA account.

Once you've chosen your IRA type, select a reputable financial institution. Consider:

- Fees: Compare annual, transaction and investment-specific fees to find a cost-effective provider.

- Services: Evaluate investment options, research tools and customer support offered.

- Reputation: Research the institution's track record, financial stability and customer reviews.

Opening an account is often possible online. You can visit your financial institution's website and set up your IRA without visiting your local branch. Follow the prompts, provide accurate information, and carefully review terms and conditions.

Step 4: Choose your investments.

If opting for a traditional or Roth IRA with limited choices, research and select pre-configured portfolios or funds that best align with your risk tolerance and retirement timeline. For self-directed IRAs, choose individual assets based on your investment strategy and research.

Step 5: Make contributions.

Link your bank account or use other methods to transfer funds to your chosen IRA. Remember, annual contribution limits apply in 2024:

|

Filing Status

|

MAGI Limit

|

Traditional IRA Limit

|

Roth IRA Limit

|

SEP IRA Limit

|

|

Single

|

$73,000

|

$7,000 ($8,000 if 50+)

|

$7,000 ($8,000 if 50+)

|

25% of compensation, up to $66,000

|

|

Married Filing Jointly

|

$210,000

|

$7,000 ($8,000 if 50+)

|

$7,000 ($8,000 if 50+)

|

25% of compensation, up to $66,000

|

|

Married Filing Separately

|

$105,000

|

$7,000 ($8,000 if 50+)

|

Up to $7,000 depending on income

|

25% of compensation, up to $66,000

|

Step 6: Manage your IRA over time.

Remember, your IRA is a long-term commitment. Regularly review your portfolio performance, rebalance allocations as needed, and adjust your strategy as your goals or market conditions evolve.

Building a diversified IRA portfolio

Your IRA is a powerful tool designed to help secure a comfortable and secure retirement. After you have opened your IRA, it is time to choose the assets within it. This section will explore the fundamentals of building a solid, diversified financial foundation within your IRA.

Asset allocation strategies

Asset allocation strategies are vital to managing risk and optimizing returns for your retirement goals within your IRA. These strategies involve distributing your investment capital across different asset classes. Each asset class has its unique risk profile and return potential, so it is important to understand each class before making investment decisions.

Key asset classes

- Stocks: Representing ownership shares in companies, stocks offer the potential for high long-term growth but carry greater volatility and risk of capital loss. You can choose to put dividend paying stocks into your IRA, and the dividends paid by those companies will help your IRA grow.

- Bonds: Loan instruments issued by governments and corporations offer lower risk and provide steady income through regular interest payments. However, their return potential is generally lower than stocks, and their value can be affected by changes in interest rates.

- Real estate: Investing in physical properties or real estate investment trusts (REITs) can offer inflation protection and income through rent or dividends. However, this asset class typically requires specific expertise and management considerations.

The power of diversification

The core principle of asset allocation lies in diversification. By spreading your investment across different asset classes, you can mitigate the potential impact of negative performance in any category. This "don't put all your eggs in one basket" approach helps to stabilize your portfolio and manage overall risk.

Choosing the optimal asset allocation for your IRA requires careful consideration of several factors:

- Risk tolerance: Your comfort level with potential fluctuations in portfolio value is paramount. Conservative investors may favor bonds and low-volatility stocks for stability, while more aggressive investors may allocate a more significant portion to equities for higher growth potential.

- Investment time horizon: The time until you plan to access your retirement funds significantly influences your risk tolerance and appropriate asset allocation. Longer time horizons generally allow for greater equity exposure due to the potential for higher long-term returns. At the same time, shorter timeframes may necessitate a more conservative approach to prioritize capital preservation.

- Financial goals: Defining your desired income generation or capital appreciation objectives dictates your portfolio composition. Seeking income may favor bond allocations for consistent interest payments, while prioritizing growth likely involves greater equity exposure for potential capital appreciation.

