Cyclical stocks belong to industries or sectors that experience fluctuations in demand depending on the economic environment. These stocks are part of the consumer cyclical and cyclical industry categories.

Consumer cyclical stocks include companies that offer goods and services consumers tend to purchase more of when the economy is thriving, such as automobiles, luxury items and travel-related services. In contrast, cyclical industries encompass sectors like construction, manufacturing and real estate, which respond directly to economic upswings and downturns.

To answer the question of "what stocks are cyclical," you must understand that these equities thrive during economic expansions and suffer during recessions. It's important to recognize cyclical sectors and conduct cyclical market analysis so you can identify the right opportunities within these cyclical industries.

What are cyclical stocks?

What does cyclical mean? Cyclical stocks, at their core, exemplify the principle of cyclicality in the stock market. Cyclicality refers to the tendency of particular stocks or sectors to move in harmony with the broader economic cycles.

Cyclicality in the stock market reflects how changes in economic conditions impact various industries and companies. When the economy is on an upswing, cyclical stocks tend to flourish as consumers increase spending on discretionary items like automobiles, luxury goods and travel experiences. Conversely, the demand for these discretionary items wanes during economic downturns, causing cyclical stocks to decline.

Understanding cyclicality is crucial for investors to navigate the stock market effectively. It entails recognizing which sectors are inherently cyclical and conducting comprehensive cyclical market analysis. Doing so lets you make informed decisions about when to invest in cyclical stocks to capitalize on economic growth and when to exercise caution during economic contractions.

Understanding cyclicality

Cyclicality in the context of the stock market is the phenomenon where certain stocks or sectors exhibit a strong correlation with the overall economic cycle. It refers to how the performance of these stocks tends to mirror the broader patterns of economic expansion, peak, recession and recovery.

Different industries and companies are affected differently by changes in economic conditions. Cyclical stocks are typically associated with automobiles, luxury goods, travel and construction. Consumers are more inclined to spend on these discretionary items when the economy thrives, driving up the demand for related stocks. Conversely, during economic downturns, people cut back on such expenditures, leading to declines in the value of cyclical stocks.

Cyclicality is a fundamental concept for investors, influencing investment strategies and decisions. A solid understanding of cyclicality enables investors to identify which sectors are inherently cyclical, conduct practical cyclical market analysis and make informed choices about when to invest in cyclical stocks.

Cyclical stock performance ties into the broader economic landscape, and various factors play pivotal roles in determining their success. Understanding these factors is crucial for investors navigating the complexities of cyclical stocks. Here is a comprehensive list of factors and their influence on cyclical stock performance.

Economic growth

Cyclical stocks thrive during periods of economic expansion when consumers and businesses have more disposable income, leading to increased demand for cyclical companies' products and services. Conversely, during economic downturns, reduced spending leads to underperformance.

Interest rates

Cyclical stocks are susceptible to interest rates. When rates rise, borrowing costs increase, impacting companies with high debt loads and potentially decreasing profits and stock prices.

Inflation

Inflation can erode the value of corporate earnings as companies face higher costs for labor and materials and can result in lower stock prices for cyclical stocks closely tied to economic growth.

Consumer spending

Strong consumer spending drives demand for cyclical sectors like travel, entertainment and luxury goods, positively affecting their revenue and stock prices. Conversely, weak consumer spending can lead to underperformance.

Business investment

Robust business investment plays a pivotal role in stimulating demand for the products and services offered by cyclical companies. When businesses are optimistic about economic prospects and anticipate growth, they often channel resources into capital expenditures, which can involve machinery, equipment, infrastructure and technology investments, frequently sourced from cyclical companies.

For instance, during economic expansions, construction firms may increase their investments in heavy machinery and building materials, benefiting companies like Caterpillar Inc. NYSE: CAT and manufacturers of construction-related products. Similarly, as businesses expand their operations, they often require additional transportation and logistical services, thereby bolstering industries like airlines and logistics providers. This surge in demand translates into heightened revenues and profits for cyclical firms, a trend that typically resonates positively with investors. Consequently, as these companies enjoy improved financial performance, their stock prices tend to respond favorably, making them attractive options for investors seeking growth opportunities within cyclical sectors.

