The global economy is undergoing a fundamental rewiring. A powerful combination of two megatrends, the mass electrification of everything and the artificial intelligence (AI) revolution, is creating a historic surge in electricity consumption.

From electrifying the transportation and industrial manufacturing sectors to the growing power needs of data centers, the world's insatiable appetite for electricity is not a cyclical trend, but a permanent step-change in global energy demand.

This demand shock is colliding with a severely outdated electrical grid. The current infrastructure was not designed for such heavy loads or for the efficient long-distance transmission of the electricity required to power a modern, digital economy. This creates a critical bottleneck that renewables alone cannot solve.

Nuclear energy is uniquely positioned to meet this challenge. It provides immense, reliable, 24/7 carbon-free baseload power for grid stability. At the same time, new technologies like Small Modular Reactors (SMRs) enable localized generation that can be built closer to demand centers, bypassing the grid infrastructure problem entirely.

This dual capability has ignited a nuclear renaissance, creating powerful, government-backed tailwinds for a select group of companies.

Cameco: The Indispensable Uranium Supplier

Cameco Today

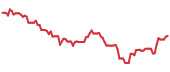

$86.91 +0.60 (+0.69%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $35.00

▼

$88.45 - Dividend Yield

- 0.14%

- P/E Ratio

- 99.90

- Price Target

- $89.55

Every nuclear reactor, old or new, needs uranium. As the base of the entire nuclear value chain, Cameco Corporation NYSE: CCJ represents a foundational investment in the fuel cycle. The stock has already responded to this dynamic, posting a one-year gain of over 94% and a five-year gain of over 700%.

Powerful global trends support the investment case for Cameco.

- A Geopolitical Safe Haven: Cameco is one of the world’s largest and most reliable Western uranium producers. The global push for energy security, reinforced by the U.S. ban on Russian uranium, makes its Canadian-based assets exceptionally valuable to utilities seeking a stable, long-term fuel supply.

- Favorable Market Dynamics: The current market is defined by a structural deficit where uranium demand exceeds supply. This creates a strong tailwind for higher prices and allows Cameco to lock in favorable terms on long-term contracts, like its recent deal with Slovakia's primary utility.

A tight global uranium market and rising demand create a favorable pricing environment. This translates directly into higher revenues and improved margins for Cameco, which is reflected in a consensus Buy rating from analysts and an average price target of $89.55.

Since the last earnings report, some analysts have rerated the stock, setting a more localized consensus price target of approximately $104. This adjustment in the consensus price since the last earnings report directly reflects the increasing demand for uranium.

BWX Technologies: The Pick-and-Shovel Powerhouse

Cameco Today

$86.91 +0.60 (+0.69%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $35.00

▼

$88.45 - Dividend Yield

- 0.14%

- P/E Ratio

- 99.90

- Price Target

- $89.55

BWX Technologies, Inc. NYSE: BWXT is the critical pick-and-shovel manufacturer providing high-tech components for the entire nuclear ecosystem. The company is well-positioned to capitalize on constructing every new reactor, a factor clearly demonstrated by its stock's 69% gain over the past year.

- Government-Backed Stability: BWX’s core business is a virtual monopoly supplying reactors for the U.S. Navy’s fleet, providing a predictable, high-margin revenue base. This stability is complemented by strong execution, as seen in its second quarter 2025 earnings report, where it posted an earnings per share (EPS) of $1.02, easily beating the consensus estimate of $0.79.

- Enabling the Next Generation: The company is a key player in developing a domestic supply chain for High-Assay Low-Enriched Uranium (HALEU), the advanced fuel essential for most SMR designs. A recent $1.5 billion contract from the National Nuclear Security Administration highlights its pivotal role.

With 94% institutional ownership, sophisticated investors view BWX Technologies as a cornerstone of the nuclear industry. Its stable government cash flow funds its expansion into high-growth areas, giving the stock a powerful combination of security and upside potential.