By understanding the key asset classes and the principle of diversification, you can make informed decisions about your IRA portfolio allocation and construct a strategy that aligns with your risk tolerance, time horizon and financial goals. This approach significantly contributes to building a strong foundation for your retirement security.

Investment options within an IRA

Building a diversified and successful IRA portfolio necessitates carefully evaluating available investment tools and aligning them with your unique financial circumstances. Your chosen options will significantly impact your portfolio's risk profile, potential returns, and future retirement.

Three primary categories of investment vehicles exist within an IRA:

- Mutual funds: These professionally managed baskets of diversified securities offer instant diversification across asset classes, mitigating individual security risk. While mutual funds are convenient and provide broad market exposure, mutual funds typically incur management fees that influence overall returns.

- Exchange-traded funds (ETFs): Similar to mutual funds in offering diversified exposure, ETFs trade like individual stocks on exchanges. This gives investors greater flexibility and potentially lower fees than actively managed mutual funds. However, ETF selection requires a fundamental understanding of underlying assets and risk profiles.

- Individual stocks and bonds: For experienced investors seeking tailored exposure and potentially higher returns, selecting specific securities offers a customized approach. This strategy requires in-depth research and analysis of individual companies and issuers, carrying greater risk due to concentrated exposure.

Choosing the most suitable investment options within each category hinges on several key factors. These factors include:

- Risk tolerance: Your comfort level with potential fluctuations in portfolio value is crucial. Conservative investors prioritize bonds and low-volatility stocks for stability, while aggressive investors may incorporate higher-risk equities for growth potential.

- Investment time horizon: The length of time before you plan to access your retirement funds influences your risk tolerance and appropriate asset allocation. Longer time horizons allow for greater equity exposure due to the potential for higher long-term returns compared to shorter timeframes requiring greater security and liquidity.

- Financial goals: Whether your primary objective is income generation or capital appreciation dictates your portfolio composition. Seeking income may favor bond allocations for consistent interest payments, while prioritizing growth typically involves greater equity exposure for potential capital appreciation.

By carefully evaluating available investment options and aligning your choices with these factors, you can strategically construct a well-diversified and risk-adjusted IRA portfolio that maximizes your potential for generating secure retirement income and achieving your long-term financial goals.

IRA portfolio maintenance is an ongoing process. Keep up with market trends, rebalance your allocations as needed and seek professional guidance if necessary. With careful planning and diversification, your IRA can flourish into a thriving asset, safeguarding your financial future and enabling you to retire confidently.

Maximizing tax advantages

Your IRA offers a unique haven for your taxes, providing avenues for both immediate and long-term tax advantages. Understanding these benefits and implementing strategic tax-minimization techniques can significantly enhance retirement wealth.

Planting the seeds of tax efficiency

- Traditional IRA contributions: Enjoy immediate tax savings by deducting your contributions from your taxable income for the year. This can lower your current tax burden and allow your retirement savings to grow tax-deferred, meaning you only pay taxes on withdrawals in retirement.

- Roth IRA contributions: Contribute after-tax dollars, gaining access to tax-free withdrawals in retirement. While you miss the immediate tax deduction, your contributions and earnings grow completely tax-free, potentially resulting in a larger nest egg upon retirement.

Nurturing tax efficiency

- Tax-loss harvesting: Within your IRA, strategically sell investments at a loss to offset capital gains realized elsewhere in your portfolio. This can reduce your annual taxable income, further contributing to your overall tax-advantaged growth.

- Roth IRA conversion: Consider converting funds from a traditional IRA to a Roth IRA, paying taxes upfront on converted amounts. This allows future withdrawals in retirement to be completely tax-free, potentially benefiting you if tax rates are expected to rise in the future.

The optimal tax strategy for your IRA depends on several factors:

- Current income tax bracket: If you're in a lower tax bracket than you expect in retirement, a traditional IRA may be beneficial due to immediate tax deductions.

- Retirement time horizon: For longer time horizons, the tax-free growth potential of a Roth IRA can be advantageous.

