The cryptocurrency rally has taken a backseat to new all-time highs in the major U.S. market indices, but that doesn’t mean enthusiasm for digital assets has faded. In fact, Wall Street has gone beyond its embrace of Bitcoin by welcoming other tokens into the fold, like Ethereum and Solana.

Ethereum has outperformed Bitcoin by approximately 5% year-to-date; however, the altcoin rally has been far more pronounced over the last three months.

What’s causing these secondary cryptos to rally beyond Bitcoin? We’ll answer that question today and discuss three stocks of interest that saw the Solana rally coming.

Why Solana Surged Ahead in the Cryptocurrency Markets

Solana is by no means a small fish in the crypto pond, but it's been a distant third to Bitcoin and Ethereum, which have been hogging Wall Street’s attention for most of the year. Bitcoin ETFs and treasuries are now commonplace on U.S. exchanges, and the success of companies like Strategy Inc. NASDAQ: MSTR has led others to enter the crypto treasury business.

Public companies treat Bitcoin like digital gold, and so far, investors have been more than willing to pay up for stocks with significant Bitcoin holdings.

If Bitcoin were gold in this scenario, Ethereum and Solana would be more like oil or soybeans. ETH and SOL are platforms that can be used to build ecosystems for NFTs or decentralized finance projects, but they can also earn yield.

We discussed Ethereum treasury strategies last month, and Solana strategies are being enacted similarly. Solana backers claim several advantages over the Ethereum platform, such as:

- Faster transfer speeds (up to 1000 transactions per second)

- Lower and more stable transaction fees

- Double the average yield on Ethereum

That last bullet is crucial; while Solana is more volatile than its larger brethren, the ability to earn higher yields makes it attractive to small-cap stocks looking to transition their business into crypto treasuries. And suppose you’re a small-cap in the competitive tech sector with minimal revenue growth.

In that case, you probably don’t mind a little volatility, mainly when the market narrative works in your favor. Solana has outperformed Bitcoin and Ethereum over the last month, and investors have handsomely rewarded the stocks of companies that began stacking SOL tokens in the previous quarter.

3 Small-Cap Stocks That Loaded Up on Solana

Like the Ethereum treasury companies, these three small caps began accumulating SOL tokens to bolster their underlying businesses. If you’re looking for fundamentally sound stocks with proven business models and strong revenue growth, you’re barking up the wrong stock sector tree.

These companies are speculative plays meant for trading, not long-term investments, so make sure your risk tolerance and goals are aligned before taking on new positions in them.

Forward Industries: The Largest Public Solana Treasury

Forward Industries Today

FORD

Forward Industries

$30.41 -2.37 (-7.23%) As of 09:48 AM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $3.30

▼

$46.00

Forward Industries Inc. NASDAQ: FORD has become the biggest public SOL holder, amassing more than 6.8 million tokens as of Sept. 15. The company’s primary businesses are manufacturing custom cases for high-value merchandise and customer electronics, and rallying when novice investors mistake its stock for Ford Motor Co. NYSE: F.

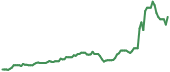

However, this pivot to Solana has been profitable for investors, and the stock has been up more than 450% year-to-date (YTD) and 160% in the last month alone.

Forward Industries earned about $30 million in total revenue in 2024, a year-over-year (YOY) decline of more than 17%. The company’s Q3 2025 revenue figure was just $2.49 million, a paltry showing compared to the $7.89 million generated in Q3 2024. The primary business has been struggling, so FORD executives have little to lose by switching to a volatile crypto treasury strategy. The stock is also down 16% in the last five days, offering a potential entry point.

DeFi Development Corp: A Natural Fintech Pivot

DeFi Development Today

DFDV

DeFi Development

$14.61 -0.73 (-4.76%) As of 09:09 AM Eastern

- 52-Week Range

- $0.49

▼

$53.88 - P/E Ratio

- 21.90

- Price Target

- $35.00

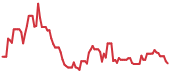

Formerly Janover Inc., DeFi Development Corp. NASDAQ: DFDV was a B2B fintech marketplace before moving into cryptocurrency. But Janover was a penny stock trading under $1 per share since June 2024, and its SOL treasury initiatives sent the stock from 57 cents to $42 in just six weeks. Yes, you read that right: 57 cents to 42 whole dollars.

DFDV shares have fallen significantly from their May highs, declining 37% over the past three months. However, the company still holds about two million SOL, and it received coverage from Cantor Fitzgerald in August, which rated it as a Strong Buy.

Upexi: Utilizing Solana to Expand Core Business

Upexi Today

$5.36 -0.80 (-13.04%) As of 09:49 AM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $1.90

▼

$22.57 - Price Target

- $15.50

Upexi Inc. NASDAQ: UPXI is ‘only’ up about 70% YTD, and has cratered more than 20% in the last month. The company’s digital consultancy business grew its annual revenue from $7.4 million in 2020 to $36.4 million by 2023. However, sales declined nearly 30% in 2024, and its latest Q1 2025 earnings release showed just $3.16 million in quarterly revenue.

The company adopted a SOL treasury strategy to boost this revenue stream and purchased just over two million tokens earlier this year.

Unlike FORD and DFDV, Upexi plans to utilize its SOL holdings as a supplementary revenue source and continue to build its primary business by helping companies market and launch new products.

Before you consider Forward Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Forward Industries wasn't on the list.

While Forward Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report