Industry-specific factors

Industry-specific variables influence different sectors within cyclical stocks. For instance, consumer discretionary sector performance can be affected by consumer confidence, wage growth and credit availability. In contrast, the industrial sector is influenced by manufacturing activity, capital spending and global economic growth.

Commodity prices

Commodity-dependent cyclical stocks, such as mining companies, perform well when commodity prices are high, as it directly impacts their profitability.

Currency fluctuations

Changes in currency exchange rates can have varying effects on cyclical stocks, benefiting exporters when the domestic currency is weaker and hurting importers when it strengthens.

Seasonal factors

Certain cyclical stocks exhibit seasonal patterns, with retailers being a prime example of this phenomenon. During the holiday season, these retailers typically experience a surge in performance thanks to heightened consumer spending.

The period leading up to Christmas and Thanksgiving shows a significant uptick in consumer purchases, including gifts, decorations, and festive items. This increase in consumer demand can lead to substantial revenue and profit gains for retailers, making it a critical time of year for their financial success. To capitalize on these seasonal variations, retailers often engage in strategic marketing, extend store hours and offer special promotions to attract holiday shoppers.

Technological advancements

Technological innovations can disrupt traditional cyclical businesses, reshaping their landscape and performance dynamics. A compelling example of this disruption is the rise of e-commerce, which has posed significant challenges to brick-and-mortar retailers. As consumers increasingly embrace online shopping platforms, the demand for physical retail spaces has diminished.

This shift in consumer behavior has forced traditional retailers to adapt or face the risk of obsolescence. Many have responded by investing in their online presence, enhancing digital shopping experiences and rethinking their supply chain strategies to thrive in the face of disruption.

Examples of cyclical industries

Certain industries exhibit a pronounced sensitivity to the ebb and flow of economic cycles. These cyclical industries experience periods of prosperity during economic upswings and navigate through downturns when economic tides recede. Let’s take a few minutes to review a list of cyclical industries, shed light on why they are cyclical and provide detailed insights into what a typical economic cycle looks like for each.

Aerospace and defense

Within the industrial sector, aerospace and defense companies see shifts in demand for aircraft and military equipment based on economic conditions and government spending. Defense budgets, geopolitical events and technological advancements affect this industry's cyclical nature.

Apparel

The fashion industry experiences cyclical fluctuations in demand as consumer spending patterns change with economic conditions. Luxury apparel is highly sensitive to economic cycles. Consumers tend to be more frugal with discretionary spending during economic downturns, impacting sales.

Automobiles

The automotive industry, often referred to as a bellwether of economic health, rides the waves of consumer sentiment. Consumers are more inclined to purchase new vehicles during economic expansions, while during recessions, they tend to postpone such significant purchases. Factors like consumer confidence and employment rates significantly influence this industry's performance.

Banks and financial services

Economic cycles, interest rates and market conditions profoundly influence financial institutions, including banks and investment firms. Interest rate policies, credit demand and regulatory changes are crucial in shaping this sector's performance.

Building materials

Manufacturers of construction-related materials, such as cement and lumber, are cyclical due to their reliance on construction activity. Housing market trends, infrastructure projects and raw material costs drive demand in this sector.

Capital goods

Industries involved in producing machinery, equipment and infrastructure-related goods experience varying demands tied to economic expansion or contraction. Capital investment decisions by businesses, influenced by interest rates and economic growth projections, drive the performance of this sector.

Chemicals

Chemical manufacturers are affected by economic cycles, with changes in demand for their products influenced by factors like construction and manufacturing activities. Commodity prices, global trade and regulatory changes also impact this industry's cyclicality.

Construction

Economic cycles profoundly influence the construction industry, as it depends on investments in real estate, infrastructure and commercial projects. Housing market trends, government infrastructure spending and business investment cycles directly affect this industry's performance.

Electrical equipment

Companies manufacturing electrical equipment and components for various sectors see fluctuations in demand based on economic conditions. Technological advancements, energy sector performance and infrastructure development projects influence this industry's cyclicality.

Forestry and paper

This sector, closely linked to the construction and packaging industries, experiences demand variations aligned with economic cycles. Housing construction, e-commerce trends and environmental regulations affect this industry's cyclicality.

Furniture

The furniture industry sees variations in sales as consumers defer non-essential purchases during economic downturns and invest in home furnishings when the economy is robust. Housing market trends and consumer sentiment are pivotal in driving this industry's cyclical nature.

