The COVID-19 pandemic has shown the world that e commerce stocks are here to stay, even as in-person shopping returns to pre-pandemic levels.

The e-commerce market has taken a significant market share, with every major individual retailer now offering some form of online shopping experience. Investing in e-commerce giants (and the tech companies that make the online buying infrastructure possible) can help traders prepare for the future of online sales.

Learning how to buy e commerce stocks starts by analyzing the industry before narrowing your search to major industry players. Read on to learn more about how to invest in e commerce stocks and some of the pros and cons of this sphere.

Understanding the global e-commerce industry

E-commerce (short for “electronic commerce”) refers to buying and selling goods and services online. While e-commerce has been a major portion of the economy well before the COVID-19 pandemic, lockdown laws exacerbated consumer preferences toward online spending.

The global e-commerce market has been growing rapidly in recent years and should continue to grow in the coming years. According to Statista, the U.S. e-commerce market was valued at $856 billion in 2020 and should reach $1.1 trillion by 2024.

The U.S. is far from the only country with a thriving e-commerce industry. China is the current largest estimated market for e-commerce, with a predicted annual revenue of $1.5 trillion. China overtook the United States as the largest e-commerce retail market in the world in 2021. Other major players in the global e-commerce market include Japan, South Korea and the United Kingdom.

Key players in e-commerce stocks

A few key players currently dominate the e-commerce industry:

- Amazon.com: Amazon.com Inc. NASDAQ: AMZN is a multinational e-commerce giant with a total market capitalization of more than $1.52 trillion. Known as a major market disruptor, Amazon.com has begun branching into digital products, direct publishing and even healthcare. Its ubiquitousness has positioned the company as a major blue-chip e-commerce option investors will likely cling to for years to come. However, its large size has also made it a target of regulatory action, which may spur doubt for investors in a shorter trading time frame.

- Alibaba Group: Based in China, the Alibaba Group NYSE: BABA is a conglomerate of various e-commerce businesses, including Alibaba.com, Taobao and Tmall. It plays a significant role in the Chinese and international e-commerce markets, with a total market capitalization of about $188 billion. While not as large as Amazon, the Alibaba Group has been one of the most successful international companies to penetrate the domestic e-commerce market.

- Pinduoduo Inc: Another major Chinese e-commerce option, PDD Holdings Inc. NASDAQ: PDD or “Pinduoduo Inc,” has a total market capitalization of $197 billion. While PDD is larger than Alibaba, it operates primarily throughout Asia and is currently not as well-known as its lower-value counterpart. However, this changed in late 2022, when PDD Holdings branched into the Western market with its Temu app, which was met with almost immediate controversy related to accusations of inferior and counterfeit product sales.

Large, dominant companies like these ecommerce giants wield significant influence and control over the market. Their strong market position allows them to capture a substantial share of consumer spending, benefit from economies of scale and enjoy preferential supplier relationships. This can result in a positive feedback loop, resulting in sustained growth and feeding back into consumer spending.

Investors may view these dominant players as stable, reliable investments due to their established market presence and consistent revenue streams. However, the concentration of market power also raises concerns about potential anti-competitive practices and the ability of smaller players to compete. For example, in September 2023, the FTC and 17 states filed legal complaints against Amazon.com for anti-competitive business practices. These companies also have a higher bar of entry if you’re interested in dividend investing, which can be less appealing for newer investors.

What to look for in e-commerce stocks

Knowing what to look for in an e-commerce stock is crucial to making smart investments. Consider the following stock characteristics before deciding which assets to add to your portfolio.

Competitive edge

The e-commerce market is rapidly expanding and changing, making it important for investors to keep up with shifting consumer preferences. Look for companies with a strong track record of revenue growth or with unique consumer experience models in place that can help drive growth.