- Risk tolerance: Roth conversions involve paying taxes upfront, which may not be suitable for everyone.

By carefully evaluating your personal financial situation and considering these factors, you can make informed decisions regarding your IRA contributions and tax-harvesting strategies, fostering a tax-efficient environment for your retirement savings to flourish.

Monitoring and adjusting your IRA

Your IRA isn't a set-and-forget endeavor. Just like a carefully tended garden, it requires vigilant monitoring and adjustments to ensure it continues to thrive within the ever-changing financial landscape. Regularly reevaluating your portfolio and adapting your strategy in response to market trends, economic indicators and legislative changes is critical for maximizing its potential and securing your retirement goals.

Navigating market swings

Regular portfolio reviews unveil struggling assets and potential rebalancing opportunities. This active management empowers you to:

- Minimize risk: By identifying underperformers and replacing them with stronger options, you build resilience against market downturns.

- Seize opportunities: By spotting emerging trends and adjusting allocations accordingly, you position your IRA to capture potential growth when markets rise.

Stay in tune with economic indicators

Keeping a pulse on factors like inflation, interest rates and broader economic trends informs your asset allocation decisions. For example:

- Optimizing income: Rising interest rates might prompt increasing bond allocations to secure consistent income through regular interest payments.

- Adapting to market shifts: Understanding broader economic trends helps you anticipate market movements and adjust your strategy accordingly, navigating potential headwinds.

Embrace legislative changes

Tax laws and IRA regulations evolve, potentially impacting your contributions, withdrawals and overall strategy. Staying informed ensures you:

- Maintain tax efficiency: New regulations might present opportunities for maximizing tax benefits through strategies like Roth conversions or qualified reinvested distributions.

- Navigate compliant withdrawals: Understanding evolving withdrawal rules helps avoid penalties and ensures access to your retirement funds when needed.

By actively monitoring these three pillars, you gain invaluable insights to cultivate a dynamic and resilient IRA. Through vigilance, informed adjustments and proactive adaptation, you transform your IRA from a static savings tool into a thriving engine of financial security, propelling you toward a fulfilling retirement.

Ensuring proactive management of your IRA involves leveraging several crucial tools. Let’s explore these tools and how to use them briefly.