Home appliances

Companies producing home appliances, such as refrigerators and washing machines, witness shifts in demand corresponding to economic cycles, with more robust sales during economic upswings. Home appliance sales also tie into homeownership rates, and consumer confidence influences appliance purchases.

Hotels and restaurants

The hospitality sector, including hotel stocks and restaurant stocks, thrives when consumers have discretionary income for travel and dining out. Conversely, during economic downturns, people tend to cut back on such expenses, affecting hotel bookings and restaurant visits. Tourism trends and corporate travel also contribute to this industry's cyclical nature.

Leisure and recreation

Industries related to leisure activities, including theme parks, cruise lines and recreational services, often experience surges in business during economic booms and contractions during economic busts. Consumer sentiment and vacation preferences significantly impact this sector's performance.

Luxury goods

Luxury brands, encompassing high-end fashion, accessories and products, are highly cyclical due to their dependence on affluent consumer spending, which fluctuates with economic cycles. This industry is susceptible to global economic conditions and luxury consumer behavior.

This sector encompasses advertising, broadcasting and entertainment companies, which experience shifts in advertising spending and consumer entertainment choices with economic cycles. Advertisers' budgets, media consumption patterns and technological disruptions influence this industry's cyclicality.

This sector, including all mining and metal production types, experiences shifts in demand and pricing due to economic cycles. These cycles affect the profitability of the sector. Commodity prices, global trade and infrastructure development significantly impact this industry's performance.

Oil and gas

Energy sectors, including oil and gas exploration and production, are highly cyclical, influenced by energy prices and global economic conditions. Oil prices, geopolitical events and energy consumption patterns impact this industry's performance.

Petrochemicals

Companies producing petrochemical products, including plastics and chemicals, witness demand fluctuations tied to the broader economy. Petrochemical prices, feedstock availability and global supply chains significantly shape this sector's cyclicality.

Plastics and rubber

Plastic and rubber manufacturing industries are susceptible to changes in consumer and industrial demand related to economic conditions. Product innovation, environmental regulations and consumer preferences contribute to this industry's cyclicality.

Railroads

Transportation industries, such as railroads, are sensitive to economic conditions, as they rely on the movement of goods and commodities. Trade volumes, energy prices and government infrastructure projects play a crucial role in shaping this sector's cyclicality.

Real estate

Real estate, including property development, investment and management, is closely tied to economic conditions, impacting property values and demand. Housing market trends, interest rates and urbanization patterns significantly affect this industry's performance.

Shipping

Global trade trends and economic fluctuations directly impact the shipping industry, including container shipping and logistics. Shipping rates, trade policies and consumer demand for imported goods influence this industry's performance.

Travel and tourism

The travel industry, including airlines, hotels and tour operators, follows economic cycles closely. In prosperous times, people travel more, while economic downturns lead to reduced travel. Factors such as oil prices, airline competition and global geopolitical stability play a vital role in this industry's performance.

A typical economic cycle for cyclical industries begins with an economic expansion marked by increased consumer spending and business investments. This phase benefits cyclical sectors, leading to higher revenue and profits.

However, as the economy peaks, signs of a slowdown emerge. Consumer and business spending may taper off, affecting cyclical sectors' demand for products and services. This slowdown eventually transitions into an economic downturn or recession, characterized by reduced consumer confidence and spending.

During recessions, cyclical industries often face challenges, with declining demand impacting their revenue and profitability. These downturns can be prolonged or relatively short-lived depending on various economic factors. Investors in cyclical industries must navigate these cycles, understanding that timing and industry-specific factors play pivotal roles in investment success.

Examples of well-known cyclical stocks

Cyclical stocks exhibit a unique sensitivity to economic cycles, mirroring the broader financial landscape. Let’s look at a selection of renowned cyclical stocks, providing insights into the distinctive trajectory of each within a typical economic cycle. We will review the dynamics that classify these stocks as cyclical and explore their performance nuances.

Ford Motor Company NYSE: F

Ford Motor Company NYSE: F, a prominent American automaker, exemplifies cyclical stock behavior. During periods of economic expansion, consumers are more inclined to purchase new cars when they have greater disposable income. This heightened demand for automobiles boosts Ford's sales and profitability, increasing its stock price.