Constellation Energy: The Market's Nuclear Leader

Constellation Energy Today

CEG

Constellation Energy

$336.65 -10.47 (-3.02%) As of 04:00 PM Eastern

- 52-Week Range

- $161.35

▼

$357.00 - Dividend Yield

- 0.46%

- P/E Ratio

- 35.14

- Price Target

- $348.22

Constellation Energy Corporation NASDAQ: CEG is the most established, large-scale nuclear power producer. The company is already capitalizing on the immense electricity demand from the AI and data center boom. It is the most immediate and profitable beneficiary of the nuclear renaissance, with its stock gaining nearly 525% since the company’s IPO three years ago.

As the largest operator of nuclear power plants in the U.S., Constellation is the primary provider of the 24/7 carbon-free power that data centers demand. The investment thesis for Constellation Energy is proven by its results. Constellation has secured long-term Power Purchase Agreements (PPAs) with tech giants to guarantee revenue streams.

Unlike speculative plays, Constellation is highly profitable today, delivering a strong 21.61% return on equity (ROE) and beating recent earnings estimates. Its ability to command premium prices for its reliable power translates directly into robust cash flow and a rising stock price, reflecting its essential role in powering the digital economy.

NuScale Power: The Future of Localized Energy

NuScale Power Today

SMR

NuScale Power

$41.55 -3.45 (-7.67%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $10.71

▼

$53.50 - Price Target

- $36.09

NuScale Power Corporation NYSE: SMR represents a strategic investment in the disruptive Small Modular Reactor (SMR) technology, which promises to solve the grid's infrastructure problem by bringing power generation directly to the customer.

NuScale’s key advantage is a formidable competitive moat. It is the first and only company with an SMR design officially certified by the U.S. Nuclear Regulatory Commission. This rigorous, multi-year approval process creates a significant barrier to entry for competitors.

SMRs are designed to be built at a smaller scale and closer to the point of use, such as an industrial park or a data center campus.

This localized model reduces the need for costly transmission lines. Commercial momentum is building, demonstrated by recent agreements to advance SMR deployment projects in key markets. As the certified leader in a transformative new market, NuScale offers exceptional long-term growth potential.

The One-Stop Shop for Sector Exposure

Sprott Uranium Miners ETF Today

URNM

Sprott Uranium Miners ETF

$60.10 +0.11 (+0.18%) As of 04:10 PM Eastern

- 52-Week Range

- $27.60

▼

$61.11 - Dividend Yield

- 2.13%

- Assets Under Management

- $1.95 billion

For investors who are bullish on the uranium fuel cycle but wish to mitigate the risks associated with a single company, the Sprott Uranium Miners ETF NYSEARCA: URNM offers a compelling solution. URNM tracks an index of the world's leading uranium companies, giving investors a stake in a basket of the most important players.

A key feature of this ETF is its allocation to the Sprott Physical Uranium Trust, which holds physical pounds of uranium. This gives investors exposure to the miners and the price of the underlying commodity itself.

With a healthy year-to-date return of over 44% and a five-year return of over 285%, URNM's performance directly reflects the powerful fundamentals driving the entire uranium market. It stands as an efficient and strategic tool for capturing the sector-wide momentum.

The Complete Nuclear Strategy

The convergence of mass electrification and the artificial intelligence revolution creates a powerful, long-term demand for clean, reliable energy that cannot be ignored. This structural shift has made the revitalization of nuclear power a strategic necessity, creating a durable investment megatrend.

The portfolio strategy covers every critical angle of this renaissance. It begins with the essential fuel from Cameco and the high-tech components from the industrial backbone, BWX Technologies.

It then captures the immediate, profitable demand for baseload power through the industry's leading operator, Constellation Energy, while looking to the future of decentralized energy with the disruptive SMR technology from NuScale Power.

Together, these companies form a complete and synergistic approach to a generational opportunity that is just beginning to unfold.

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report