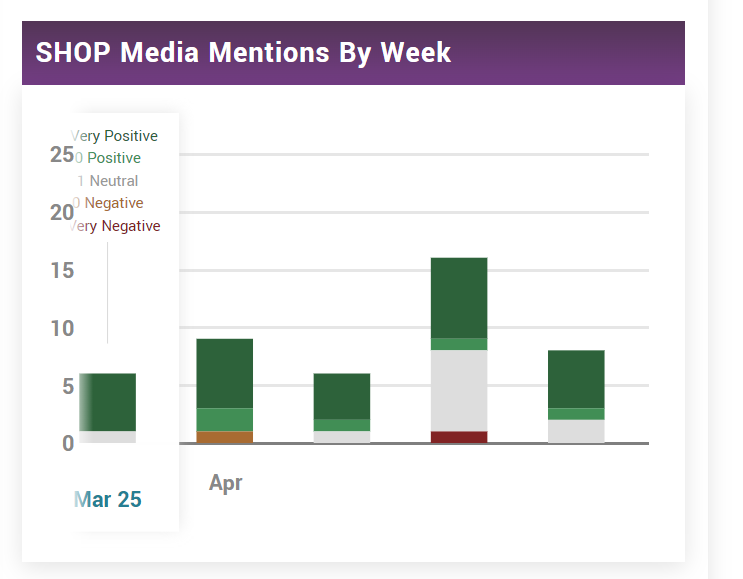

Image: Monitoring media sentiment can help you estimate companies' growth potential by keeping up-to-date with changing consumer preferences.

Financial performance

In addition to market competitiveness, considering a company’s financial sustainability before investing is important. Look at financial health signifiers like debt levels and profit margins to ensure your investment will be a solid long-term hold.

Strategies for investing in e-commerce stocks

There are an array of blue-chip and emerging e-commerce stocks for investors to support, making the sector especially appealing for progress-oriented growth investors and dividend investors. Some of the most common strategies seen with e-commerce stocks include:

- Long-term buying and holding: Most investors interested in e-commerce stocks take a long-term buy-and-hold approach to investing. These investors start by assessing underlying financials, pulling the company's most recent balance sheet to learn about debt obligations versus revenue. They may also analyze figures like P/E ratio to determine if the stock is at a reasonable entry point or if recent market events may be inflating or depressing its value. When evaluating companies for long-term holdings, consider their unique position in the market; more dominant market players may hold an advantage due to their size. Look at debt trends and revenue changes over time when evaluating e-commerce stocks, and choose assets with positive trends indicating company longevity.

- Emerging e-commerce markets: Some e-commerce investors avoid key players and focus on more niche markets where there's more opportunity for growth — including emerging international markets. One of the top emerging markets for e-commerce investors is India, which has seen a high level of internet penetration in 2020 and beyond. The Philippines, Indonesia and other Southeast Asian countries are also in the midst of an online revolution; a growing middle class, increased mobile internet usage and expanding logistics networks contribute to the region's e-commerce potential.

- Niche sites and e-commerce: Some investors use niche sites and e-commerce operations to complement a larger portfolio of blue-chip options. These investors focus primarily on fundamental analysis, purchasing shares of companies with a unique product or appeal to online shoppers. For example, Etsy NASDAQ: ETSY is an e-commerce site focusing entirely on vintage and handmade items and their sellers.

As with any type of individual sector investment, it's important to thoroughly research the companies you're considering investing in before you buy or sell shares. Start by defining your trading strategy and how long you’ll hold your shares. From here, explore recent financial statements and look for P/E value and expense ratio to determine an entry and exit point when relevant. You should also be sure to diversify across multiple e-commerce sites within your realm of interest to limit losses in the event of financial insolvency.

10 best e-commerce stocks to buy now

Now that you understand the basics of ecommerce stocks, it's time to explore some of the top market options. The following are 10 of the best e-commerce stocks to buy right now.

1. Amazon.com Inc.

Discussing the top e commerce stocks without mentioning Amazon.com Inc. NASDAQ: AMZN is impossible. Amazon is one of the world's most well-known and successful e-commerce companies. Since its founding in the mid 1990’s, Amazon has expanded to become a massive online marketplace, offering a wide range of products and services, including electronics, clothing, groceries, streaming video and cloud computing. Today, Amazon is one of the largest names in e-commerce, with a total market capitalization of more than $1.1 trillion in April 2023.

