Move over FAANG, there’s a new and improved basket of stocks leading the way: The ‘Magnificent Seven.’

Earlier this year, Bank of America's Michael Hartnett dubbed a group of top stocks the "Magnificent Seven". These global leading companies focus on tech trends like AI, cloud computing, online gaming, and innovative hardware and software.

Technology stocks have been the rally's primary beneficiary and driving force this year, and that trend looks set to continue next year. Artificial Intelligence has been a significant theme of 2023 and will only grow more prominent in 2024. The magnificent seven are all technology-driven AI powerhouses in their own right and positioned to benefit from the next generation of AI.

But how can an investor gain exposure to all seven stocks without buying each one individually? Well, here’s an overview of the magnificent seven stocks and one ETF which provides access to all seven stocks and further diversification:

How to gain exposure to the Magnificent Seven

The Invesco QQQ ETF NASDAQ: QQQ, up a whopping 53% year-to-date, is an excellent option for investors seeking portfolio diversification, access to the Nasdaq-100 Index, and the potential growth of prominent global tech companies.

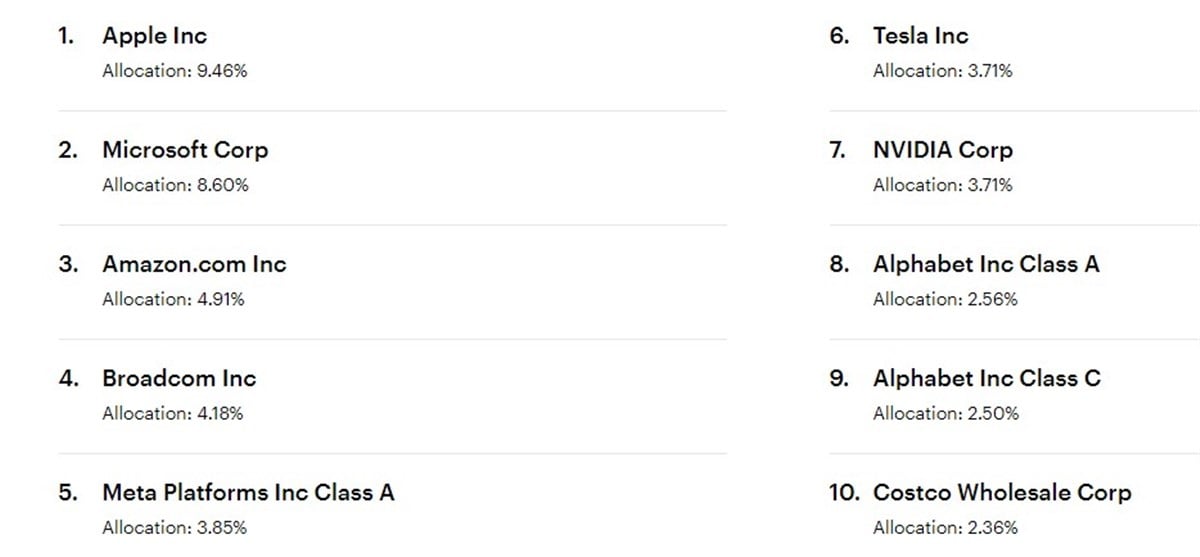

And if you’re wondering how much exposure you’ll get to the seven stocks, well, look no further than the ETF’s top holdings:

Seven of the eight top holdings in the ETF are members of the so-called Magnificent Seven. Here’s what you should know about each one:

Microsoft NASDAQ: MSFT

Microsoft, the world's largest software company, is renowned for Windows, Azure cloud services, LinkedIn, Office suite, and Xbox gaming. In 2023, its acquisition of Activision Blizzard and innovative AI developments with OpenAI garnered significant attention. Year-to-date, the software giant is up over 55% and has projected earnings growth of 14.11%.

Apple NASDAQ: AAPL

Apple, a top consumer electronics brand, thrives on iPhone sales and offers Macs, iPads, Apple Watches, and wearables. The company's services, like the App Store, iCloud, and ads, contribute significantly. Despite a dip in iPhone sales growth, robust performance in high-margin services compensates for it. Apple has a moderate buy rating, with analysts forecasting an upside of over 2%. Year-to-date, the stock is up almost 50%.

Amazon.com NASDAQ: AMZN

Amazon is a major global player in online retail, cloud services, and digital entertainment. Notably, its acquisition of Whole Foods and the introduction of Amazon Prime, offering Prime Video and expedited free shipping, mark key strategic pivots for the company. Impressively, Amazon has projected earnings growth north of 36% and is one of the most upgraded stocks by analysts.

Meta Platforms NASDAQ: META

Meta Platforms controls prominent social media and messaging networks like Facebook, WhatsApp, Messenger, and Instagram. Meta is a dominant force in online advertising, with over 3 billion daily active users across its platforms by September 2023. Shifting from a social media focus to constructing the metaverse, the company rebranded from Facebook to Meta Platforms in 2021. Year-to-date, shares of META are up a staggering 194%.

Alphabet NASDAQ: GOOGL

Alphabet, a worldwide tech firm and Google's parent company oversees YouTube, Waymo, Mandiant, and various tech subsidiaries. Its key ventures involve online and mobile search, advertising, cloud services, and app sales. Holding over 90% of the global search market, Alphabet leads in online search. Additionally, Google's Bard AI chatbot competes prominently with ChatGPT.

Tesla NASDAQ: TSLA

Tesla pioneers electric vehicles, driver assistance tech, and renewable energy goods. Dominating U.S. EV sales, it's helmed by the charismatic and contentious CEO Elon Musk, amassing a devoted following. Although its stock has surged by over 100% year-to-date, it’s currently one of the lowest-rated and most downgraded stocks.

Nvidia NASDAQ: NVDA

Nvidia specializes in top-tier graphics and mobile processors for various devices. Among the Magnificent Seven, its exceptional performance shines, boasting an impressive 235% gain year-to-date. Nvidia's processors excel in online gaming and cryptocurrency mining, yet its primary allure in 2023 lies in dominating the AI chip market. Analysts are bullish on the stock, placing a moderate buy rating and forecasting an upside of over 22%.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report