In August, used car prices recorded their highest monthly gain since March 1969, with

prices jumping 5.4% from July. Those gains followed a strong July, when used car

prices increased 3.4% over June levels.

People are investing a lot of money into used cars, and automotive aftermarket parts suppliers such as O’Reilly Automotive NASDAQ: ORLY stand to benefit.

After a tough Q1, analysts underestimated O’Reilly, even though the company’s still-active 27-year streak of same-store sales growth should have given ORLY the benefit of the doubt.

The Q2 numbers show that O’Reilly is well on its way to extending that streak to 28.

Q2 Blew Away Expectations

O’Reilly’s Q2 sales comps increased 16.2% yoy. Consensus estimates had called for gains of just 0.6%.

EPS increased 57% yoy to $7.10, beating estimates by $3.00 per share.

O’Reilly’s margins were facing pressure during the dog days of April. I believed that the company’s 17% operating profit margin would be able to withstand some pressure, but there are obvious limits to that.

My concerns were overblown, however, as O’Reilly generated an operating profit margin of 23.8% in Q2, its best-ever single quarter performance by more than 300 basis points. Even though O’Reilly says they “don't view these levels of SG&A leverage to be sustainable over the long term,” investors can breathe a sigh of relief.

Used Car Sales Should Remain Strong

New car sales have been weak of late partially due to automakers being forced to shut down in the early stages of the pandemic, which led to a decrease in new vehicle inventory.

That benefits O’Reilly’s business, but only temporarily until car makers can ramp up production.

However, even pre-pandemic, the average lifespan of a car was in a long-term uptrend. That means more used cars on the road and more potential customers for O’Reilly.

Government Support is Helping O’Reilly

On its Q2 earnings call, O’Reilly noted that government stimulus payments and enhanced unemployment benefits were a tailwind. Even though the government won’t be offering that level of support forever, the unemployment rate has already decreased a lot since the dog days of April.

And even in a tight economic environment, when you need to repair your car, you need to repair your car.

There’s a reason why I called O’Reilly a recession-proof business two months ago.

AutoZone NYSE: AZO Could Give ORLY a Boost

O’Reilly shares increased 5.4% on the Q2 earnings report. That’s a decent move, but the excellent report warranted a bigger move. And since then, shares have pulled back near where they were just prior to the release.

I see AutoZone being a catalyst for higher O’Reilly share prices in the near future.

AutoZone just received a few major upgrades last week:

- Morgan Stanley NYSE: MS increased its price target from $1,140 to $1,505.

- JPMorgan NYSE: JPM adjusted its target from $1,265 to $1,435.

- Wells Fargo NYSE: WFC boosted its target from $1,300 to $1,375.

AutoZone is released its Q4 numbers tomorrow and Morgan Stanley’s Simeon Gutman said he expects a “big beat,” which is probably what a lot of other analysts are thinking.

I could see a sympathy move from O’Reilly this week if the big beat comes to fruition for AutoZone.

Now is a Good Time to Buy

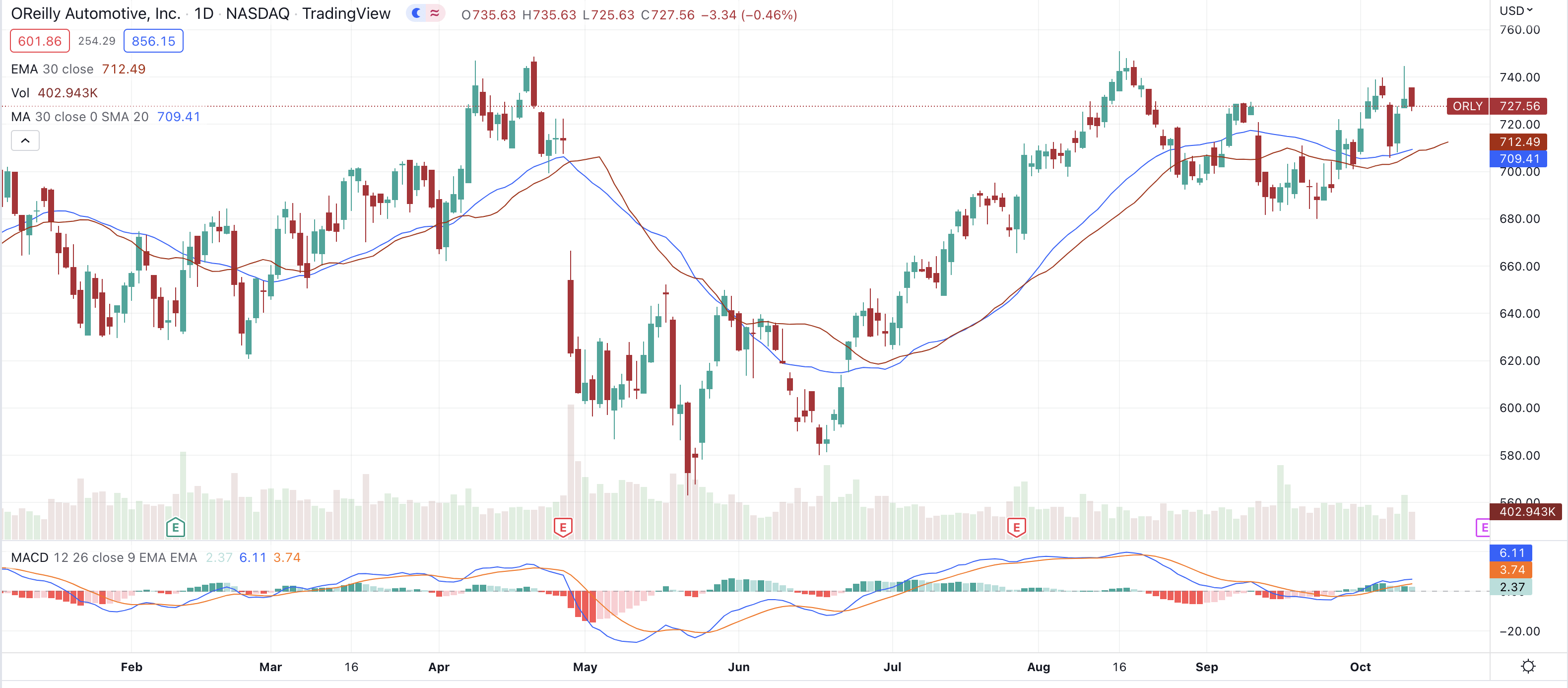

The market has been in pullback mode lately and ORLY has been no exception.

But shares got support at the 50-day moving average on Thursday and Friday, which is also near the earnings gap-up point.

If you pick up some shares around Friday’s close, you could place a stop-order a little below Friday’s lows and give yourself a downside of less than 2%.

The Final Word

While you could place a very tight stop on ORLY and see if it holds support, I would give it a little more space before pulling the plug.

Shares are an excellent value at these levels. This is a stock with a high floor – it’s unlikely that ORLY collapses from here.

After all, this is a company that has recorded 27 straight years of increasing comps, and could easily add several more years to that streak.

A trade on ORLY could make you a nice chunk of change, but this is a stock you should seriously consider buying and holding through the 2020s.

Before you consider O'Reilly Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and O'Reilly Automotive wasn't on the list.

While O'Reilly Automotive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.