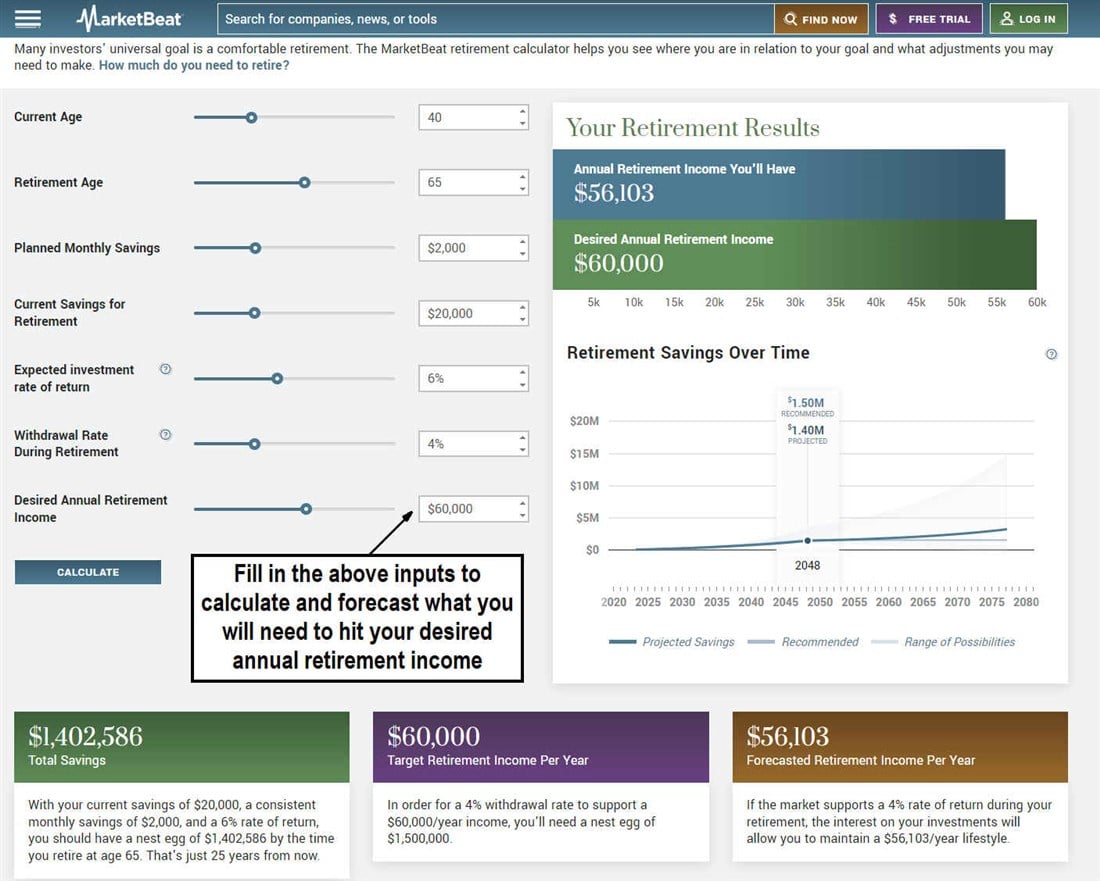

Online platforms providing real-time performance metrics, analytical tools and rebalancing capabilities empower informed decision-making. Utilize these features to monitor your portfolio's progress and make timely adjustments aligned with your financial goals. One way to double-check your math is by using MarketBeat’s Roth IRA calculator.

Financial news and analysis resources

Subscribing to reputable publications and leveraging financial analysis websites keeps you updated on market trends, economic indicators and legislative shifts. Staying informed about these factors helps make strategic investment decisions and adapt to changing market conditions.

Professional financial advisors

Engaging a qualified financial advisor becomes essential, especially during complex financial situations or significant life changes. Their expertise offers tailored advice, ensuring your IRA aligns with your evolving financial objectives and risk tolerance. Consider their insights to optimize your IRA strategy and confidently navigate potential complexities.

Strategies for dynamic adaptation

Strategies for dynamically adapting your IRA involve several key approaches:

Portfolio rebalancing

Regularly reassess and adjust your asset allocation to sustain desired percentages, effectively managing risk and ensuring alignment with your evolving financial objectives. This process mitigates potential overexposure to certain asset classes and maintains a balanced investment profile.

Tax-efficient portfolio adjustments

Employing tax-efficient strategies like tax-loss harvesting or qualified reinvested distributions helps minimize tax obligations, enhancing wealth accumulation within your IRA. These approaches optimize tax advantages while strategically managing your investment portfolio.

Reviewing contribution and withdrawal strategies

Continuously evaluate your contribution levels and withdrawal plans, factoring in life changes, market dynamics and revised retirement income necessities. Adjusting these strategies in response to shifting circumstances ensures your IRA remains responsive and aligned with your evolving financial landscape. This adaptability enables effective wealth management and long-term financial security.

By embracing a proactive approach, you can transform your IRA from a passive savings vehicle into a dynamic tool for navigating market shifts and solidifying your financial future. Remember, staying informed, adapting your strategy and seeking professional guidance when needed are crucial for cultivating a resilient and prosperous IRA that blooms into a secure and fulfilling retirement.