Conversely, during economic downturns, car sales tend to decline as consumers become more cautious about major purchases, adversely affecting Ford's performance. Ford's cyclical nature depends on economic conditions that influence consumer buying decisions in the automotive sector.

Researching Ford Motor Company’s chart data reveals that during the Great Recession of 2008-2009, Ford faced a substantial downturn influenced by several cyclical factors.

Reduced consumer demand for vehicles was a significant contributor, driven by factors such as widespread job losses, declining home values and stricter credit conditions that dissuaded individuals from purchasing new vehicles.

Foreign automakers like Toyota and Honda posed intensified competition in the United States, capitalizing on their reputation for quality and fuel efficiency. Lastly, the rising costs of raw materials, including steel and aluminum, placed immense pressure on Ford's profit margins. Consequently, Ford's sales plummeted from 2.6 million vehicles in 2006 to 1.4 million in 2009, with a substantial drop in profits from $5.3 billion in 2006 to a loss of $14.6 billion in 2009.

Caterpillar Inc. NYSE: CAT

Caterpillar Inc. NYSE: CAT, a renowned construction and mining equipment manufacturer, operates within the cyclical sphere. Its fortunes are tied closely to economic growth cycles. During periods of economic expansion, when construction projects and infrastructure development flourish, Caterpillar experiences increased demand for its heavy machinery and equipment.

Consequently, the company witnesses higher revenues and profits, positively impacting its stock performance. Conversely, during economic downturns, reduced construction and infrastructure spending lead to a decline in demand for Caterpillar's products, which can result in a dip in its stock price. Caterpillar's cyclical nature is primarily rooted in its reliance on the broader economic climate, which influences capital investments in construction and infrastructure projects.

Reviewing Caterpillar's stock price performance during the COVID-19 pandemic provides a clear example of its sensitivity to cyclical events. In 2019, the company reported sales of $53.8 billion and a net income of $5.8 billion, with a stock price of $145.40 per share. However, the pandemic caused a significant downturn in 2020, with sales dropping to $41.7 billion and net income declining to $1 billion. The stock price also decreased to $111.50 per share.

Fortunately, in 2021, Caterpillar's performance rebounded alongside the global economic recovery. Sales surged to $55.6 billion, and net income improved to $4.7 billion, while the stock price reached $213.20 per share.

Delta Air Lines Inc. NYSE: DAL

Delta Air Lines Inc. NYSE: DAL, a major player in the airline industry, is a great example of a cyclical stock. Its performance closely follows economic cycles.

During economic expansions, when consumers are more willing to spend and travel, airlines experience higher demand for air travel services. This translates into increased revenue for Delta and a boost in its stock price. Conversely, during economic contractions, reduced consumer spending and travel caution lead to a decline in demand for air travel, negatively impacting Delta's performance. Delta Air Lines' cyclical nature depends on consumer spending patterns and consumers' willingness to engage in air travel, influenced by the state of the economy.

The 9/11 terrorist attacks in 2001 serve as a poignant example of how cyclical events can profoundly impact Delta Air Lines' performance. These tragic events triggered an economic downturn, substantially reducing consumer spending on travel. Consequently, Delta Air Lines experienced a sharp decline in demand for air travel services, leading to a significant downturn in its financials.

Looking at Delta Air Lines’ earnings data during 2001, the airline giant saw its revenue plummet by 20%, accompanied by a staggering net income loss of $1.3 billion. Simultaneously, Delta Air Lines' stock price dropped substantially, falling by more than 70%.

How to identify cyclical stocks

Identifying a cyclical stock entails recognizing the underlying principles that govern its performance concerning economic cycles. Cyclical stocks are those whose fortunes rise and fall in tandem with the economy's overall health.

Cyclical stocks link to industries heavily influenced by economic conditions, such as manufacturing, construction or consumer discretionary sectors. Understanding the sector's reliance on economic trends is crucial.

Consider the economic indicators that shape cyclical stock performance. These indicators encompass GDP growth rates, inflation and interest rates. Cyclical stocks thrive during economic expansions as increased consumer and business spending bolsters their revenue. Conversely, during economic downturns, these stocks often struggle as spending declines.