2. Shopify Inc.

In an expanding e-commerce market, it's now more important than ever for small business owners to offer online sales to remain competitive. Shopify Inc. NYSE: SHOP is a popular e-commerce platform allowing businesses to set up and operate online stores. Shopify’s stock price has increased by more than 10 times since its initial offering, weathering the pandemic to end with a $62 billion market capitalization in April 2023.

3. Alibaba Group

The Alibaba Group NYSE: BABA is one of the top names in Chinese e-commerce. Its core offering, Alibaba.com, is currently the 3rd largest e-commerce platform when measured by sales. Alibaba had a total market capitalization of $236 billion in April 2023.

In addition to its e-commerce business, Alibaba has also invested heavily in new markets, such as cloud computing, digital media, and entertainment. For example, Alibaba Cloud, the company's cloud computing division, is one of the largest in the world and provides a range of services, including infrastructure, security and data analytics. This can make Alibaba a stronger e-commerce investment option for those interested in international, diverse exposure.

4. Wayfair Inc.

Wayfair Inc. NYSE: W is an online retailer specializing in home goods, including furniture, decor and bedding. Its selection of furniture includes a range of price points, which makes it ideal for a range of consumers. It has also recently begun investing in new e-commerce technology, including artificial intelligence and augmented reality delivered via app. In April of 2023, Wayfair had a total market capitalization of more than $4 billion.

5. Walmart Inc.

Walmart Inc. NYSE: WMT is one of the world's largest retailers and has significantly invested in its e-commerce business recently. The company operates several online marketplaces, including Walmart.com and Jet.com, which connect customers with a wide range of products, including groceries, electronics and clothing.

In April of 2023, Walmart had a total market capitalization of more than $400 billion and a dividend yield of 1.50%. This makes Walmart a viable e-commerce investment with consistent dividend announcements on MarketBeat.

6. eBay Inc.

eBay Inc. NASDAQ: EBAY is one of the pioneers of the e-commerce industry. It is best known for its online marketplace that allows individuals and businesses to buy and sell new and secondhand goods online. In April 2023, eBay had a total market capitalization of more than $23 billion, with a dividend yield of 2.32%.

7. Baidu Inc.

While Baidu Inc. NASDAQ: BIDU is primarily known for its Chinese language search engine, it also operates an e-commerce platform called Baidu Mall. This site allows merchants to set up online storefronts and sell products directly to consumers, with Baidu taking a commission on transactions. Baidu also offers various services, such as online advertising, cloud storage and AI technology. In April 2023, Baidu had a total market capitalization of $43 billion.

8. JD.com Inc.

JD.com Inc. NASDAQ: JD is a Chinese e-commerce company that operates a large online retail platform comparable to similar operations like Alibaba and Taobao. The company also offers a logistics network that allows for fast and reliable delivery to customers across mainland China, which makes the service popular for customers in rural areas. In April 2023, JD.com and its subsidiaries had a total market capitalization of $48 billion.

9. MercadoLibre Inc.

MercadoLibre Inc. NASDAQ: MELI is a Latin American e-commerce company that operates in 18 countries across the region, including Argentina, Brazil and Mexico. It offers a range of services, including user marketplaces and advertising services. In April 2023, MercadoLibre had a total market capitalization of more than $64 billion.

10. Meta Platforms Inc.

While you might not think of Meta Platforms Inc. NASDAQ: FB (formerly Facebook) as an e-commerce stock, the company has been improving its online shopping exposure. Facebook Marketplace is a platform that allows users to buy and sell goods within the Facebook app, while Instagram Shopping offers a similar experience for brands with verified accounts. In April 2023, Meta Platforms had a total market capitalization of more than $550 billion — making it a great choice for large-cap investors looking for e-commerce exposure.

Pros and cons of investing in e-commerce stocks

Be sure to consider both the benefits and potential drawbacks of investing in e-commerce stocks before you buy — and never invest more than you can afford to lose in an individual company.

Pros

The COVID-19 pandemic has shown that consumers are becoming more accustomed to online shopping, increasing the performance of e-commerce companies.

