If you want to catch a glimpse of a stock as it forms a bullish chart pattern, look no further than ServiceNow Inc. NYSE: NOW. The cloud-based IT services provider appears to be forming a cup-with-handle pattern, with a buy point above $482.33.

ServiceNow is flashing any number of positive signals for would-be investors, but let’s begin with its chart.

As of April 11, the handle portion of the cup pattern was working on its fifth day. Historically, a proper handle takes at least five days to form, as that gives investors who want to nab some profits time to sell some shares, while setting the stock up for others who want to add shares at a slightly lower price.

A handle should take shape in the upper half of a base, and decline no more than about 12% from its peak. The handle shouldn’t drop below the prior structure low of the cup pattern that preceded it and should also take shape above the stock’s 10-week or 50-day moving average.

ServiceNow’s current chart pattern meets every one of those criteria.

Double-Digit Growth

The stock also boasts numerous other positive signs. Earnings and sales both grew at double-digit rates in each of the past eight quarters. MarketBeat earnings data show ServiceNow has a long history of exceeding bottom-line views, going back as far as 2018.

It also tends to beat revenue views, but missed a couple of times in 2022, as the economy slowed. Techs, as a whole, experienced some sales declines as customers tightened their belts due to inflation, higher interest rates, and uncertain economic conditions. The strong dollar also put a dent in overseas sales for many techs.

Santa Clara, California-based ServiceNow provides a wide range of IT service management and operations management solutions. It helps enterprise customers automate workflows, streamline operations, and improve the customer experience. Its modules can be customized to meet each client’s requirements.

As it aims for continued growth, the company also branched out to offer capabilities beyond IT to include human resources, finance, security, and customer service. This could help cement its role as a comprehensive platform for enterprise management, meaning managers don’t need to weld together various elements of a tech stack.

Gap-Up After Ratings Boost

ServiceNow shares gapped up 2.49% in heavier-than-average volume on April 4, as analysts at financial services firm Robert W. Baird boosted their rating on the stock, nudging it to outperform from neutral.

With a market capitalization of $95.32 billion, ServiceNow is easily big enough to be an S&P 500 component. As such, it’s also part of the S&P tech index, as tracked by the Technology Select Sector SPDR Fund NYSEARCA: XLK. It constitutes 1.31% of the tech sector.

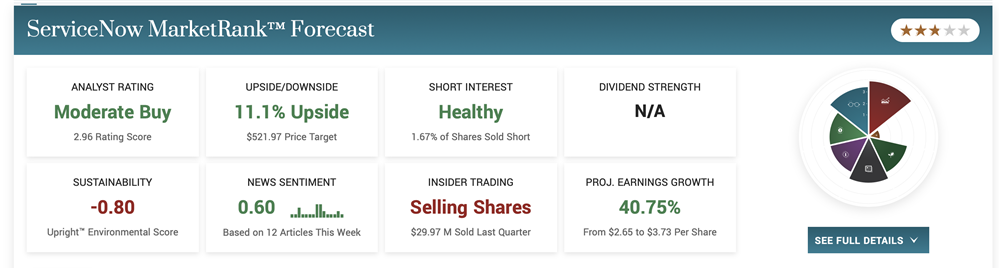

That size also means it’s widely followed by analysts. MarketBeat data for ServiceNow show that 27 analysts have a consensus rating of “moderate buy,” with a price target of $521.97. That’s an upside of 11.10%.

Cloud-computing services companies can differ widely from one another in terms of their offerings, which makes it difficult to make a direct comparison between ServiceNow and others. However, companies including Salesforce Inc. NYSE: CRM, Microsoft Corp. NASDAQ: MSFT, Oracle Corp. NYSE: ORCL, SAP SE NYSE: SAP, International Business Machines Corp. NYSE: IBM, Atlassian Corp. NASDAQ: TEAM, VMware Inc. NYSE: VMW offer certain elements that correspond to ServiceNow’s suite of services.

Great Expectations For Earnings Growth

Wall Street expects the company to earn $6.89 per share this year, which would be a decrease of 9%. Next year, analysts see a return to earnings growth, with net income of $10.78 per share, a very healthy 57% increase.

In the most recent earnings report, chief financial officer Gina Mastantuono said the company expects subscription revenues between $8.44 billion and $8.5 billion this year, representing 22.5% to 23.5% year-over-year growth.

In the first quarter, which ended on March 31, and which the company reports on April 26, the company expects subscription revenue in a range between $1.99 billion and $2 billion, which would be 25% to 25.5% year-over-year growth on a constant currency basis.

Constant currency is a method of financial reporting that removes exchange-rate exchange rate fluctuations to provide a clearer picture of a company's operational and financial results.

Technology Strategy Is Business Strategy

As she wrapped up remarks in the quarterly report, Mastantuono made a telling comment.

“As we enter 2023, the macro challenges many enterprises face underscore a point we have made consistently. The technology strategy has become the business strategy. Digital technologies are growth-stimulating deflationary force,” she said.

That could be a theme that sets the stage for tech rebounds throughout 2023, despite the continuing headwinds of inflation, geopolitical uncertainty, and high interest rates.

Watch for Service Now to clear its handle buy point. But also be aware of the upcoming earnings report, which could be a catalyst for a big price move in either direction.

Before you consider ServiceNow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ServiceNow wasn't on the list.

While ServiceNow currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report