Thirdly, analyze historical patterns. Cyclical stocks exhibit recurrent cycles of growth and decline that correspond with economic cycles. Examining past performance can identify these cyclical patterns, recognizing when a stock flourishes and falters.

Additionally, scrutinize the industry’s dynamics. Certain sectors, such as automotive or housing, are inherently cyclical due to their sensitivity to economic conditions. If a company operates within one of these sectors, it is more likely to be influenced by cyclical forces.

Financial metrics also play a role. Monitor metrics like revenue and earnings growth, as cyclical stocks often experience substantial fluctuations in these areas. They typically exhibit robust growth during economic upswings and contractions during downturns. The beta coefficient is a valuable tool to monitor the stock's health. A beta exceeding 1 indicates the stock is more volatile than the broader market, indicating a higher degree of cyclicality.

Lastly, consider management's perspective. Insights from annual reports or investor presentations can provide information on a company's exposure to economic cycles and its strategies to manage them.

The hunt for cyclical stocks revolves around understanding the symbiotic relationship between these stocks and economic cycles. You can effectively identify and navigate the cyclical stock market by grasping the fundamental principles governing their performance.

Stocks recently bought or sold

In the ever-changing landscape of the stock market, certain stocks have recently experienced significant buying or selling activity driven by their cyclical nature. These movements reflect the market's response to various economic factors and business conditions.

Here, we present a detailed list of stocks that have been either heavily bought or sold in recent times due to their cyclical attributes, along with explanations for each stock's performance.

Stocks recently bought

- Energy stocks like Chevron NYSE: CVX and ExxonMobil NYSE: XOM have witnessed substantial buying activity. This surge depends on rising oil and gas prices, essential commodities used across multiple industries. Historically, these prices tend to increase during economic expansions, driving interest in energy companies.

- Materials sector stocks such as Alcoa NYSE: AA and Freeport-McMoRan NYSE: FCX have experienced increased buying due to the growing demand for metals, crucial components in construction, manufacturing and transportation. Economic expansions often trigger demand as businesses invest in new projects and infrastructure.

- Industrial stocks represented by Caterpillar NYSE: CAT and Boeing NYSE: BA have been bought due to heightened demand for heavy machinery and equipment. Industries like construction, mining and manufacturing rely on these machines, making them more sought-after during economic expansions when businesses invest in new projects and expand operations.

Stocks recently sold

- Consumer discretionary stocks Peloton NASDAQ: PTON and Netflix NASDAQ: NFLX, have faced significant selling pressure. Concerns about a potential economic slowdown have led to these actions. When economic conditions weaken, consumer discretionary spending is often among the first areas consumers cut back on.

- Technology stocks, including Meta Platforms NASDAQ: META and Shopify NYSE: SHOP, have seen substantial selling activity. This is primarily attributed to the impact of rising interest rates. Higher interest rates can increase borrowing costs for companies, potentially affecting their earnings growth. Additionally, rising interest rates make the future earnings of technology companies less attractive to investors, as they can earn higher returns from bonds.

These recent trends offer invaluable insights into market dynamics influenced by cyclical factors. Investors should recognize the intricate relationship between economic cycles and stock performance while making informed investment decisions.

Categories of cyclical stocks

Cyclical stocks are a subset of equities closely tethered to the overall economic climate. These stocks tend to prosper during economic expansions but can face challenges during periods of recession.

Categorically, cyclical stocks are often grouped into distinct sectors, each with its unique response to economic fluctuations. Let’s take a look at these categories of cyclical stocks, shedding light on their nuanced reactions to economic conditions.

Consumer cyclicals

Consumer cyclicals encompass companies offering discretionary goods and services like automobiles, furniture, travel and entertainment. During economic upswings, consumers tend to spend more on these non-essential items when disposable income increases. Conversely, during economic downturns, individuals often curtail such expenditures.

Industrial cyclicals

Industrial cyclicals represent businesses engaged in manufacturing and selling capital goods such as machinery, equipment and construction materials. Their fortunes tie into corporate investments, which surge during economic expansions and dwindle during recessions.

Financial cyclicals

Financial cyclicals encompass banks, financial institutions and insurance companies. These entities thrive in growing economies, witnessing heightened demand for their services. However, they can be adversely affected during economic contractions as loan defaults and insurance claims tend to rise.