- Growth potential: E-commerce is a rapidly expanding industry with relatively low startup costs. Companies that can capture market share and expand their operations can potentially generate significant returns for investors with a comparatively lower initial investment.

- International exposure: Many e-commerce stocks operate internationally, providing international diversification to investors.

- Dividend potential: Select e-commerce stocks pay out a portion of profits to investors through dividends, providing a potential long-term passive income stream.

Cons

The drawbacks of e-commerce stocks mainly relate to the volatile nature of this new and developing industry.

- High competition: E-commerce is highly competitive, with many companies vying for limited market share. This can make it more difficult for individual companies to stand out and maintain profitable operations.

- Volatility: The e-commerce industry constantly evolves, with new technologies and market entrants emerging regularly. This can make individual stocks more volatile and thus less suitable for long-term holds.

Technological innovations driving e-commerce stock performance

The e-commerce sphere is steadily becoming increasingly crowded in a constantly evolving online market. Companies that can leverage the latest technology to connect with changing consumer preferences may be in a more advantageous position to retain customers and market share. Some top trends driving the e-commerce market in 2023 and beyond include the following.

- Augmented reality (AR): Augmented reality (AR) is a major trend in e-commerce, especially among mobile-dominated markets. AR uses AI technology to populate products or samples using the customer’s smartphone camera, allowing them to visualize potential purchases better. For example, AR allows customers to try eyewear or cosmetics virtually, enhancing the online shopping experience.

- Artificial intelligence (AI): Besides augmented reality, e-commerce companies have found various ways to use AI in customer service contexts. Virtual assistants leverage natural language processing to enhance customer interactions and improve customer service. AI algorithms may also analyze customer data to provide personalized product recommendations, enhancing the user experience and increasing the likelihood of conversions.

- Blockchain: While blockchain is most commonly associated with cryptocurrencies, the use of transparent transfer of value technology is also of tantamount importance to online sales. Blockchain technology ensures transparency in the supply chain by recording and verifying every transaction across the network. E-commerce companies can use blockchain to track the origin of products, verify authenticity, and build trust among consumers concerned about product sourcing and ethical practices.

- Automated marketing: While it’s not fiscally possible to use a human advertising team to craft an individual advertisement for each customer, AI marketing could make this feat possible. E-commerce companies can leverage AI to analyze customer behavior and preferences, creating personalized marketing campaigns that improve customer engagement based on the individual and their previous purchases.

- Smart contracts: Smart contracts, self-executing contracts with the terms written in code, automate various processes within e-commerce, including order fulfillment. This reduces the need for intermediaries, minimizes errors, and enhances the efficiency of transactions.

Companies that can effectively and creatively implement these technologies to connect with customers may be primed for success in an increasingly digital market. Keep up-to-date with company developments and new tech incorporation, investing in companies embracing customer technology connections.

Alternatives to investing in e-commerce stocks

If individual e-commerce stocks aren't the right option, you have options. The following are two common alternatives to stock orders that help provide exposure to the future of e-commerce.

- E-commerce ETFs: E-commerce exchange-traded funds (ETFs) are "baskets" of stocks that trade together on the market as a single unit throughout the day. Investing in an e-commerce ETF provides a wider range of market exposure without selecting individual companies to invest in. Some popular e-commerce ETFs include the Amplify Online Retail ETF NYSE: IBUY and the Global X E-commerce ETF NASDAQ: EBIZ.

- Startup investing: Investing in e-commerce startups can be trickier than investing in established e-commerce companies, as startups are typically not publicly traded and are often only accessible to accredited investors or venture capital firms. However, there are a few ways that individual investors can potentially invest in e-commerce startups, including angel investing and crowdfunding platforms.

The future of e-commerce

While many e-commerce sites show massive potential for investors, it’s important to remember that individual stocks also carry management risk. If you’re a newer investor, it may be a good idea to consider the individual stocks that make up major e-commerce ETFs before selecting individual stocks. With so many e-commerce competitors, analyzing top ETF holdings can provide investors with a simple route to pre-screened investment choices.

Before you consider Target, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Target wasn't on the list.

While Target currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report