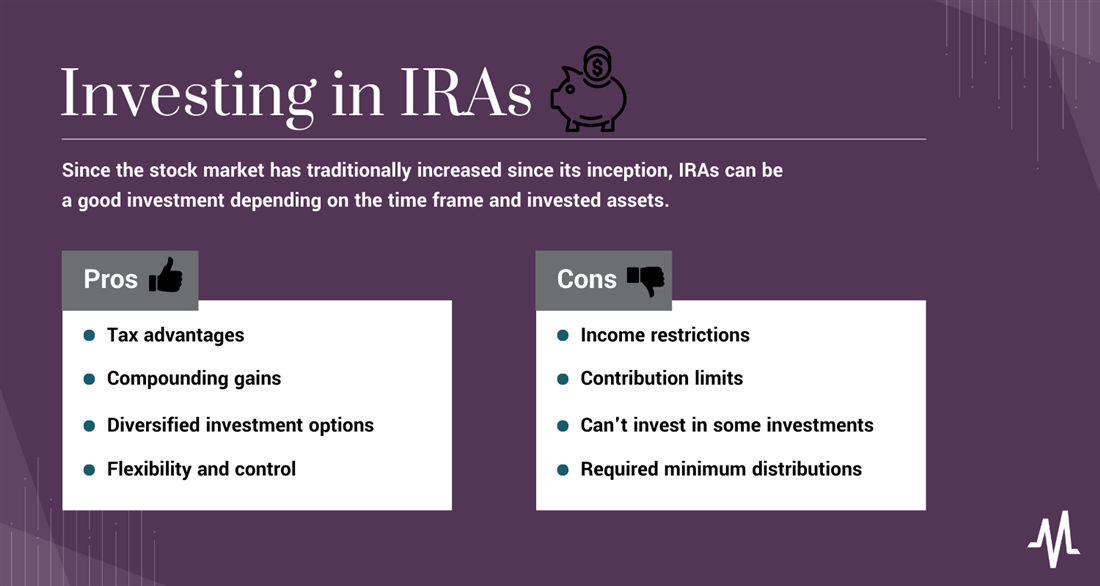

Pros and cons of investing in IRAs

IRA investing has its pros and cons. It's up to you to weigh them and decide if the pros outweigh the cons before investing in IRAs.

Pros

There are many advantages to investing in IRAs. Here are some key pros:

- Tax advantages: Traditional IRAs enable tax-deferred growth for your investments, which means you pay income taxes on withdrawals. Roth IRAs are paid with after-tax funds, so you won't be taxed capital gains on your investments.

- Compounding gains: IRAs enable you to compound your gains over time. Since capital gains are paid throughout the life of the IRA, those potential taxes would help grow your gains.

- Diversified investment options: IRAs allow you to invest in various financial asset classes. It also depends on your IRA provider, as stock brokerages tend to offer more investment options than banks.

- Flexibility and control: You are in charge of making your investment contributions and decisions. You don't have to depend on an employer to decide whether to or how much to contribute to your retirement plan or wait for it to vest.

Cons

It's not all roses, all the time. There are cons involved with investing in an IRA as well. Some cons include the following:

- Income restrictions: IRAs come with restrictions based on your income levels to determine eligibility and tax deduction limits. High-income earnings may not be able to tax deductions on traditional IRA contributions. High-wage earners may even be unable to contribute directly to a Roth IRA.

- Contribution limits: How many IRAs can you have? Having multiple IRAs doesn't matter since contribution limits apply to the cumulative total of all IRA accounts. There is an annual limit to the amount you can contribute to an IRA.

- Disallowed investments: Certain assets are not allowed in IRAs. These include life insurance, collectibles and most coins, personal real estate, derivatives, short selling or the use of margin.

- Penalties and fees: Taking unqualified withdrawals from an IRA before turning 59 1/2 years of age will result in penalties. The penalties can be costly at 10%. Fees can vary depending on the IRA provider. Starting in 2024, you can avoid the penalty if you have emergency expenses. You will be limited to one withdrawal of $1,000 per year and have up to three years to pay it back.

- Required minimum distributions: Traditional IRAs must start taking required minimum distributions starting at the age of 73. This may be different from your desired distribution plans. Roth IRAs do not have that requirement.

Common mistakes to avoid

Even the most meticulous investor can encounter pitfalls on the path to a secure retirement. While your IRA offers a powerful tool for financial growth, potential missteps can hinder your journey. This section flags some common mistakes to avoid, ensuring your IRA navigates a smooth course toward your retirement goals.