Materials cyclicals

Materials cyclicals consist of companies involved in producing and selling raw materials, including metals, chemicals and energy resources. Their performance hinges on demand from other industries, typically expanding during economic growth and contracting during downturns.

Technology cyclicals

Technology cyclicals encompass businesses specializing in technology products and services, such as semiconductors, computer hardware and software. They typically flourish during economic expansions when companies invest in technological advancements. Conversely, they may face challenges in recessions as businesses trim IT expenditures.

Understanding the categorization of cyclical stocks is a cornerstone if you want to navigate the dynamic world of equity trading. The ability to classify these stocks, anticipate their reactions to economic cycles and strategically incorporate them into a diversified portfolio empowers investors to adapt to ever-changing market conditions effectively.

Remember that not all companies within a specific cyclical category react to economic cycles similarly, and careful consideration of the individual risks and rewards is essential before investing in cyclical stocks.

Pros and cons of investing in cyclical stocks

Investing in the stock market is a dynamic endeavor, and one approach that investors often consider is allocating a portion of their portfolio to cyclical stocks. While there are potential advantages, it's essential also to be aware of the downsides associated with such investments.

Pros

The benefits include:

- Potential for high returns: One of the primary attractions of cyclical stocks is their potential for delivering impressive returns. During economic expansions, these stocks thrive as consumer and business demand surges, resulting in substantial capital appreciation.

- Diversification benefits: Incorporating cyclical stocks into your investment portfolio can contribute to diversification. These stocks often exhibit low correlation with non-cyclical assets, offering a way to spread risk effectively across various sectors.

- Dividend income: Some cyclical companies have a history of distributing dividends, making them appealing to income-focused investors. When companies typically generate robust profits during economic upswings, these dividends can provide a steady income stream.

- Cyclical recovery potential: When the economy emerges from a recession, cyclical stocks are known for their potential to rebound vigorously. As economic conditions improve, the demand for their products and services can skyrocket, leading to a strong stock price recovery.

- Timing opportunities: Cyclical stocks present opportunities for astute timing. Investors who can accurately anticipate economic cycles may strategically buy and sell these stocks, potentially maximizing returns.

Cons

The downsides include:

- Risk of economic downturns: Perhaps the most significant drawback of cyclical stocks is their vulnerability during economic downturns. Reduced consumer spending, decreased business investments and economic contractions can lead to substantial declines in stock prices.

- Volatility: Cyclical stocks are notorious for their price volatility. Their performance can be turbulent, characterized by rapid and unpredictable price fluctuations. This volatility can be unsettling, particularly for risk-averse investors.

- Industry-specific challenges: Different cyclical industries face unique challenges. For example, the airline industry may contend with fluctuating fuel prices and global events like pandemics, while construction-related companies may grapple with material cost fluctuations.

- Timing challenges: Successfully investing in cyclical stocks hinges on the precise timing of economic cycles. Mistimed investments can result in missed opportunities, suboptimal returns, or losses.

- Earnings sensitivity: Cyclical stocks are heavily influenced by earnings trends. Any factors affecting a company's earnings, such as rising costs or competitive pressures, can directly impact stock performance.

Investing in cyclical stocks should come with a deep understanding of both their potential rewards and inherent risks. As an investor, carefully assess your risk tolerance, stay attuned to economic conditions and align your investment choices with your financial objectives.

How to manage risk of cyclical stocks

Investing in cyclical stocks offers opportunities for significant gains but has inherent risks. These stocks closely follow economic cycles, which can lead to volatile market performance. To manage these risks effectively, employ various strategies and tactics. Let’s explore strategies and real-world examples of managing the risks associated with cyclical stocks.

Diversification

Diversifying your portfolio is a fundamental strategy to reduce risk. Consider allocating your investments across different sectors, including cyclical and non-cyclical stocks. Doing so can minimize the impact of economic downturns on your overall portfolio.

