Despite inflation and the constant and ever-changing threat of an economic downturn (a few weeks ago it was bank failures, this week it’s rising gas prices), restaurant chains including Chipotle Mexican Grill Inc. NYSE: CMG, Wingstop Inc. NASDAQ: WING and Yum Brands Inc. NYSE: YUM continue to outperform. Those three stocks are nearing possible buy points.

While not immune to challenges, including labor shortages and food-price inflation, these restaurant chains are managing through the seemingly never-ending series of crises. They are continuing to grow sales and earnings.

Consumers don’t seem put off by price increases as restaurants cover higher costs or even longer waits as restaurants are working with fewer employees than in the past. In the past three months, restaurants as a group have rallied.

Believe it or not, there’s actually an entire exchange-traded fund dedicated exclusively to the restaurant industry. The AdvisorShares Restaurant ETF NYSEARCA: EATZ, was up 9.52% in the first quarter. Chipotle and Yum Brands are among top holdings, along with McDonald’s Corp. NYSE: MCD, Bloomin’ Brands Inc. NASDAQ: BLMN, Dutch Bros. Inc. NYSE: BROS, and Domino’s Pizza Inc. NYSE: DPZ.

Wingstop is also a component of the ETF, with a weighting of 4.41%.

In a February 2023 report, “2023 State Of The Restaurant Industry,” the National Restaurant Association identified several factors driving current industry conditions:

- Growth will continue: The food service industry is forecast to reach $997 billion in sales this year, driven in part by higher menu prices.

- Industry help wanted: The food service industry workforce is expected to grow by 500,000 jobs, for total industry employment of 15.5 million by the end of 2023 and surpassing pre-pandemic levels. That doesn’t exactly sound like it bodes well for restaurants already facing worker shortages.

- Rising costs: According to the report, 92% of restaurant operators say the cost of food is a significant issue.

- Growing competition: In 2023, 47% of operators expect competition to be more intense than in 2022.

- Consumers want restaurant experiences: 84% of consumers say going out to a restaurant with family and friends is a better use of their leisure time than cooking and cleaning up.

There are clearly some mixed signals in there when it comes to the forecast for the industry as a whole. However, it doesn’t appear that staffing challenges, increased competition and higher input costs are dissuading customers, at least not yet.

For Chipotle, Yum and Wingstop, which are all approaching potential buy points, the business outlook looks strong.

Chipotle’s chart shows the stock has staged two breakouts in less than a year but hasn’t been able to garner much traction. Most recently, the stock has been approaching a buy point out of a cup base, above $1,724.71.

According to MarketBeat analyst data for Chipotle, the consensus rating is “moderate buy” with a price target of $1,844.79, an upside of 7.40%. Wall Street expects the company to increase earnings by 28% this year and 22% next year.

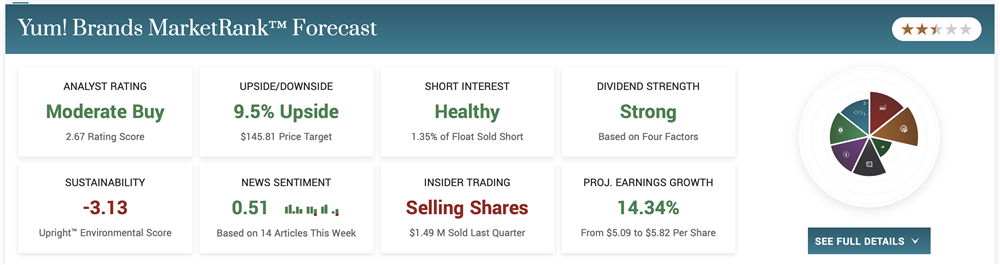

Yum Brands, whose restaurants include KFC, Pizza Hut, Taco Bell, and Habit Burger Grill, also has a “moderate buy” rating. Its price target is $145.81, an upside of 9.46%.

The stock has been trending essentially sideways lately, which is a good signal that institutional investors are holding shares ahead of the company’s next earnings report, on May 3. Analysts expect the company to earn $1.13 a share on revenue of $1.62 billion. Both would be year-over-year increases.

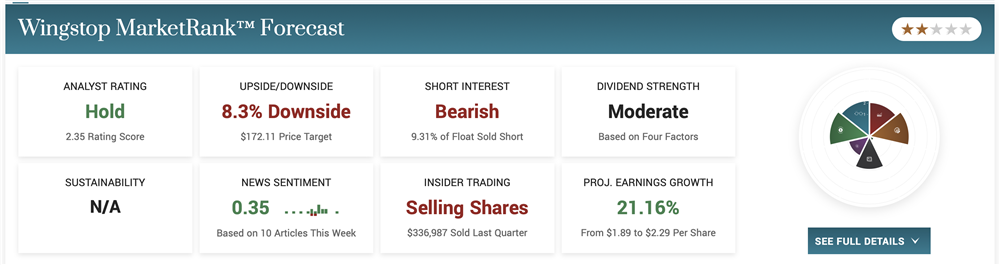

Wingstop has seen both earnings and revenue growth acceleration in recent quarters. With a market capitalization of $5.62 billion, this stock is more volatile than either Chipotle or Yum, both of which are large caps. A look at its chart shows some fairly wide intraday price swings.

The stock cleared a buy point above $168.33 on February 14. It flew 7.88% in the past month and 33.53% in the past three months. It’s currently consolidating above its 50-day moving average and could offer an additional buy point as it crosses above $189.13.

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.