The technology sector continues to show strength, driven by accelerating AI adoption, capital inflows, and renewed investor confidence. Several stocks are emerging with bullish chart patterns and active catalysts, pointing to the potential for triple-digit gains in the near term.

Timing and triggers will be critical, with upcoming earnings, product launches, and broader sector momentum likely to determine the next phase of these moves.

Advanced Micro Devices' Stock Price Rise Is Just Getting Started

Advanced Micro Devices Today

AMD

Advanced Micro Devices

$237.40 +19.31 (+8.85%) As of 02:39 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $76.48

▼

$240.10 - P/E Ratio

- 135.99

- Price Target

- $231.00

Advanced Micro Devices' NASDAQ: AMD 30% stock price surge, sparked by its OpenAI deal, is just the beginning of a much larger movement. The agreement affirms AMD’s position in the AI ecosystem as a critical provider of AI infrastructure at scale. The deal hinges on the launch of the MI450 lineup and is likely the first in a flood of orders. The first follow-on is from Oracle, which also plans to utilize a significant number of the GPUs, and word from Amazon, Google, and Microsoft is also expected.

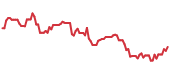

Regarding the chart, the 30% stock price increase is worth $75, which is the base-case projection. Assuming the consolidation that followed the surge continues, AMD’s stock could easily advance $75 from the critical support target, provided another catalyst emerges, which is now at $220. That puts the market at $295, on track to hit $300. Coincidentally, the robustly bullish analyst trends are pointing to a high-end target of $310, in line with the technical outlook. The catalyst for such a move could occur before the early November earnings release, but if not, the release is a likely candidate.

Analysts forecast a solid quarter, but growth will slow compared to the prior quarter. The likely outcome is that AMD will outperform the consensus 28% revenue growth, but it will be the MI450 news that drives the market. AMD’s revenue growth will accelerate when it launches and is likely to exceed 100% year-over-year growth for several quarters, beginning as early as Q4 next year.

Super Micro Computers: Market Support Swells Ahead of Earnings

Super Micro Computer Today

SMCI

Super Micro Computer

$54.01 +0.90 (+1.70%) As of 02:39 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $17.25

▼

$66.44 - P/E Ratio

- 32.51

- Price Target

- $45.36

Super Micro Computers' NASDAQ: SMCI stock price has struggled to gain traction despite the company’s emergence from financial uncertainty and a robust outlook, but signs suggest it is about to change. Although analysts remain in a wait-and-see mode, the data show that sentiment bottomed after the Q2 report, and institutions are buying at a solid pace, at a ratio of greater than $3 to $1, as seen in the stock price. The stock price action shows support is rising.

A possible catalyst for the upside is the upcoming earnings release, which will likely reflect the growing pipeline of data center deals that began with Stargate, continued with Saudi Arabia's entry into AI, and now includes AMD, which is about to become a significant AI infrastructure player. The critical resistance point is near the top of the 2025 trading range, a break of which could lead to a quick 20% upside. The next crucial resistance target is near $68, which may also be exceeded if the results are strong, as the datacenter pipeline suggests it could be.

Quantum Computing, Inc., Poised to Rocket Higher in Q4

Quantum Computing Today

QUBT

Quantum Computing

$21.30 -0.48 (-2.22%) As of 02:39 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $0.70

▼

$27.15 - Price Target

- $26.33

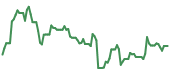

While legitimate issues have impacted Quantum Computing, Inc.’s NASDAQ: QUBT share price, the market for this stock is nonetheless bullish and on track to hit new highs. The critical detail is that hitting new highs aligns with the action in other quantum stocks, which subsequently skyrocketed. Rigetti Computing NASDAQ: RGTI, whose business is equally questionable, surged nearly 200% after crossing the comparable mark, while D-Wave Quantum NYSE: QBTS gained more than 100% and IonQ NYSE: IONQ gained approximately 60%.

Analysts and institutional support are light but bullish, and they are growing for this stock. The data tracked by MarketBeat shows only four analysts and 5% institutional ownership, but the rating is pegged at Hold, and institutions are accumulating. Analyst sentiment has improved, with increased coverage over recent months. The consensus predicts a 20% upside, reaching all-time high targets.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.