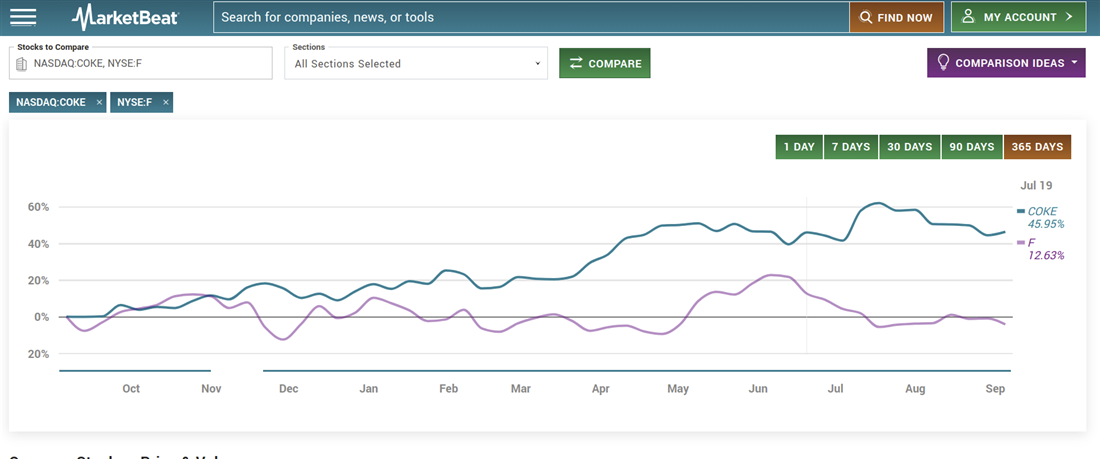

Example: An investor holds shares in Ford Motor Company NYSE: F (cyclical) and The Coca-Cola Company NASDAQ: COKE (non-cyclical). When the automotive sector faces challenges during an economic downturn, the stability of Coca-Cola's non-cyclical business helps offset potential losses. YOu can use MarketBeat’s stock comparison tool to look at the two stocks.

Research and analysis

Conduct thorough research and analysis before investing in cyclical stocks. Examine a company's financial health, historical performance during economic cycles and industry-specific trends. This diligence informs your investment decisions and reduces the risk of making ill-informed choices.

Example: Before investing in Caterpillar Inc. NYSE: CAT (a cyclical stock in the industrial sector), you should analyze the Caterpillar Inc.’s balance sheet, past performance during economic downturns and the demand outlook for heavy machinery. This research guides their decision to invest or wait for more favorable conditions.

Monitor economic indicators

Keep a close eye on economic indicators that can signal changes in the business cycle. Factors such as GDP growth rates, unemployment figures and consumer sentiment can provide valuable insights. Adjust your portfolio allocation based on these indicators to protect your investments.

Example: An investor observes declining GDP growth rates, rising unemployment and diminishing consumer confidence. These indicators signal a potential economic downturn. To manage risk, they reduce their exposure to cyclical stocks and increase investments in defensive sectors like healthcare and utilities.

Timing strategies

Implement timing strategies by adjusting your portfolio allocation based on the stage of the economic cycle. Overweight your portfolio with cyclical stocks during economic expansions and gradually shift towards defensive stocks as signs of a slowdown emerge.

Example: During an economic upswing, an investor increases their holdings in Home Depot Inc. NYSE: HD (a cyclical stock in the home improvement sector) to capitalize on increased construction activity. As economic indicators suggest a downturn, they rebalance their portfolio towards utility stocks, such as Duke Energy Corp. NYSE: DUK.

Risk tolerance assessment

Assess your risk tolerance to align your investments with your comfort level for potential losses. If you have a lower risk tolerance, you may opt for a more conservative allocation in cyclical stocks, reducing exposure to market volatility.

Example: An investor discovers they have a low-risk tolerance and prefer stability in their portfolio. They allocate smaller investments to cyclical stocks and focus on bonds and dividend-paying stocks for stability.

By implementing these strategies and considering real-world examples, investors can effectively manage the risks associated with cyclical stocks. This proactive approach allows them to navigate the challenges and capitalize on the potential rewards of investing in this dynamic sector.

Ride economic waves by investing in cycles

Investing in cyclical stocks can be a rewarding but challenging endeavor. These equities closely tie into economic cycles, and their performance can fluctuate significantly. Understand the various categories of cyclical stocks to navigate this landscape, the pros and cons of investing in them and how to manage the associated risks effectively.

By incorporating these strategies into your investment approach, you can harness the potential for high returns while safeguarding your portfolio against economic downturns.

Before you consider Alcoa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alcoa wasn't on the list.

While Alcoa currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.