Falling prey to fee famine

Don't let excessive fees devour your returns! While professional guidance can be valuable, hefty investment vehicles or advisor fees can significantly erode your long-term wealth. Compare options and prioritize cost-effective solutions like low-expense index funds or fee-based advisors with transparent pricing models.

Chasing market mirages

Resist the siren song of market timing! Predicting short-term market gyrations is notoriously tricky, and impulsive trading decisions based on market whims can lead to missed opportunities and losses. Instead, focus on building a diversified portfolio and staying with a long-term investment strategy aligned with your risk tolerance and goals.

Ignoring your inner compass

Don't let your investments drift far from your financial north star! Regularly evaluate if your portfolio composition aligns with your goals and risk tolerance. Adjust your asset allocation accordingly if your desired retirement age or income needs change. Remember, your IRA should reflect your unique financial trajectory, not a cookie-cutter mold.

Neglecting the tax terrain

Don't let tax intricacies trip you up! Understanding the tax implications of IRA contributions, withdrawals, and investment choices is crucial. Opting for tax-advantaged options like Roth IRAs or strategically utilizing tax-loss harvesting can significantly boost your overall return. Seeking professional guidance can help you navigate complex tax rules and maximize your IRA's tax efficiency.

Forgetting to revisit and refine

Don't set your IRA on autopilot and forget it exists! Regularly review your portfolio performance, economic indicators and your evolving financial situation. Periodic rebalancing ensures your asset allocation remains aligned with your goals and risk tolerance, adjusting to market changes and life events. Staying proactive strengthens your IRA's resilience and increases your chances of a secure retirement.

By recognizing these common pitfalls and implementing prudent strategies, you can cultivate a resilient and tax-advantaged IRA that propels you toward financial freedom in your golden years. Remember, a successful IRA isn't built overnight; it requires thoughtful planning, informed choices, and consistent attention to stay on the path to a secure and fulfilling retirement.

Nurturing a prosperous retirement with IRAs

Investing in an IRA is crucial to ensuring a stable retirement, particularly in light of the uncertainty surrounding government subsidies like Social Security.

Supplementing fixed-income sources is prudent, underscoring the importance of early investment to take advantage of compounding over time. If early investment is not an option, you can still invest in IRAs even with little or no money currently saved for retirement.

Maintaining an IRA requires vigilance, adaptability to market fluctuations, and using available tools. Understanding the advantages and disadvantages, avoiding pitfalls, and implementing prudent strategies will ensure the development of a strong, tax-efficient IRA that will propel individuals toward a secure and fulfilling retirement.

FAQs

Here are answers to frequently asked questions about IRAs and how to set up an IRA.

How much money do you need to start an IRA?

IRAs technically don't have minimum investment requirements. However, some providers may have their minimums to open an IRA account. Keep in mind that many mutual funds also have required minimum investments which could range from $500 and higher. Be sure to check with the financial institution on the minimums and any additional fees associated with having an IRA account.

How do you make money with an IRA?

You make money in an IRA by selecting the suitable financial instruments and holding them until retirement. The compounding effect tends to amplify investment returns in a balanced portfolio. Be careful not to day trade or take short-term speculations in an IRA.

Can I open an IRA on my own?

IRAs must be opened with licensed providers like banks, brokers or credit unions. You can open an IRA individually with any licensed provider. You can't just create an IRA account out of thin air.

You may also wonder, “How many IRAs can you have?” The IRS sets no limits on the number of IRAs you can own.

Are IRAs a good investment?

Since the stock market has traditionally increased since its inception, IRAs can be a good investment depending on the time frame and invested assets. Picking individual stocks in an IRA can be risky, especially if the company goes out of business or has years of underperformance. Investing in benchmark indexes through mutual funds or ETFs is a suitable investment over a long-term horizon. Before you dive in, learn everything you can about how to open an IRA account.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...